HSBC 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

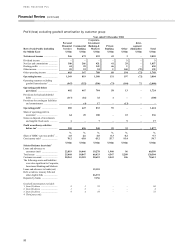

Financial Review (continued)

96

products, including a range of adjustable rate

mortgages, were launched during the year

contributing to an overall increase in gross new

lending of 3 per cent to US$32.6 billion. The income

benefit of this growth, however, was partly offset by

pressure on spreads. Competitive pricing in a

contracting market forced a general downward trend

in mortgage yields in 2004 compared with the levels

seen in 2003.

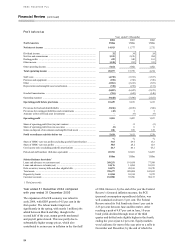

Other operating income rose by US$164 million

or 20 per cent to US$979 million, of which

US$82 million came from acquisitions. Growth was

largely attributable to the strong performance in

Mexico, where expansion of the pension funds

business, acquired in the last quarter of 2003,

complemented higher fee income from credit cards,

deposit-related services and international

remittances. Sales of pension and bancassurance

products grew strongly, attracting some 270,000 new

customers, following an expansion of the sales force.

An enhanced customer relationship management

system and the employment of WHIRL helped the

number of credit cards in circulation in Mexico to

rise by 29 per cent to 568,000. Fee income from

credit cards rose by 20 per cent compared with 2003.

Operations in Canada benefited from a rise in retail

broking volumes, as market activity revived. In the

US, a revised fee structure and improved collection

processes produced a 9 per cent increase in fee

income from cards and deposit-related services.

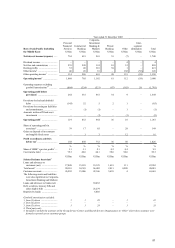

The US mortgage banking business contributed

a pre-tax profit of US$270 million, in line with 2003,

despite a fall in other operating income. Lower

origination and sales-related income in the secondary

market was only partly offset by a reduction in net

servicing expenses. There was a net loss of

US$4 million from sale of mortgage loans in 2004

compared with a net gain of US$117 million in

2003. This was mainly driven by lower gains on

sales of mortgages, as narrower spreads combined

with a fall in the volume of loans originated for sale.

As interest rates increased in 2004 from the

historically low levels experienced in 2003,

prepayments of residential mortgages, mostly in the

form of loan refinancing, reduced significantly and

residential mortgages originated for sale declined by

64 per cent compared with 2003, despite an overall

increase in mortgage lending. Loan refinancing

activity represented 50 per cent of the total loan

originations, compared with 74 per cent in 2003.

Pricing also fell from the unusually high levels seen

in 2003 and, as a result, HSBC earned lower returns

on loans sold.

The net cost of servicing mortgages fell,

improved primarily as a result of lower amortisation

expenses on mortgage servicing rights (‘MSR’ ) and

increased income associated with the derivatives

used to offset the changes in the economic value of

the MSRs. The reduction in amortisation expenses

was also partly affected by lower MSR balances in

2004. The cost reduction was partly offset by higher

temporary impairment reserves.

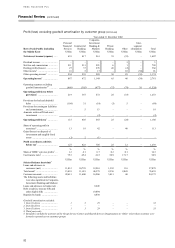

Operating expenses, excluding goodwill

amortisation, were 16 per cent higher than in 2003.

This was due mainly to a 15 per cent increase in

costs in Mexico, where the expansion of the pension

funds business and the inclusion of the insurance

business acquired in the last quarter of 2003

contributed to generally higher salaries and

performance-related bonuses. Staff numbers

increased in the Mexican branch network to support

growth in business volumes, improve customer

service, and support the rollout of HSBC Premier.

The introduction of the WHIRL credit card system in

Mexico and the US, at a cost of US$23 million, was

completed by the end of October. In the US,

expansion in the mortgage sales force and higher

performance-related bonuses led to higher staff

costs, while the launch of advertising campaigns for

mortgages and deposits added to marketing costs.

Additional staff were recruited in the branch network

to support business expansion and to improve

customer service. Costs in Canada increased by 4 per

cent, principally due to higher performance-related

staff costs in the brokerage business and

restructuring expenses arising from the integration of

Intesa Bank Canada, acquired in May.

The net bad debts charge fell by 29 per cent to

US$99 million. Recoveries of amounts previously

written-off in Mexico more than offset the

US$11 million increase in new specific provisions in

the US, predominantly for the credit cards portfolio

within HSBC Bank USA. There was also a

US$28 million release of general provisions in

Mexico following a review of historical loss

experience, reflecting a general improvement in the

credit quality of consumer loan portfolios, and the

improved market environment.

Consumer Finance contributed a pre-tax profit,

before goodwill amortisation, of US$3,576 million

in 2004, an increase of US$1,508 million of which

US$1,097 million was an additional quarter’s

contribution. On an underlying basis, pre-tax profit,

before goodwill amortisation, grew by 20 per cent to

US$2,479 million.

The integration of HSBC Finance Corporation

into HSBC continued to deliver funding benefits in

line with those anticipated. Since December 2003,

HSBC Finance Corporation has sold US$3.7 billion