HSBC 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Financial Review (continued)

74

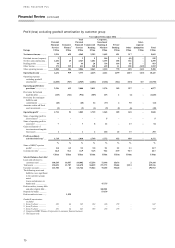

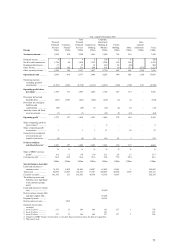

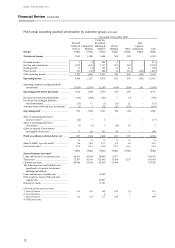

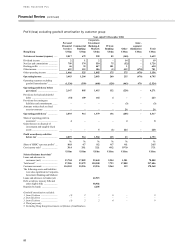

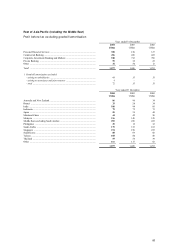

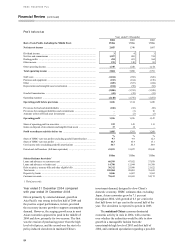

Year ended 31 December

2004

US$m

2003

US$m

2002

US$m

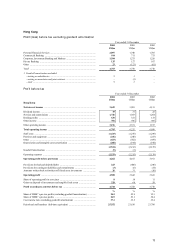

Selected balance sheet data1

Loans and advances to customers (net) .......................................................... 78,888 73,988 69,948

Loans and advances to banks (net) ................................................................. 45,300 38,640 33,359

Debt securities, treasury bills and other eligible bills ..................................... 69,464 66,158 60,083

Total assets2 ................................................................................................... 217,406 197,487 180,433

Deposits by banks .......................................................................................... 4,325 4,777 2,379

Customer accounts ......................................................................................... 178,368 164,024 148,904

1Third party only.

2Excluding Hong Kong Government certificates of indebtedness.

Year ended 31 December 2004 compared

with year ended 31 December 2003

The Hong Kong economy expanded rapidly in 2004.

Despite rising US interest rates and mainland

China’ s cooling-off measures, Hong Kong continued

to benefit from robust re-export trade with mainland

China. The positive outlook for Hong Kong, together

with the re-emergence of inflation, helped sustain a

recovery in local confidence which began in late

2003. Hong Kong’ s domestic demand also grew

steadily, supported by reviving asset prices and

falling unemployment. The continued inflow of

liquidity suppressed local interest rates, which in

turn encouraged a flow of local funds into asset

markets. Rising property prices stimulated private

consumption and alleviated past concerns over

negative equity in residential mortgages. The

unemployment rate fell from 7.3 per cent to 6.5 per

cent, with strong growth in the trade and retail

sectors helping to sustain consumer spending,

though the rate of job creation slowed in the second

half of the year as China’ s cooling-off measures took

effect on the trade sector. Investment revived in the

robust tourism industry, which continued to benefit

from the liberalisation of regulations governing visits

by residents of mainland China.

In the second half of 2004, inflation re-emerged

in Hong Kong after a nearly six year-long period of

deflation. Stimulated by a weak US dollar,

recovering property prices and rising local

confidence, prices rose from a year ago when the

economy was suffering from the effect of the severe

acute respiratory syndrome (‘SARS’ ) epidemic.

Significant inflows of liquidity from foreign

investors left the Hong Kong market flush with

surplus funds. This caused Hong Kong dollar and

US dollar interest rates to diverge, with the already

cash-rich local economy slow to absorb external

funds. Moreover, demand for credit remained muted,

other than in the trade sector, with individuals and

enterprises slow to increase borrowings, reflecting

nervousness regarding the sustainability of the

recovery. The improving economy helped to ease

concerns over Hong Kong’ s fiscal position as it

resulted in a significant narrowing in the budget

deficit in 2004.

HSBC’s operations in Hong Kong reported a

pre-tax profit of US$4,744 million, an increase of

US$1,016 million, or 27 per cent, over 2003.

Excluding goodwill amortisation, pre-tax profit also

grew by 27 per cent to US$4,753 million,

representing 24 per cent of HSBC’s total profit on

this basis.

Personal Financial Services in Hong Kong

reported a pre-tax profit, before goodwill

amortisation, of US$2,097 million, 21 per cent

higher than in 2003. This improvement was largely

driven by strong growth in other operating income,

within which fee and commission income was 27 per

cent higher. This, together with a significant

reduction in the net bad debt charge, more than

offset an 8 per cent reduction in net interest income.

During 2004, the Hong Kong banking sector

was characterised by high levels of surplus liquidity

as foreign funds entered Hong Kong to invest in the

buoyant stock market, and there were inflows from

investors anticipating an upward realignment of the

currency as the US dollar weakened. This excess

liquidity depressed Hong Kong dollar interest rates

and so reduced spreads on deposits, as banks were

unable to pass on the full effect of the reduction in

rates to depositors. The lower Hong Kong dollar

interest rates contributed to the overall reduction in

net interest income of US$186 million. Net interest

income was further reduced by the continued

pressure on yields in the mortgage business, where

market competition remained intense. Average

mortgage balances fell by 2 per cent compared with

last year due to a reduction in balances under the

Government Home Ownership Scheme (‘GHOS’ ),

which remained suspended during the year. With

plenty of low cost funding in the market, and fierce

competition for quality mortgage business, the

average yield on the mortgage portfolio, excluding

GHOS loans, fell by 25 basis points to 202 basis

points below HSBC’s best lending rate.