Honeywell 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Honeywell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interest and other financial charges increased by 1 percent in 2009 compared with 2008 due to lower debt balances offset by higher borrowing costs on

term debt.

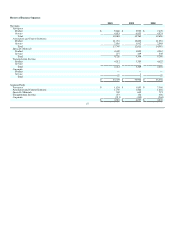

Tax Expense

2010 2009 2008

Tax expense $ 808 $ 465 $ (226)

Effective tax rate 28.4% 22.7% (37.7)%

The effective tax rate increased by 5.7 percentage points in 2010 compared with 2009 primarily due to a change in the mix of earnings related to lower

U.S. pension expense, the impact of an enacted change in the tax treatment of the Medicare Part D program, the absence of manufacturing incentives, a

decreased impact from the settlement of audits and an increase in the foreign effective tax rate. The foreign effective tax rate increased by approximately 7

percentage points which primarily consisted of i) a 6 percentage point impact from the absence of tax benefits related to foreign exchange and investment

losses and ii) a 0.5 percentage points impact from increased valuation allowances on net operating loss. The effective tax rate was lower than the U.S.

statutory rate of 35 percent primarily due to earnings taxed at lower foreign rates.

The effective tax rate increased by 60.4 percentage points in 2009 compared to 2008 primarily due to a change in the mix of earnings related to lower

U.S. pension expense and to a lesser extent, a decreased impact from the settlement of audits. The effective tax rate was lower than the U.S. statutory rate of

35 percent primarily due to earnings taxed at lower foreign rates.

In 2011, the effective tax rate could change based upon the Company's operating results and the outcome of tax positions taken regarding previously

filed tax returns currently under audit by various Federal, State and foreign tax authorities, several of which may be finalized in the foreseeable future. The

Company believes that it has adequate reserves for these matters, the outcome of which could materially impact the results of operations and operating cash

flows in the period they are resolved.

Net Income Attributable to Honeywell

2010 2009 2008

Net income attributable to Honeywell $ 2,022 $ 1,548 $ 806

Earnings per share of common stock – assuming dilution $ 2.59 $ 2.05 $ 1.08

Earnings per share of common stock – assuming dilution increased by $0.54 per share in 2010 compared with 2009 primarily due to increased segment

profit in our Automation and Control Solutions, Specialty Materials and Transportation Systems segments and lower pension expense, partially offset by

higher tax expense and higher repositioning and other charges.

Earnings per share of common stock – assuming dilution increased by $0.97 per share in 2009 compared with 2008 primarily relates to lower pension

expense and lower repositioning charges, partially offset by a decrease in segment profit in each of our business segments, decreased Other (Income) Expense,

as discussed above, and an increase in the number of shares outstanding.

For further discussion of segment results, see "Review of Business Segments".

BUSINESS OVERVIEW

This Business Overview provides a summary of Honeywell and its four reportable operating segments (Aerospace, Automation and Control Solutions,

Specialty Materials and Transportation Systems), including their respective areas of focus for 2011 and the relevant economic and other factors impacting

their results, and a discussion of each segment's results for the three years ended December 31, 2010. Each of these segments is comprised of various product

and service classes that serve multiple end markets. See Note 23 to the financial statements for further information on our reportable segments and our

definition of segment profit.

25