HSBC 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

78

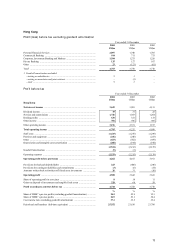

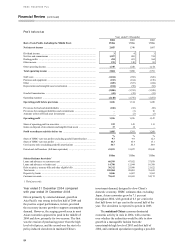

Personal Financial Services in Hong Kong

reported a pre-tax profit, before goodwill

amortisation, of US$1,740 million, 2 per cent higher

than in 2002. Given the pressure on net interest

income as a consequence of muted credit demand

and the impact of lower interest rates on the value of

deposits, there was continued focus on the insurance

business and wealth management. Sales of unit trusts

and of capital-guaranteed funds were particularly

successful.

Net interest income fell by US$161 million or

7 per cent compared with 2002, largely due to a

reduction in spreads on the value of deposits taken in

the low interest rate environment and continued

pressure on yields in the mortgage business,

although there was some benefit from lower cost of

funds.

Partly offsetting the decline in net interest

income, other operating income at US$1,182 million

was 13 per cent higher than in 2002. HSBC’s

position as one of Hong Kong’s leading providers of

insurance and wealth management services was

sustained amid keen competition. Income from

wealth management initiatives, including

commissions on sales of unit trust products, funds

under management, and securities transactions, grew

by 38 per cent to US$408 million. This was achieved

by strong growth in sales of unit trusts and capital

guaranteed funds, which increased by

US$1.6 billion, or 32 per cent, over 2002.

Net fee income from credit cards was broadly in

line with 2002. Despite fierce competition in the

market, HSBC maintained its position as the largest

credit card issuer in Hong Kong with some

3.1 million cards in circulation, 9 per cent higher

than in 2002.

During the year, HSBC continued to place

significant emphasis upon the growth and

development of its insurance business. HSBC

increased sales of regular premium individual life

insurance by 59 per cent, growing its market share

from 13.9 per cent to 18.6 per cent. Income from the

insurance business, including the Mandatory

Provident Fund, grew by 53 per cent or

US$118 million.

Operating expenses, excluding goodwill

amortisation, were 5 per cent lower than in 2002,

with savings in staff costs partly offset by higher

marketing costs. Headcount reduced as HSBC

continued to migrate a wide range of back office and

call centre functions to the Group Service Centres in

Guangzhou and Shanghai. The Group Service

Centres in mainland China now provide about half

the operational support for credit card operations in

Hong Kong.

Provisions for bad and doubtful debts were

broadly in line with last year. The charge for specific

provisions for bad and doubtful debts decreased

compared with 2002, mainly due to a reduced charge

for unsecured lending (including credit cards), in line

with lower personal bankruptcy filings and improved

economic conditions in the latter half of the year.

This was partly offset by higher provisions against

mortgage lending. 2002 benefited from a higher

release of general provision. As the economy grows

and property prices stop falling the environment for

personal credit is expected to improve in 2004.

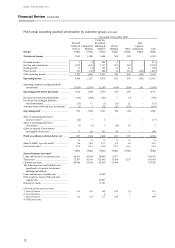

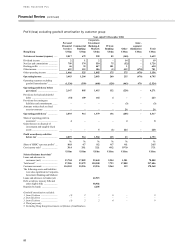

Commercial Banking in Hong Kong

contributed a pre-tax profit, before amortisation of

goodwill, of US$711 million, a fall of

US$22 million, or 3 per cent.

Net interest income declined by 7 per cent

largely due to lower recoveries of suspended interest

and the effect of lower spreads on deposits. There

was good volume growth in the loan book, despite

the impact of SARS and the war in Iraq. This was

offset by narrower spreads caused by limited local

investment and market pressure as banks competed

for quality business. Loan growth was driven by

increased demand for finance to support record trade

flows between mainland China and the rest of the

world, especially the US. This was particularly

evidenced in the manufacturing and transportation

sectors. Several new business banking/trade service

centres were opened to focus on the business needs

of small and medium-sized customers and start-ups.

Other operating income rose by US$57 million,

or 14 per cent, reflecting growth in cash

management and trade services. Both benefited from

the increase in trade flows and closer liaison between

branches of the bank in Hong Kong and mainland

China. This was developed in order to service the

growth of investment in the Pearl River delta by

Hong Kong-based customers. Additionally, Hang

Seng Bank opened its first branch in Macau aimed at

assisting customers setting-up offices in the territory.

Results of this alignment were particularly

successful, with referrals significantly higher than

anticipated. Trade finance benefited from a

campaign specifically aimed at the increase in export

trade business which occurs during the peak summer

season. Insurance income rose as a consequence of

business expansion, increasing by 36 per cent.

Operating expenses were in line with 2002. Staff

costs increased marginally as headcount rose to

support the insurance business expansion. This was

offset by lower legal and professional fees.