Honeywell 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

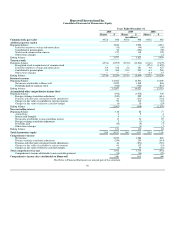

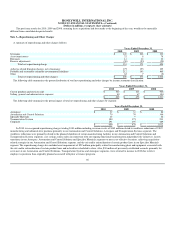

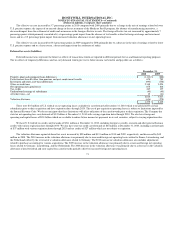

Consolidated Statement of Shareowners Equity

Year Ended December 31, 2009

Previously

Reported Revised Effect of

Change

Retained earnings

Beginning balance 16,250 13,391 (2,859)

Net income attributable to Honeywell 2,153 1,548 (605)

Ending balance 17,487 14,023 (3,464)

Accumulated other comprehensive income (loss)

Beginning balance (3,809) (1,078) 2,731

Pensions and other post retirement benefit adjustments (1,021) (271) 750

Ending balance (4,429) (948) 3,481

Total shareowners equity 8,954 8,971 17

Comprehensive income

Net income 2,189 1,584 (605)

Pensions and other post retirement benefit adjustments (1,021) (271) 750

Total comprehensive income 1,569 1,714 145

Comprehensive income (loss) attributable to Honeywell 1,533 1,678 145

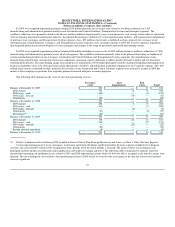

Year Ended December 31, 2008

Previously

Reported Revised Effect of

Change

Retained earnings

Beginning balance 14,273 13,400 (873)

Net income attributable to Honeywell 2,792 806 (1,986)

Ending balance 16,250 13,391 (2,859)

Accumulated other comprehensive income (loss)

Beginning balance (544) 329 873

Pensions and other post retirement benefit adjustments (2,576) (718) 1,858

Ending balance (3,809) (1,078) 2,731

Total shareowners equity 7,269 7,141 (128)

Comprehensive income

Net income 2,812 826 (1,986)

Pensions and other post retirement benefit adjustments (2,576) (718) 1,858

Total comprehensive income (453) (581) (128)

Comprehensive income (loss) attributable to Honeywell (473) (601) (128)

Foreign Currency Translation—Assets and liabilities of subsidiaries operating outside the United States with a functional currency other than U.S.

dollars are translated into U.S. dollars using year-end exchange rates. Sales, costs and expenses are translated at the average exchange rates in effect during

the year. Foreign currency translation gains and losses are included as a component of Accumulated Other Comprehensive Income (Loss). For subsidiaries

operating in highly inflationary environments, inventories and property, plant and equipment, including related expenses, are remeasured at the exchange rate

in effect on the date the assets were acquired, while monetary assets and liabilities are remeasured at year-end exchange rates. Remeasurement adjustments for

these subsidiaries are included in earnings.

Derivative Financial Instruments—As a result of our global operating and financing activities, we are exposed to market risks from changes in interest

and foreign currency exchange rates and commodity prices, which may adversely affect our operating results and financial position. We minimize our risks

from interest and foreign currency exchange rate and commodity price fluctuations through our normal operating and financing activities and, when deemed

appropriate through the use of derivative financial instruments. Derivative financial instruments are used to manage risk and are not used for trading or other

speculative purposes and we do not use leveraged derivative financial instruments. Derivative financial instruments used for hedging purposes must be

designated and effective as a hedge of the identified risk exposure at the inception of the contract.

61