HSBC 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

98

collections, and the move into prime and near-prime

markets. Improvements in delinquency were seen

across most products and in a number of key

indicators, including early stage delinquency, charge-

offs and year-on-year bankruptcy filings. The rate of

improvement declined in the second half of the year

reflecting seasonality, a slowdown in employment

growth and rising energy prices.

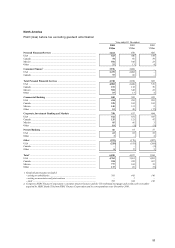

Commercial Banking reported pre-tax profits,

before amortisation of goodwill, of US$845 million

for 2004, an improvement of 41 per cent over 2003.

Net interest income increased by 8 per cent, of

which 3 per cent was attributable to the acquisition

of Bank of Bermuda. Adjusting for the loss of net

interest income following the disposal of the US

equipment-leasing portfolio last year, underlying

growth was 7 per cent.

In the US, the recruitment of 50 additional

relationship managers, focusing on the SME market,

contributed to a 12 per cent rise in lending balances

and a 17 per cent increase in commercial deposits.

Improved economic conditions and stronger

consumer confidence also led to increased demand

for credit, but spreads suffered in the competitive

marketplace. Commercial real estate lending

increased by 11 per cent, largely as a result of

expansion into the US West Coast and Miami.

In Canada, net interest income increased by

16 per cent. Growth in lending reflected stronger

demand for credit in the low interest rate

environment, improved market conditions and

additional income following the integration of Intesa

Bank. In Mexico, competitors displaying a greater

appetite for risk enabled HSBC to selectively reduce

loan balances. This, together with the effect of lower

interest rates on deposit spreads and a restructuring

of prices, which emphasised fees at the expense of

margin, led to an 11 per cent reduction in Mexican

net interest income.

Other operating income was US$13 million or

3 per cent higher than in 2003. Excluding the

disposal of the US factoring and equipment leasing

businesses, which in 2003 contributed other

operating income of US$109 million, the underlying

growth was 25 per cent. The impact of acquisitions

during 2004 was not material.

In Mexico, fees and commissions grew by

US$10 million or 11 per cent. Fees earned from

payments and cash management and electronic

banking both increased. The Mexican authorities

changed the tax regulations to require all companies

to make tax payments via electronic banking

channels from January 2004. HSBC seized the

opportunities presented by this change to increase

both the number of clients using electronic banking,

and the number of transactions and income per

client. Earnings from new trade services products

and increased loan fees (from the price restructuring)

also contributed.

Operating expenses declined by 6 per cent

compared with 2003 as a result of the disposal of the

factoring and equipment leasing businesses in the

US. Adjusting for this, there was a 3 per cent rise in

expenses reflecting additional costs from the

restructuring and integration of Intesa Bank, the

inclusion of Bank of Bermuda, and the effect of

increased transaction volumes and business flows

between Mexico and the US.

The charge for bad and doubtful debts fell by 90

per cent to US$13 million, reflecting an improved

economic environment and falling corporate default

rates. In 2003, the charge included US$33 million in

the US factoring and leasing businesses which were

sold during that year.

Corporate, Investment Banking and Markets

reported pre-tax profit, before amortisation of

goodwill, of US$750 million, 11 per cent lower than

in 2003.

Net interest income was 11 per cent lower than

in 2003, notwithstanding the first contribution from

Bank of Bermuda, which added US$31 million, or 4

per cent to the total. In part this reflected the cost of

funding trading strategies where the offsetting

income arises within dealing revenues. The return on

investments held for liquidity fell and the yield on

loans dropped as re-financing reached record levels

following the reductions in interest rates in the latter

part of 2003 and early 2004. The lower interest rates

resulted in large early redemptions of mortgage-

backed securities. Reinvestment opportunities,

however, failed to match the yields given up on these

redemptions. In Canada, a combination of interest

rate cuts in the early part of 2004 and lower

corporate loan balances reduced net interest income.

However, in Mexico, investment portfolios profited

from having locked into higher long-term interest

rate structures.

Other operating income improved by 15 per

cent, of which 7 per cent was attributable to Bank of

Bermuda, which improved its market share in funds

administration following its acquisition. A 23 per

cent increase in fees and commissions in the US was

driven by increased underwriting fees from debt

issues and syndication, coupled with higher deal

execution revenues. Increased revenues from

customers reflected improved client coverage. The

growing use of electronic trading by clients resulted