HSBC 2004 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378

|

|

HSBC HOLDINGS PLC

Financial Review (continued)

166

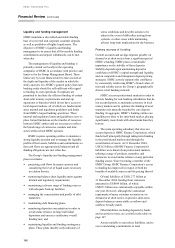

Liquidity and funding management

HSBC maintains a diversified and stable funding

base of core retail and corporate customer deposits

as well as portfolios of highly liquid assets. The

objective of HSBC’ s liquidity and funding

management is to ensure that all foreseeable funding

commitments and deposit withdrawals can be met

when due.

The management of liquidity and funding is

primarily carried out locally in the operating

companies of HSBC in accordance with practice and

limits set by the Group Management Board. These

limits vary by local financial unit to take account of

the depth and liquidity of the market in which the

entity operates. It is HSBC’s general policy that each

banking entity should be self-sufficient with regard

to funding its own operations. Exceptions are

permitted to facilitate the efficient funding of certain

short-term treasury requirements and start-up

operations or branches which do not have access to

local deposit markets, all of which are funded under

strict internal and regulatory guidelines and limits

from HSBC’s largest banking operations. These

internal and regulatory limits and guidelines serve to

place formal limitations on the transfer of resources

between HSBC entities and are necessary to reflect

the broad range of currencies, markets and time

zones within which HSBC operates.

HSBC requires operating entities to maintain a

strong liquidity position and to manage the liquidity

profile of their assets, liabilities and commitments so

that cash flows are appropriately balanced and all

funding obligations are met when due.

The Group’ s liquidity and funding management

process includes:

• projecting cash flows by major currency and

considering the level of liquid assets necessary

in relation thereto;

• monitoring balance sheet liquidity ratios against

internal and regulatory requirements;

• maintaining a diverse range of funding sources

with adequate back-up facilities;

• managing the concentration and profile of debt

maturities;

• maintaining debt financing plans;

• monitoring depositor concentration in order to

avoid undue reliance on large individual

depositors and ensure a satisfactory overall

funding mix; and

• maintaining liquidity and funding contingency

plans. These plans identify early indicators of

stress conditions and describe actions to be

taken in the event of difficulties arising from

systemic or other crises while minimising

adverse long-term implications for the business.

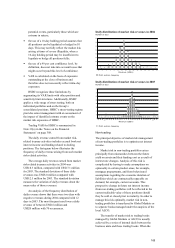

Primary sources of funding

Current accounts and savings deposits payable on

demand or at short notice form a significant part of

HSBC’ s funding. HSBC places considerable

importance on the stability of these deposits.

Stability depends upon maintaining depositor

confidence in HSBC’ s capital strength and liquidity,

and on competitive and transparent deposit-pricing

strategies. HSBC actively supports this confidence

by consistently reinforcing HSBC’ s brand values of

trust and solidity across the Group’ s geographically

diverse retail banking network.

HSBC accesses professional markets in order to

provide funding for non-banking subsidiaries that do

not accept deposits, to maintain a presence in local

money markets and to optimise the funding of asset

maturities not naturally matched by core deposit

funding. In aggregate, HSBC’ s banking entities are

liquidity providers to the inter-bank market, placing

significantly more funds with other banks than they

borrow.

The main operating subsidiary that does not

accept deposits is HSBC Finance Corporation, which

funds itself principally through taking term funding

in the professional markets and through the

securitisation of assets. At 31 December 2004,

US$112 billion of HSBC Finance Corporation’s

liabilities were drawn from professional markets,

utilising a range of products, maturities and

currencies to avoid undue reliance on any particular

funding source. Since becoming a member of the

HSBC Group, HSBC Finance Corporation’s access

to funding has improved in respect of both the

breadth of available sources and the pricing thereof.

Of total liabilities of US$1,277 billion at

31 December 2004, funding from customers

amounted to US$694 billion, of which

US$671 billion was contractually repayable within

one year. However, although the contractual

repayments of many customer accounts are on

demand or at short notice, in practice short-term

deposit balances remain stable as inflows and

outflows broadly match.

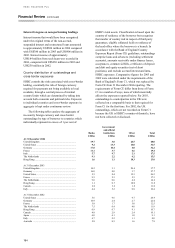

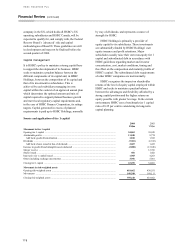

Other liabilities, including deposits by banks

and securities in issue, are set forth in the table on

page 167.

Assets available to meet these liabilities, and to

cover outstanding commitments to lend