Honeywell 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

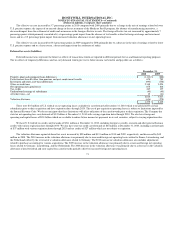

In 2009, we recognized repositioning charges totaling $224 million primarily for severance costs related to workforce reductions of 4,423

manufacturing and administrative positions mainly in our Automation and Control Solutions, Transportation Systems and Aerospace segments. The

workforce reductions were primarily related to the adverse market conditions experienced by many of our businesses, cost savings actions taken in connection

with our ongoing functional transformation initiative, the planned downsizing or shutdown of certain manufacturing facilities, and organizational realignments

of portions of our Aerospace and Transportation Systems segments. Also, $53 million of previously established accruals, primarily for severance at our

Automation and Control Solutions, Aerospace, and Transportation Systems segments, were returned to income in 2009 due to fewer employee separations

than originally planned associated with prior severance programs and changes in the scope of previously announced repositioning actions.

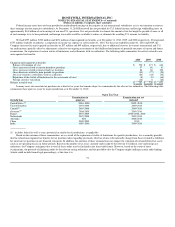

In 2008, we recognized repositioning charges totaling $444 million including severance costs of $333 million related to workforce reductions of 7,480

manufacturing and administrative positions across all of our segments. The workforce reductions primarily relate to the planned downsizing or shutdown of

certain manufacturing facilities in our Aerospace, Automation and Control Solutions and Transportation Systems segments, the rationalization of non-

manufacturing infrastructure, outsourcing of non-core components, managing capacity utilization to address product demand volatility and our functional

transformation initiative. The repositioning charge also included asset impairments of $78 million principally related to manufacturing plant and equipment in

facilities scheduled to close or be downsized and certain administrative facilities, and information technology equipment in our Corporate segment. Also, $20

million of previously established accruals, primarily for severance at our Automation and Control Solutions segment were returned to income in 2008 due

mainly to fewer employee separations than originally planned associated with prior severance programs.

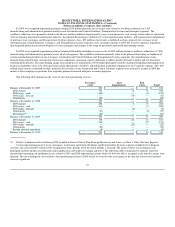

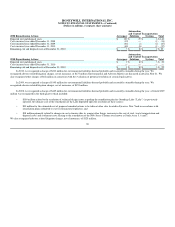

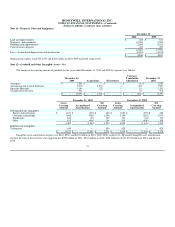

The following table summarizes the status of our total repositioning reserves:

Severance

Costs Asset

Impairments Exit

Costs Total

Balance at December 31, 2007 $ 201 $ — $ 11 $ 212

2008 charges 333 78 33 444

2008 usage - cash (149) — (8) (157)

2008 usage - noncash — (78) — (78)

Adjustments (20) — — (20)

Balance at December 31, 2008 365 — 36 401

2009 charges 206 8 10 224

2009 usage - cash (193) — (7) (200)

2009 usage - noncash — (8) — (8)

Adjustments (51) — (2) (53)

Divestitures(1) (24) — — (24)

Balance at December 31, 2009 303 — 37 340

2010 charges 145 22 14 181

2010 usage - cash (134) — (17) (151)

2010 usage - noncash — (22) — (22)

Adjustments (30) — — (30)

Foreign currency translation (8) — — (8)

Balance at December 31, 2010 $ 276 $ — $ 34 $ 310

(1) Relates to businesses divested during 2009 included in Gain on Sale of Non-Strategic Businesses and Assets see Note 4, Other (Income) Expense.

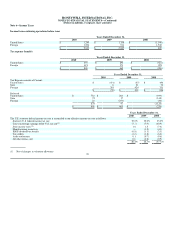

Certain repositioning projects in our Aerospace, Automation and Control Solutions and Transportation Systems segments included exit or disposal

activities, the costs related to which will be recognized in future periods when the actual liability is incurred. The nature of these exit or disposal costs

principally includes product recertification and requalification and employee training and travel. The following tables summarize by segment, expected,

incurred and remaining exit and disposal costs related to 2010 and 2008 repositioning actions which we were not able to recognize at the time the actions were

initiated. The exit and disposal costs related to the repositioning actions in 2009, which we were not able to recognize at the time the actions were initiated

were not significant.

67