HSBC 2004 Annual Report Download - page 298

Download and view the complete annual report

Please find page 298 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

296

HSBC

HSBC

Holdings Associates

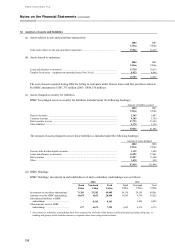

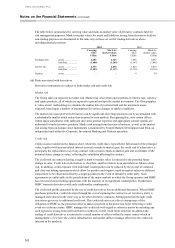

US$m US$m US$m

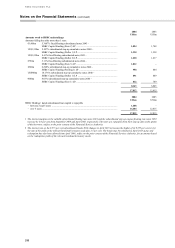

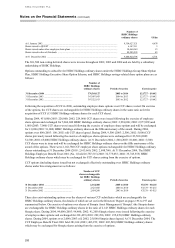

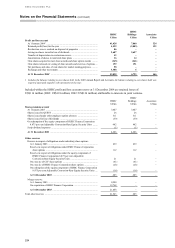

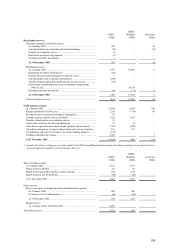

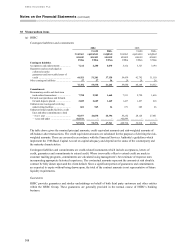

Revaluation reserves

Investment property revaluation reserve:

At 1 January 2002 .................................................................................. 269 – 46

Unrealised deficit on revaluation of land and buildings ......................... (23) – (1)

Transfer of depreciation from profit and loss account reserve ................ 7 – –

Realisation on disposal of properties ..................................................... (4) – –

Exchange and other movements ............................................................. (2) – (1)

At 31 December 2002 ............................................................................ 247 – 44

Revaluation reserve:

At 1 January 2002 .................................................................................. 2,002 32,436 6

Realisation on disposal of properties ..................................................... (29) (4) –

Unrealised deficit on revaluation of properties ...................................... (297) – –

Transfer of depreciation from profit and loss account reserve ............... (37) – –

Net increase in attributable net assets of subsidiary undertakings .......... – 4,553 –

Exchange and other movements ............................................................. 68 (102) –

At 31 December 2002 ............................................................................ 1,707 36,883 6

Total revaluation reserves .............................................................................. 1,954 36,883 50

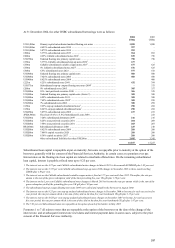

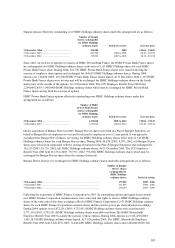

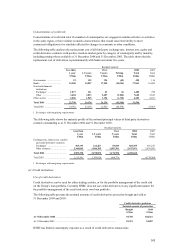

Profit and loss account

At 1 January 20021 ..................................................................................... 26,596 4,721 255

Retained profit for the year ........................................................................ 1,238 266 (11)

Revaluation reserve realised on disposal of properties ............................... 33 4 –

Depreciation realised on disposal of properties .......................................... 37 – –

Arising on shares issued in lieu of dividends ............................................. 1,023 1,023 –

Transfer of depreciation to revaluation reserve .......................................... (7) – –

Amortisation of shares in restricted share plans ......................................... 19 10 –

Own shares acquired to meet share awards and share option awards ......... (5) (11) –

Own shares released on vesting of share awards and exercise of options ... 45 42 –

Exchange and other movements ................................................................. 3,715 – (1)

At 31 December 20021 ............................................................................... 32,694 6,055 243

1Includes the balance relating to own shares held. In the 2003 Annual Report and Accounts, the balance relating to own shares held was

reported separately together with movements in the year.

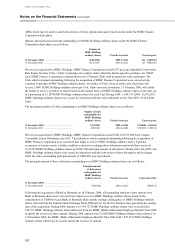

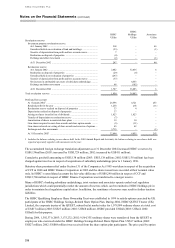

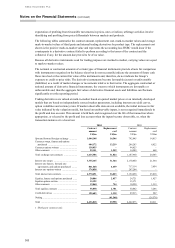

The accumulated foreign exchange translation adjustment as at 31 December 2004 increased HSBC’ s reserves by

US$9,134million (2003: increased by US$5,729 million; 2002: increased by US$411 million).

Cumulative goodwill amounting to US$5,138 million (2003: US$5,138 million; 2002: US$5,138 million) has been

charged against reserves in respect of acquisitions of subsidiary undertakings prior to 1 January 1998.

Statutory share premium relief under Section 131 of the Companies Act 1985 was taken in respect of the acquisition

of CCF in 2000 and HSBC Finance Corporation in 2003 and the shares issued were recorded at their nominal value

only. In HSBC’ s consolidated accounts the fair value difference of US$8,290 million in respect of CCF and

US$12,768 million in respect of HSBC Finance Corporation was transferred to a merger reserve.

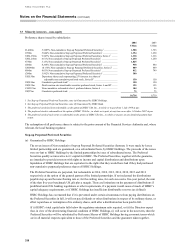

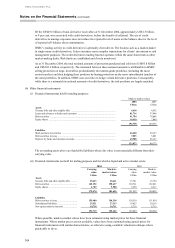

Many of HSBC’ s banking subsidiary undertakings, joint ventures and associates operate under local regulatory

jurisdictions which could potentially restrict the amount of reserves which can be remitted to HSBC Holdings plc in

order to maintain local regulatory capital ratios. In addition, the remittance of reserves may result in further taxation

liabilities.

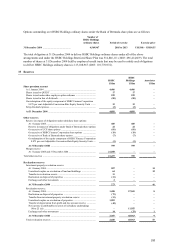

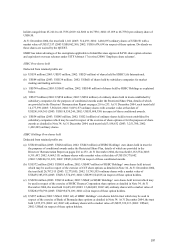

The HSBC Qualifying Employee Share Ownership Trust was established in 1999 to satisfy options exercised by UK

participants of the HSBC Holdings Savings-Related Share Option Plan. During 2004, HSBC QUEST Trustee (UK)

Limited, the corporate trustee of the QUEST, subscribed at market value for 1,079,099 ordinary shares at a total cost

of US$17 million (2003: US$27 million; 2002: US$68 million). HSBC provided US$nil (2003: US$nil; 2002:

US$nil) for this purpose.

During 2004, 1,592,371 (2003: 3,175,232; 2002: 9,564,355) ordinary shares were transferred from the QUEST to

employees who exercised under the HSBC Holdings Savings-Related Share Option Plan. US$17 million (2003:

US$27 million; 2002: US$68 million) was received from the share option plan participants. The price paid by option