HSBC 2004 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

217

prevailing market practice; and

• HSBC has a long history of paying close

attention to its customers in order to provide

value for shareholders. This has been achieved

by ensuring that the interests of HSBC and its

employees are aligned with those of its

shareholders and that HSBC’s approach to risk

management serves the interests of all.

Accordingly, employees are encouraged to

participate in the success they help to create,

through participating in the HSBC Holdings

savings-related share option plans and in local

share ownership and profit sharing

arrangements.

During 2004, a comprehensive review of share-

based remuneration arrangements was conducted.

This review was undertaken in light of changing

business needs, taking into account HSBC’ s

expansion in certain markets and an evolving

external environment.

Approval for The HSBC Share Plan will be

sought at the forthcoming Annual General Meeting.

The proposed arrangements for the most senior

executives of HSBC are described under ‘Long-term

incentive plan’ on page 219. Shareholders and their

representatives were consulted and the proposed

arrangements reflect feedback that has been

received.

Below the senior executive level and in the

context of an employee’s total remuneration

package, the practice of awarding share options at all

levels within HSBC has been reconsidered. In future

and commencing with awards to be made in 2005,

restricted shares will be granted to a substantially

smaller number of executives than those who

previously received share options, with awards

focused on those individuals who bring key talents

and high levels of performance to the Group. These

awards will normally vest after three years, subject

to the individual remaining in employment. Awards

of share options will only be granted in limited

circumstances. For those who will normally no

longer be eligible to receive awards of shares or

share options, variable bonus arrangements have

been reviewed and enhanced, as appropriate, taking

account of local markets. Such changes may include

an element of deferral.

To encourage greater participation in the HSBC

Holdings Savings-Related Share Option Plan:

(International), two amendments to existing

arrangements will be proposed for approval at the

forthcoming Annual General Meeting. The first is

the introduction of the facility to save in US dollars,

Hong Kong dollars and euros as well as in pounds

sterling. The maximum savings limit of £250 per

month will continue to apply but be converted to the

other currencies on a consistent and appropriate date.

The second proposal is to offer individuals the

choice of options over one year in addition to the

existing three and five year terms. This change will

carry tax advantages in certain jurisdictions.

The impact on existing equity of granting share

options which are to be satisfied by the issue of new

shares is shown in diluted earnings per share on the

face of the consolidated profit and loss account, with

further details disclosed in Note 10 of the ‘Notes on

the Financial Statements’ on page 261. The effect on

basic earnings per share of exercising all outstanding

share options would be to dilute it by 0.6 per cent.

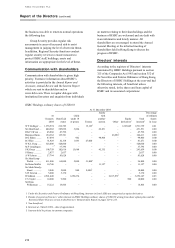

At the Annual General Meeting in 2000,

shareholders approved a limit of 848,847,000

ordinary shares (approximately 10 per cent of the

ordinary shares then in issue), which may be issued

or become issuable under all employee share plans in

any ten year period. Within this limit, not more than

5 per cent of the ordinary shares in issue from time

to time (approximately 560,000,000 ordinary shares

at 28 February 2005) may be put under option under

the HSBC Holdings Group Share Option Plan and

the HSBC Holdings Restricted Share Plan 2000. In

the ten year period to 31 December 2004, less than

650 million ordinary shares had been issued or could

become issuable under all employee share plans and

less than 350 million ordinary shares had been issued

or could become issuable under discretionary

employee share plans, including the HSBC Holdings

Group Share Option Plan and the HSBC Holdings

Restricted Share Plan 2000. At the forthcoming

Annual General Meeting, revised limits on the

number of shares that may be issued or become

issuable under employee share plans will be

proposed to reflect the increase in share capital since

2000.

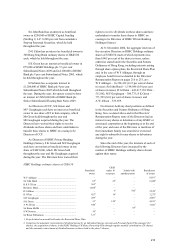

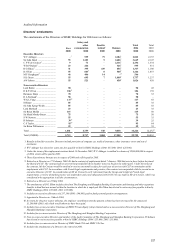

Directors and Senior Management

HSBC’ s operations are substantial, diverse and

international; for example, over 73 per cent of profit

before tax is derived from outside the United

Kingdom.

With effect from 1 March 2005 the HSBC

Holdings’ Board will comprise 15 non-executive

Directors and seven executive Directors. With

businesses in 77 countries and territories, HSBC

aims to attract Directors with a variety of experience,

both in its key areas of activity and internationally.

The Board currently includes nationals of five

different countries. The seven executive Directors,

four Group Managing Directors and 23 Group