HSBC 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.95

S&P500 was up about 9 per cent from the beginning

of the year. Over approximately the same period, the

value of the US dollar fell, reaching US$1.36 to the

euro by the end of December.

In Canada, annualised GDP growth slowed to

2.7 per cent in the first quarter of 2004 from 3.3 per

cent in the final quarter of 2003, largely because of a

fall in stockbuilding. Consumer spending and

investment growth began the year strongly.

However, the Bank of Canada (‘BoC’ ) cut interest

rates three times in the first half of 2004 in response

to low inflation and currency appreciation. With the

global economy recovering and Canadian GDP

growth having rebounded to 3.9 per cent in the

second quarter, the BoC started to reverse its policy,

raising rates by 25 basis points in both September

and October. Growth remained robust in the second

half of the year with consumer spending

accelerating. Import growth was significant, partly

reflecting a very large build-up of inventory in the

third quarter, much of it related to the auto sector.

Although inflation picked up a little, the BoC kept

rates on hold in November and December, because

of concerns about the impact of a stronger Canadian

dollar. This left the overnight rate at 2.5 per cent,

still below the rate at which it started the year.

Mexico’ s macro-economic fundamentals

remained strong in 2004, with year-on-year GDP

growth of 4.4 per cent in line with that of the US. At

year-end, the fiscal accounts were showing relatively

low deficits helped by the windfall of high oil prices.

Driven by oil receipts and an unprecedented level of

workers´ remittances, the current account deficit

shrank to a figure below the level of reinvested

earnings from existing foreign direct investment.

Inflation increased from 4.0 per cent at the end of

2003 to 5.2 per cent in 2004, as a result of increases

in external energy and food prices, but remained

manageable. HSBC anticipates that inflation will be

reduced in 2005 due to a restrictive monetary policy,

and that moderate to strong GDP growth will

continue with a mildly appreciating currency.

On 1 July 2004, HSBC Bank USA, Inc.

consolidated its banking operations under a single

national charter, following approval from the Office

of Comptroller of Currency. This enabled the newly

formed HSBC Bank USA to serve its customers

more efficiently and effectively across the US and

provide an expanded range of products. It also put

HSBC Bank USA on the same footing as other major

US banks.

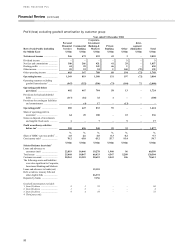

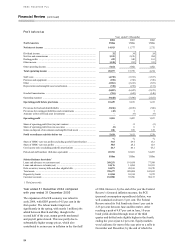

HSBC’s operations in North America reported a

pre-tax profit of US$5,419 million, compared with

US$3,613 million in 2003. Excluding goodwill

amortisation, pre-tax profit was US$6,180 million,

compared with US$4,257 million in 2003, and

represented 32 per cent of HSBC’ s total pre-tax

profit on this basis.

Within these figures HSBC Finance reported a

pre-tax profit, before goodwill amortisation, of

US$3,576 million in 2004, an increase of

US$1,524 million, of which US$1,084 million was

an additional quarter’ s contribution. Profit was

21 per cent higher than for the comparable period in

the prior year.

Bank of Bermuda, acquired in February 2004,

contributed US$73 million to pre-tax profit, before

goodwill amortisation, in the North American

segment.

At constant exchange rates, and on an

underlying basis, HSBC’s pre-tax profit, before

goodwill amortisation, was 17 per cent higher than

in 2003.

The detailed customer group commentary that

follows is based on constant exchange rates.

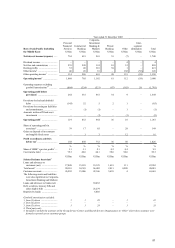

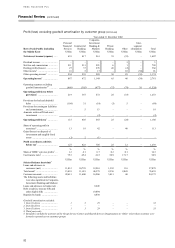

Excluding Consumer Finance, Personal

Financial Services generated a pre-tax profit, before

goodwill amortisation, of US$1,164 million, 35 per

cent higher than in 2003. Approximately 22 per cent

of this growth arose from the acquisition of Bank of

Bermuda and certain insurance interests in Mexico.

Growth in net interest income was 19 per cent.

This was driven mainly by a 34 per cent increase in

Mexico, where growth in low cost deposits and

consumer loans, and higher interest income from the

insurance business, contributed to the rise.

Acquisitions in Mexico accounted for 17 per cent of

the overall improvement. HSBC attracted 359,000

net new deposit customers in Mexico during the

year, and this contributed to the US$1.6 billion rise

in average deposit balances. Despite an increasingly

competitive marketplace, market share in deposits

rose to 14.4 per cent, driven by the bank’s extensive

branch and ATM network. Consumer loan growth

was robust in the second half of the year, particularly

in pre-approved payroll loans offered through the

ATM network, and residential mortgages.

Net interest income in the US grew by 10 per

cent, reflecting a US$10.9 billion, or 58 per cent,

increase in average residential mortgage balances

and the widening of spreads on savings and deposits,

as interest rates rose. Sales of residential mortgages

remained strong following an expansion of the sales

force and the development of the correspondent

network, competitive pricing and increased

marketing. In 2004, customers generally favoured

variable rate products over fixed. Several new