Honeywell 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

probable recoveries. Projecting future events is subject to various uncertainties that could cause the insurance recovery on asbestos related liabilities to be

higher or lower than that projected and recorded. Given the inherent uncertainty in making future projections, we reevaluate our projections concerning our

probable insurance recoveries in light of any changes to the projected liability, our recovery experience or other relevant factors that may impact future

insurance recoveries. See Note 21 to the financial statements for a discussion of management's judgments applied in the recognition and measurement of

insurance recoveries for asbestos related liabilities.

Defined Benefit Pension Plans— We sponsor both funded and unfunded U.S. and non-U.S. defined benefit pension plans covering the majority of our

employees and retirees.

In 2010, we elected to change our method of recognizing pension expense. Previously, for our U.S. defined benefit pension plans we used the market-

related value of plan assets reflecting changes in the fair value of plan assets over a three-year period. Further, net actuarial gains or losses in excess of 10

percent of the greater of the market-related value of plan assets or the plans' projected benefit obligation (the corridor) were recognized over a six-year period.

Under our new accounting method which we adopted in 2010, we will recognize changes in the fair value of plan assets and net actuarial gains or losses in

excess of the corridor annually in the fourth quarter each year (MTM Adjustment). This new accounting method results in faster recognition of net actuarial

gains and losses than our previous amortization method. Net actuarial gains and losses occur when the actual experience differs from any of the various

assumptions used to value our pension plans or when assumptions change as they may each year. The primary factors contributing to actuarial gains and

losses are changes in the discount rate used to value pension obligations as of the measurement date each year and the differences between expected and

actual returns on plan assets. This accounting method also results in the potential for volatile and difficult to forecast MTM adjustments. MTM adjustments

were $471, $741 and $3,290 million in 2010, 2009 and 2008, respectively. The remaining components of pension expense, primarily service and interest costs

and assumed return on plan assets, will be recorded on a quarterly basis (On-going Pension Expense). See Note 1 to the financial statements for further details

of the change and the impact of our retrospective application of the new policy.

For financial reporting purposes, net periodic pension expense is calculated based upon a number of actuarial assumptions, including a discount rate for

plan obligations and an expected long-term rate of return on plan assets. We determine the expected long-term rate of return on plan assets utilizing historic

and expected plan asset returns over varying long-term periods combined with current market conditions and broad asset mix considerations (see Note 22 to

the financial statements for details on the actual various asset classes and targeted asset allocation percentages for our pension plans). The discount rate

reflects the market rate on December 31 (measurement date) for high-quality fixed-income investments with maturities corresponding to our benefit

obligations and is subject to change each year. Further information on all our major actuarial assumptions is included in Note 22 to the financial statements.

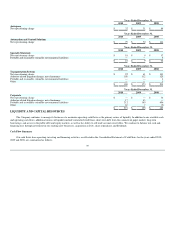

The key assumptions used in developing our 2010, 2009 and 2008 net periodic pension expense for our U.S. plans included the following:

2010 2009 2008

Discount rate 5.75% 6.95% 6.50%

Assets:

Expected rate of return 9% 9% 9%

Actual rate of return 19% 20% (29%)

Actual 10 year average annual compounded rate of return 6% 4% 4%

The discount rate can be volatile from year to year because it is determined based upon prevailing interest rates as of the measurement date. We will use

a 5.25 percent discount rate in 2011, reflecting the decrease in the market interest rate environment since December 31, 2009. We will use an expected rate of

return on plan assets of 8 percent for 2011 down from 9 percent in 2010 due to lower future expected market returns.

In addition to the potential for MTM adjustments, changes in our expected rate of return on plan assets and discount rate resulting from economic

events also affects future on-going pension expense. The following table highlights the sensitivity of our U.S. pension obligations and on-going expense to

changes in these

48