HSBC 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.97

of residential mortgages and US$15.6 billion of its

domestic private label assets to HSBC Bank USA,

the latter in December 2004. Under various service

level agreements, HSBC Finance Corporation will

continue to maintain the related customer account

relationships for the assets transferred. By the end of

2004, HSBC had provided a total of US$35.6 billion

in direct and client funding to HSBC Finance

Corporation, and cash savings realised in 2004 were

in excess of US$400 million.

Following receipt of regulatory approval for the

sale of the private label portfolio, and prior to the

sale, HSBC Finance Corporation adopted charge-off

and account management policies in accordance with

the Uniform Retail Credit Classification and Account

Management Policy issued by the Federal Financial

Institutions Examination Council (‘FFIEC policies’ ),

for its domestic private label, MasterCard and Visa

credit card portfolios. The main effect of this was on

the private label credit card portfolio, where the

FFIEC policies resulted in accounts being charged-

off earlier. Certain pools of accounts were already

following FFIEC policies, and so their adoption

improved conformity across all relevant portfolios.

The FFIEC account management practices change

the delinquency and roll rates applicable to these

portfolios, and resulted in a one-off charge to pre-tax

profit, before goodwill amortisation, of

US$154 million, which is expected to be offset by

future funding benefits in the region of

US$47 million per annum.

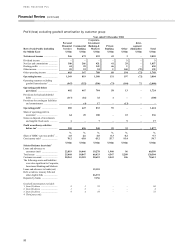

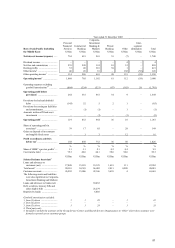

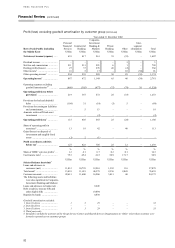

Net interest income of US$10,541 million was

US$2,690 million higher than in 2003, although on

an underlying basis adjusting for the additional

quarter in 2004, it was only marginally higher.

Average customer loan balances increased by 11 per

cent to US$120.6 billion. Lower funding costs gave

HSBC Finance Corporation the opportunity to

expand its prime and near-prime customer base,

particularly in the mortgage business. Average

mortgage balances grew by 23 per cent to

US$54.1 billion. Some US$3.9 billion of gross new

lending balances were originated from a single

correspondent relationship, while balances of

US$1.6 billion were originated following the launch

in 2003 of the ‘Secured Plus’ mortgage product.

Organic growth of 16 per cent to US$9.6 billion

in vehicle finance loans was primarily achieved

through a network of 5,200 motor dealers, extensive

alliance relationships and direct sales channels.

Loans in the MasterCard and Visa credit card

portfolios grew by 3 per cent to US$18 billion,

driven largely by growth in the sub-prime portfolio.

Spreads widened reflecting the change in product

mix towards the sub-prime market. The private label

business also achieved growth in average loan

balances, 5 per cent higher than in 2003, through

new and existing merchant agreements.

The benefit of strong growth in loan balances

was reduced significantly by lower yields. A greater

than normal run-off of older, higher-yielding loans,

product expansion into near-prime customer

segments, and competitive pricing pressures from

excess capacity, particularly in the mortgage market,

contributed to an overall decline in loan yields. The

decline was only partly offset by increased pricing of

variable-rate products in line with interest rate

movements, and continued growth in sub-prime

credit cards. Also, the adoption of the FFIEC

policies reduced net interest income by

US$57 million.

Other operating income rose by

US$895 million, or 52 per cent, to

US$2,602 million, largely reflecting the additional

quarter’s income. On an underlying basis, and

excluding the effect of adopting the FFIEC policies,

the increase was 10 per cent, predominantly

reflecting strong growth in fee income from credit

cards, and increased revenue from sales of value

added products.

Operating expenses, excluding goodwill

amortisation, of US$4,470 million were 44 per cent

higher than in 2003. On an underlying basis,

operating expenses, excluding goodwill

amortisation, increased by 10 per cent to

US$3,422 million due mainly to increased staff costs

and higher IT and marketing expenditure. Additional

staff were recruited in the branch network and in the

mortgage services business to support growth in

volumes and to improve customer service. Increased

business volumes also led to higher performance-

related bonuses and higher IT costs. Marketing costs

increased, largely due to changes in contractual

obligations associated with the General Motors co-

branded credit card portfolio, but were partly offset

by lower account origination costs. Marketing

expenses were also incurred in support of income

growth initiatives in the sub-prime market. In

September 2004, HSBC rebranded a number of its

Consumer Finance businesses at a cost of

US$8 million.

The charge for bad and doubtful debts rose by

17 per cent to US$5,136 million. On an underlying

basis and excluding the effect of adopting the FFIEC

policies, the charge fell by 12 per cent. This reflected

a marked improvement in credit quality, driven by

the economic upturn, improved origination, growth

in the proportion of secured lending, improved