HSBC 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.75

HSBC maintained its position as the largest

credit card issuer in Hong Kong. An attractive

rewards programme, successful cross-sales to both

existing and new customers, and customer

acquisition, helped grow the number of cards in

circulation by 14 per cent to 3.5 million. Cardholder

spending increased by 32 per cent compared with

2003, reflecting the successful promotion of credit

card internet bill payment services, and promotional

campaigns launched in conjunction with retail

merchants. Average credit card balances grew by

11 per cent against a backdrop of an overall

reduction in outstanding balances in the market. Fee

income from credit cards rose by 12 per cent

compared with 2003.

Other operating income increased by 24 per cent

to US$1,466 million, largely driven by the continued

strong performance from the insurance and

investment businesses.

During the year, strong emphasis was placed on

growing the insurance business. A series of

promotional campaigns was launched, and the

number of financial planning managers was

increased by 24 per cent to 742. The insurance

product range was also enhanced as new products

designed to meet customers’ needs were introduced.

In 2004, HSBC recorded growth of 40 per cent in

new regular premium life sales, driven by the

success of flexible products tailored to customers’

specific needs, such as the Target Protection Plus

product. Income from the insurance business,

including the Mandatory Provident Fund also grew

by 31 per cent to US$441 million.

Income from sales of unit trusts and structured

products grew by 43 per cent to US$183 million,

reflecting the successful deployment of customer

relationship management systems, an increase in the

number of HSBC Premier relationship managers,

and a rise in stock market activity. New products,

including a range of structured treasury products,

capital-guaranteed funds, open-ended funds and

certificates of deposit, were launched to broaden the

range of investment options. Overall, sales of unit

trusts and structured products grew by

US$609 million, or 9 per cent, compared with 2003.

Higher fee income also came from stockbroking

and custody services, which grew by 49 per cent to

US$185 million, reflecting increased levels of stock

market activity and IPO-related services. Sixty eight

per cent of all securities transactions were processed

on-line in 2004, 5 percentage points higher than in

2003.

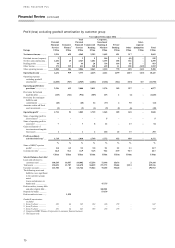

Operating expenses, excluding goodwill

amortisation, were 4 per cent higher than in 2003.

Performance-related staff costs increased in line with

sales of investment and insurance products and the

general improvement in profits. Excluding the

impact of incentive payments, staff costs fell by

5 per cent, reflecting greater operational efficiencies

and higher utilisation of the Group Service Centres.

The various income growth initiatives also involved

higher marketing costs, particularly for credit cards,

insurance and investment products.

Credit conditions improved markedly as the

economy recovered, with falling unemployment,

lower bankruptcies, higher residential property

prices and stronger GDP growth. The charge for bad

and doubtful debts fell by US$312 million to

US$54 million. New specific provisions declined by

over 74 per cent to US$95 million, as provisions for

credit card, mortgage and unsecured personal

lending portfolios all fell. There was also a

US$41 million release of general provisions

following a review of historical loss experience and

the improved market environment, in particular a

reduction in mortgage loans with negative equity.

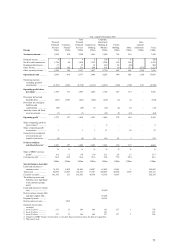

Pre-tax profits, before goodwill amortisation, in

Commercial Banking rose by 29 per cent to

US$914 million, driven by a 14 per cent rise in

operating income and significant releases and

recoveries in provisions.

Operating income benefited from the success of

a series of initiatives designed to enhance the service

offered to middle market customers. The

introduction of a greater number of experienced

relationship managers to service key accounts

contributed significantly to income growth, while a

number of dedicated business development

relationship managers were appointed to focus on

new customers, leading to a 3 per cent increase in

customer numbers. Small and medium-sized

enterprises (‘SME’ s) benefited from the opening of

five new business banking centres offering a

comprehensive range of bespoke services, while an

SME start-up marketing campaign, launched in

October, promoted these services with specific

reference to the BusinessVantage all-in-one account.

These initiatives, together with call centre expansion,

contributed to an increase in income arising from

SME business.

Net interest income increased by 13 per cent as

strong growth in both lending balances and customer

deposits reflected the impact of the relationship

managers and business banking centres. Spreads on

deposits narrowed during the year in the continued

low interest rate environment.

Other operating income rose by 16 per cent to

US$525 million due largely to a significant rise in