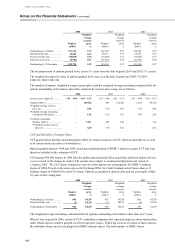

HSBC 2004 Annual Report Download - page 336

Download and view the complete annual report

Please find page 336 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

334

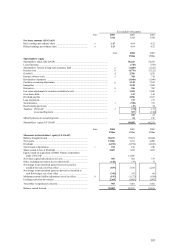

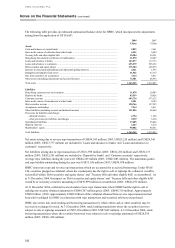

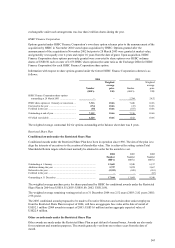

2004 2003

US$m US$m

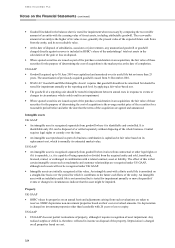

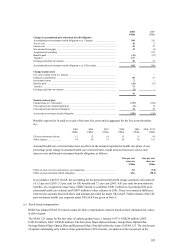

Change in projected benefit obligation

Projected benefit obligation as at 1 January ................................................................. 21,085 15,463

Service cost ................................................................................................................. 743 429

Interest cost ................................................................................................................. 1,209 915

Employee contributions ............................................................................................... 21 4

Net actuarial loss .......................................................................................................... 1,244 2,306

Acquisition of subsidiary ............................................................................................. –897

Plan amendment .......................................................................................................... –6

Benefits paid ................................................................................................................ (845) (714)

Transfers ......................................................................................................................417 –

Exchange movements .................................................................................................. 1,632 1,779

Projected benefit obligation as at 31 December ........................................................... 25,506 21,085

Change in plan assets

Plan assets at fair value as at 1 January ........................................................................ 17,344 11,786

Actual return on plan assets ......................................................................................... 1,828 2,399

Acquisition of subsidiary ............................................................................................. –832

Employer contributions ............................................................................................... 431 1,653

Employee contributions ............................................................................................... 21 4

Benefits paid ................................................................................................................ (845) (714)

Transfers ......................................................................................................................264 –

Exchange movements .................................................................................................. 1,235 1,384

Plan assets at fair value as at 31 December .................................................................. 20,278 17,344

Funded status ............................................................................................................... (5,228) (3,741)

Unrecognised net actuarial loss ................................................................................... 4,526 3,558

Unrecognised prior service cost ................................................................................... 49 42

Accrued pension cost ................................................................................................... (653) (141)

Additional minimum liability ...................................................................................... (3,261) (2,789)

Intangible assets .......................................................................................................... 12 14

Net amount recognised ................................................................................................. (3,902) (2,916)

Amounts recognised under US GAAP in the balance sheet consist of:

Prepaid benefit cost ..................................................................................................... 783 833

Accrued benefit liability .............................................................................................. (1,436) (974)

Additional minimum liability ...................................................................................... (3,261) (2,789)

Intangible assets .......................................................................................................... 12 14

(3,902) (2,916)

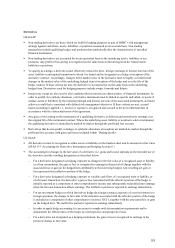

US GAAP adjustment

Amount recognised under US GAAP .......................................................................... (3,902) (2,916)

Amounts recognised for these schemes under UK GAAP ........................................... (874) (206)

(4,776) (3,122)

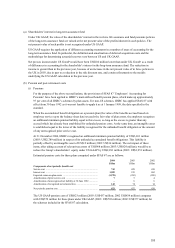

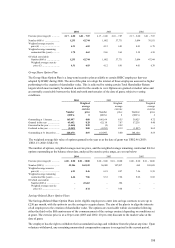

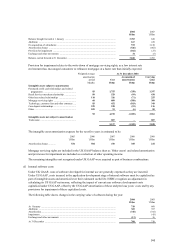

In 2004, plans with an aggregate accumulated benefit obligation of U$20,566 million

(2003: US$17,332 million) and assets with an aggregate fair value of US$16,128 million (2003: US$13,739

million) had an accumulated benefit obligation in excess of plan assets. Plans with an aggregate projected

benefit obligation of US$22,914 million (2003: US$17,841 million) and assets with an aggregate fair value

of US$17,422 million (2003: US$13,739 million) had a projected benefit obligation in excess of plan assets.

Plan assets are invested primarily in equities, fixed interest securities and property. Included within plan

assets at 31 December 2004 are direct holdings of 4,797,952 HSBC Holdings shares with a market value of

US$82 million (2003:760,690 shares; US$12 million). Plan asset valuations are as at 31 December.

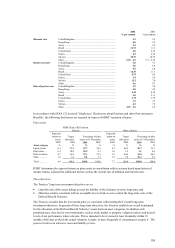

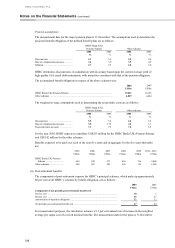

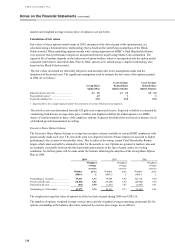

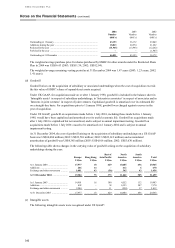

The projected benefit obligations at 31 December 2004 and 2003 for HSBC’ s main pension plans have been

calculated using the following financial assumptions on a weighted average basis: