HSBC 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

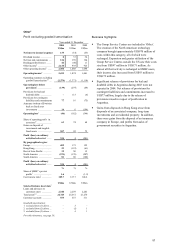

the planned programme to upgrade critical

infrastructure and staff skills.

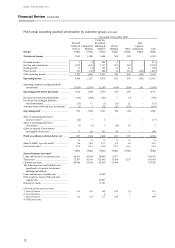

Net interest income was 16 per cent lower than

in 2003, in part reflecting the costs of funding a

higher level of equity swaps, the trading impact and

dividend benefit from which is reported in other

operating income. Global Markets earnings declined

as higher yielding assets ran off and were replaced

by investments at lower prevailing money market

rates. Market concerns over future interest rate

increases, oil prices at record highs, and the Iraq

crisis all drove down demand for credit. A reduction

in the level of customer activity led to a fall in

corporate and institutional account balances. In

Turkey, significant reductions in local interest rates

resulted in lower income streams from net free

funds.

Other operating income rose by 6 per cent to

US$3,210 million of which 2 per cent arose in Bank

of Bermuda's European operations. Adjusting for the

Bank of Bermuda acquisition, operating income

increased by US$76 million or 4 per cent. In the UK,

a US$414 million rise in dividends from equity

swaps activity reflected an increase in volumes and

size of trades, primarily driven by the growth in the

equity swaps market. This gain was partly offset by a

related decrease in dealing profits and higher fees

payable of US$354 million and funding costs of

US$38 million, reported under net interest income.

Fixed income revenues fell, mainly from lower

volatility in credit spreads and a reduced level of

corporate debt issuance. Foreign exchange and

derivatives revenue increased due to higher customer

volumes across a wider range of products, with

supplementary gains from the continued weakening

of the US dollar. Improved performance in structured

derivatives reflected the successful investment in

additional execution capabilities, while Global

Markets in Turkey experienced a boost in revenues

from foreign exchange gains and securities trading

following its integration with HSBC’s other dealing

rooms in Europe. In Germany, higher fees and

commissions were generated from investment

banking advisory business and improved volumes on

derivatives.

Costs increased by 18 per cent, of which 3 per

cent represented Bank of Bermuda. The remaining

costs reflected the restructuring of the business, with

extensive expenditure on systems and people to

improve client coverage. Overall, these

developments saw the departure of 856 staff and the

recruitment of 1,051 during the course of the year,

improving levels of proficiency and customer

delivery. Key appointments included global sector

heads for certain industry teams based in the UK and

additional senior hires in investment banking

advisory, while staff were also recruited to support

the expansion of the cash equities, options,

structured products and derivatives businesses. The

planned development of global research continued,

with the recruitment of people across a variety of

sectors and products. The restructuring of regional

research franchises into a globally managed

business, encompassing all research across all

product areas, was completed. Non-staff costs also

increased, reflecting the continued investment in

technology, including US$19 million for the

development of HSBCnet. HSBC Securities Services

incurred additional costs to develop insourcing

capabilities for third party processing.

The net release of provisions for bad and

doubtful debts, compared with a net charge in 2003,

reflected the benefit of a number of recoveries and

releases of certain provisions resulting from

successful refinancing during the year. Corporate

lending weakness in the power generation sector,

which adversely affected 2003, was not repeated.

The recoveries included sizeable amounts for a

single name in the industrial sector in France.

Gains on investment disposals were

US$210 million, reflecting the disposal of HSBC’s

interest in a number of private equity investments in

the UK and France.

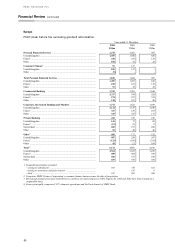

Private Banking contributed a pre-tax profit,

before goodwill amortisation, of US$432 million, an

increase of 26 per cent compared with 2003.

Growth of 19 per cent in net interest income was

driven by a 27 per cent increase in lending balances,

predominantly in the UK and Switzerland, where

clients leveraged their wealth by borrowing on a

secured basis in the low interest environment to

reinvest in higher-yielding securities or in alternative

investments. Income also benefited from a shift in

the profile of investment securities to higher-yielding

HSBC Finance Corporation paper.

Net fees and commissions increased by 11 per

cent to US$658 million. Performance fees included a

US$24 million increase in fees from the Hermitage

Fund, one of the world’s leading public equity funds

dedicated to Russia in which HSBC Private Bank

has been invested from its inception. In the UK,

commission income in HSBC’s residential property

advisory business grew strongly, supported by the

generally buoyant housing market, and increased

client referrals.

Funds under management grew by 13 per cent

to US$107.8 billion, as clients moved cash liquidity

to higher-yielding investment products in the low