Honeywell 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

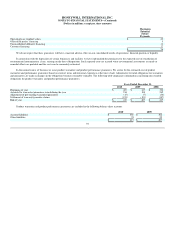

HONEYWELL INTERNATIONAL INC.

NOTES TO FINANCIAL STATEMENTS—(Continued)

(Dollars in millions, except per share amounts)

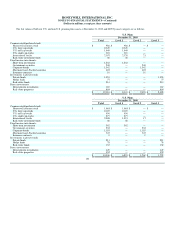

Pension Benefits

U.S. Plans Non-U.S. Plans

Net periodic benefit cost 2010 2009 2008 2010 2009 2008

Service cost $ 221 $ 183 $ 198 $ 51 $ 41 $ 57

Interest cost 768 785 765 228 208 244

Expected return on plan assets (902) (767) (1,140) (248) (221) (301)

Amortization of transition

(asset) obligation — — — 1 1 1

Amortization of prior service

cost (credit) 32 26 30 (1) (1) (1)

Recognition of actuarial losses 182 447 3,192 289 308 112

Settlements and curtailments — — — 4 — 18

Net periodic benefit cost $ 301 $ 674 $ 3,045 $ 324 $ 336 $ 130

Other Changes in Plan Assets and

Benefits Obligations Recognized in

Other Comprehensive (Income) Loss

U.S. Plans Non-U.S. Plans

2010 2009 2008 2010 2009 2008

Actuarial (gains)/losses $ 325 $ 686 $ 4,432 $ (20) $ 449 $ 311

Prior service cost (credit) 117 — 27 — 2 —

Transition (asset) obligation

recognized during year — — — (1) (1) (1)

Prior service (cost) credit

recognized during year (32) (26) (30) 1 1 —

Actuarial losses recognized

during year (182) (447) (3,192) (289) (308) (129)

Foreign exchange translation

adjustments — — — (17) 42 (54)

Total recognized in other

comprehensive (income) loss $ 228 $ 213 $ 1,237 $ (326) $ 185 $ 127

Total Recognized in net periodic

benefit costs and other

comprehensive (income) loss $ 529 $ 887 $ 4,282 $ (2) $ 521 $ 257

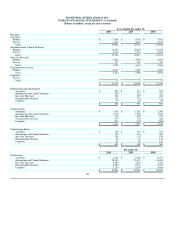

The estimated prior service cost for pension benefits that will be amortized from accumulated other comprehensive (income) loss into net periodic

benefit cost in 2011 are expected to be $33 million and $(2) million for U.S. and Non-U.S. benefit plans, respectively.

98