HSBC 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC Holdings plc Annual Report

and Accounts

Table of contents

-

Page 1

HSBC Holdings plc Annual Report and Accounts -

Page 2

... to as 'Hong Kong' . This document comprises the Annual Report and Accounts 2004 for HSBC Holdings plc and its subsidiary and associated undertakings. It contains the Directors' Report and Financial Statements, together with the Auditors' Report thereon, as required by the UK Companies Act 1985... -

Page 3

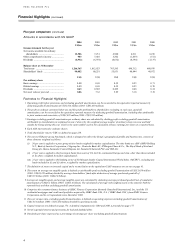

...to shareholders2 ...For the year (as reported) Operating profit before provisions ...Profit on ordinary activities before tax ...Profit attributable to shareholders ...Dividends ...At year-end Shareholders' funds ...Capital resources ...Customer accounts and deposits by banks ...Total assets ...Risk... -

Page 4

... assets9 ...Performance ratios (as reported) Return on average shareholders' funds ...Post-tax return on average total assets ...Post-tax return on average risk-weighted assets ...Credit coverage ratios Provisions for bad and doubtful debts as a percentage of operating profits before goodwill... -

Page 5

... At year-end Share capital ...Shareholders' funds ...Capital resources12 ...Customer accounts ...Undated subordinated loan capital ...Dated subordinated loan capital ...Loans and advances to customers13 ...Total assets ...For the year Net interest income ...Other operating income ...Operating profit... -

Page 6

... Household International, Inc.) and the US residential mortgages and credit card portfolios acquired by HSBC Bank USA, N.A. ('HSBC Bank USA' ) from HSBC Finance Corporation and its correspondents since December 2003. 11 The cost:income ratio, excluding goodwill amortisation, is defined as operating... -

Page 7

...-established exchange rates (for example, between the Hong Kong dollar and the US dollar); volatility in interest rates; volatility in equity markets, including in the smaller and less liquid trading markets in Asia and South America; lack of liquidity in wholesale funding markets in periods... -

Page 8

...viable financial system with stability in monetary, fiscal and exchange rate policies; and the effects of competition in the markets where HSBC operates including increased competition resulting from new types of affiliations between banks and financial services companies, including securities firms... -

Page 9

... the time. Exchange Controls and Other Limitations affecting Equity Security Holders There are currently no UK laws, decrees or regulations which would prevent the import or export of capital or remittance of distributable profits by way of dividends and other payments to holders of HSBC Holdings... -

Page 10

... range of financial services is offered to personal, commercial, corporate, institutional, investment and private banking clients. HSBC manages its business through the following customer groups: Personal Financial Services; Commercial Banking; Corporate, Investment Banking and Markets; and Private... -

Page 11

... Insurance listed its shares through an initial public offering ('IPO' ) in Hong Kong. HSBC invested a further US$168 million, reducing its holding to 9.99 per cent. In March 2003, HSBC acquired Household International, Inc. which, in December 2004, changed its name to HSBC Finance Corporation. HSBC... -

Page 12

...its internal and external reporting around customer groups, it reinforces to all its employees the Group's customer focus. The acquisition of HSBC Finance Corporation in 2003, and subsequent skills sharing and technology transfer, have highlighted the importance within Personal Financial Services of... -

Page 13

... of HSBC's international customer base through effective relationship management and improved product offerings in all the Group's markets; Corporate, Investment Banking and Markets: accelerate growth by enhancing capital markets and advisory capabilities focused on client service in defined sectors... -

Page 14

... market positioning of HSBC' s local business. Typically, products provided include current and savings accounts, mortgages and secured and unsecured personal loans, credit cards, and local payments services. Personal Financial Services customers prefer to conduct their financial business at times... -

Page 15

... three months of the year. HSBC Finance Corporation's business in the UK provides mid-market consumers with mortgages, secured and unsecured loans, insurance products, credit cards and retail finance products. It concentrates on customer service through its 216 HFC Bank and Beneficial branches, and... -

Page 16

...number of Commercial Banking customers need occasional investment banking advisory support. Co-operation with Corporate, Investment Banking and Markets ensures that in most key markets such requirements can be serviced internally. Wealth management services: These include advice and products related... -

Page 17

...and discretionary investment services. A wide range of investment vehicles is covered, including bonds, equities, derivatives, structured products, mutual funds and hedge funds. Supported by six major advisory centres in Hong Kong, Singapore, Geneva, New York, Paris and London, Private Banking seeks... -

Page 18

... consumer finance products there through its subsidiary, Losango. HSBC also has one of the largest insurance businesses in Argentina, HSBC La Buenos Aires and, through HSBC Máxima and HSBC New York Life, offers pensions and life assurance in Argentina. 1 Excludes Hong Kong Government certificates... -

Page 19

... mono-line providers of both consumer lending and savings products has grown in recent years often through the use of attractive pricing to capture market share. Consolidation in the market for credit and charge cards has increased in recent years as retailers look to outsource their finance company... -

Page 20

... In Canada, the financial services industry continues to be dominated by the five largest banks in the country. However, the market remains highly competitive as other banks, insurance companies and financial institutions offer a range of comparable products and services. While merger activity among... -

Page 21

... of foreign institutions, including HSBC. The top ten banking groups account for around two thirds of total financial system assets. Although 2004 saw little consolidation among the larger players, the year was characterised by continued positioning for growth in the consumer finance market. Lending... -

Page 22

... trading on each of these exchanges. In the UK, these are the Listing Rules of the Financial Services Authority; in Hong Kong, The Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited; in the US, where the shares are traded in the form of ADS' s, HSBC Holdings' shares... -

Page 23

..., risk control, loan portfolio composition and organisational changes, including succession planning. UK depositors and investors are covered by the Financial Services Compensation Scheme which deals with deposits with authorised institutions in the UK, investment business and contracts of insurance... -

Page 24

...the Federal Deposit Insurance Corporation ('FDIC' ) and the Office of the Comptroller of Currency ('OCC' ) govern many aspects of HSBC' s US business. HSBC and its US operations are subject to supervision, regulation and examination by the Federal Reserve Board because HSBC is a bank holding company... -

Page 25

... Fund. Under the FDIC' s risk-based system for setting deposit insurance assessments, an institution' s assessments vary according to the level of capital an institution holds, its deposit levels and other factors. At 31 December 2004, HSBC Bank USA, Household Bank and Wells Fargo HSBC Trade Bank... -

Page 26

..., the types of actions that may be taken to collect or foreclose upon delinquent loans or the information about a customer that may be shared. HSBC's US consumer finance branch lending offices are generally licensed in those jurisdictions in which they operate. Such licences have limited terms but... -

Page 27

...At 31 December 2004, HSBC had some 9,500 operational properties worldwide, of which approximately 3,200 were located in Europe, 600 in Hong Kong and the rest of Asia Pacific, 3,800 in North America (including 1,600 in Mexico) and 1,700 in Brazil. Additionally, properties with a net book value of US... -

Page 28

... year ended 31 December 2003 'HSBC Finance' is defined for this purpose as HSBC Finance Corporation' s consumer finance, insurance and commercial banking operations together with the US residential mortgages and private label credit cards acquired by HSBC Bank USA from HSBC Finance Corporation and... -

Page 29

... the Group's profit and loss account changed as a result of the HSBC Finance Corporation acquisition, reflecting the nature of its business model. HSBC Finance generally serves non-conforming and sub-prime customers who, for a variety of reasons, have a higher delinquency and credit loss probability... -

Page 30

... on the value of deposits and pressure on lending margins, particularly in mortgages. Foreign funds investing in the buoyant stock market, and inflows from investors anticipating an upward realignment of the currency as US dollar weakened, boosted liquidity in the market, depressing Hong Kong dollar... -

Page 31

..., Malaysia, Australia and Singapore, and an increase in holdings of long-term securities in the US and debt securities in Hong Kong. HSBC' s net interest margin was 3.29 per cent in 2003, compared with 2.54 per cent in 2002. The acquisitions of HSBC Finance Corporation and HSBC Mexico increased net... -

Page 32

... US$m Account services ...Credit facilities ...Remittances ...Cards ...Imports/exports ...Underwriting ...Insurance ...Mortgage servicing rights ...Trust income ...Broking income ...Global custody ...Maintenance income on operating leases ...Funds under management ...Unit trusts ...Corporate finance... -

Page 33

... and commercial lending. Dealing profits of US$2,566 million were US$388 million, or 18 per cent, higher than in 2003 with US$49 million of the increase coming from acquisitions. Strong growth in foreign exchange and interest rate derivatives trading offset lower income from debt securities, while... -

Page 34

...Financial Review (continued) The acquisitions of HSBC Finance Corporation and HSBC Mexico reduced the proportion of fee revenues exposed to stock market fluctuations by bringing into the Group significant levels of account service fees (HSBC Mexico) and credit card fee income (HSBC Finance). Fees... -

Page 35

... operating expenses ...Cost:income ratio (excluding goodwill amortisation) ...14,492 2,726 6,965 24,183 1,664 28 1,814 27,689 % 51.1 2002 US$m 8,609 1,824 3,331 13,764 1,189 1 854 15,808 % 56.2 2004 Staff numbers (full-time equivalent) Europe ...Hong Kong ...Rest of Asia-Pacific ...North America... -

Page 36

... increase related to acquisitions in 2004, and the underlying rise in cost at constant currencies was 12 per cent. Staff costs increased by 2 per cent, with higher levels of performance-related bonuses, particularly in Corporate, Investment Banking and Markets and higher social taxes. Transactional... -

Page 37

...to the Group Service Centres in India, Malaysia and mainland China added to costs. In North America, operating expenses, excluding goodwill amortisation, increased by Bad and doubtful debts 2004 US$m By geographical region Europe ...Hong Kong ...Rest of Asia-Pacific ...North America ...South America... -

Page 38

... 2004, 78 per cent of customer lending was located in Europe and North America, with 12 per cent in Hong Kong. Personal lending accounted for 57 per cent of the customer loan portfolio, a marginal increase on the position at 31 December 2003. Excluding the effect of foreign exchange translation... -

Page 39

...acquisition of HSBC Finance Corporation, over 90 per cent of loan growth in 2003, excluding the financial sector, was generated in personal lending, predominantly mortgages, credit cards and other personal products. Over 90 per cent of the charge for bad and doubtful debts in 2003 related to lending... -

Page 40

... on the exchange of HSBC' s interest in World Finance International Limited for a 7 per cent interest in Bergesen Worldwide. The substantial increase in other disposals comprises the sale of venture capital investments in France and the US and the disposal of an investment in NYCE Corporation in the... -

Page 41

...US profits are taxed at a higher rate than the average for the rest of the Group and this change in mix raised the effective tax rate. A number of fair value acquisition accounting adjustments relating to HSBC Finance Corporation and HSBC Mexico resulted in net credits to the profit and loss account... -

Page 42

...US profits are taxed at a higher rate than the average for the rest of the Group and this change in mix raised the effective tax rate. A number of fair value acquisition accounting adjustments relating to HSBC Finance Corporation and HSBC Mexico resulted in net credits to the profit and loss account... -

Page 43

... markets in the US, the UK and parts of Asia-Pacific. Growth in corporate lending was concentrated in the Commercial Banking customer group, while increased financial lending largely reflected expansion of the euro government bond trading portfolios in France. At constant exchange rates, gross loans... -

Page 44

... business, including affiliates, reported funds under management of US$224 billion, and the private banking business reported funds under management of US$178 billion. 2004 US$bn Funds under management At 1 January ...Net new money ...- Bank of Bermuda ...- Other ...Value change ...Exchange... -

Page 45

... revaluation reserves ...Average invested capital2 ...Profit after tax ...Add: goodwill amortisation ...depreciation charged on property revaluations ...Less: equity minority interest ...preference dividends ...Return on invested capital3 ...Benchmark cost of capital ...Economic profit/spread ...80... -

Page 46

... C Financial Review (continued) Analysis by Customer Group and by Geographical Region By Customer Group: Profit/(loss) excluding goodw ill amortisation Year ended 31 December 2004 Total Corporate, Personal Investment Financial Commercial Banking & Private Services Banking Markets Banking US$m US... -

Page 47

... assets ...Profit on ordinary activities before tax3 .. Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data7 Loans and advances to customers (net) ...Total assets8,9 ...Customer accounts ...The following assets and liabilities were significant to customer groups as... -

Page 48

...tax ...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data7 Loans and advances to customers (net) ...Total assets8,9 ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking and Markets: Loans and advances banks... -

Page 49

... on-line sale of shares to personal customers in France. In the UK, HSBC' s mortgage products remained highly rated, receiving the 'Best National Bank' award over two, five and 10 years from What Mortgage magazine in March 2004. In July 2004, Mortgage Magazine named HSBC as 'Best First Time Buyer... -

Page 50

... into the Smart Home account and the flexibility to redraw the extra funds paid. Balances of mortgages increased by 112 per cent year on year. North America • Free current account services were successfully launched in the US, which has attracted over 110,000 new customers and added some US$200... -

Page 51

...-prime markets. Improvements were seen across most products and in a number of key indicators. The rate of improvement began to slow in the second half of the year reflecting the maturing of the portfolio, less robust employment growth and rising energy prices. Loans and advances to customers grew... -

Page 52

... I N G S PL C Financial Review (continued) • In October 2004, Household Mortgage Services was rebranded HSBC Mortgage Services. The launch of a new marketing campaign, new product line and an increase in sales staff resulted in a record number of account acquisitions. Nearly 50 per cent of all... -

Page 53

... ...Hong Kong ...Rest of Asia-Pacific ...North America ...South America ...Profit on ordinary activities before tax3...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data7 Loans and advances to customers (net) ...Total assets8,9 ...Customer accounts ...Goodwill... -

Page 54

... which is currently underserved by banks. • • • Hong Kong • Five business banking centres were established in 2004, serving small commercial customers. Located in key business areas, they offer a onestop service for account opening, trade services and insurance sales. HSBC launched the... -

Page 55

... Asia-Pacific ...North America ...South America ...Profit on ordinary activities before tax3 ...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data7 Loans and advances to: - customers (net) ...- banks (net) ...Total assets8,9 ...Customer accounts ...Debt securities... -

Page 56

.... In securities services, the successful integration of Bank of Bermuda' s alternative funds services, resulted in several new business opportunities. In addition, HSBC agreed a seven year deal with Gartmore to provide back office operations. In Group Investment Businesses, assets under management... -

Page 57

... Mexico in November, and Malaysia in May. Operations in Europe, Asia, and North America were strengthened through front office recruitment during the year. The HSBC Private Bank brand was launched globally, supported by a major marketing campaign, bringing a single identity to HSBC' s core operation... -

Page 58

...the UK' s private banking website in December. • North America • The alignment of HSBC' s international and domestic private banking segments continued, bringing operational cost savings and a more coherent infrastructure. The integration of Wealth and Tax Advisory Services ('WTAS' ), acquired... -

Page 59

...investments and tangible fixed assets ...Profit /(loss) on ordinary activities before tax3 ...By geographical region: Europe ...Hong Kong ...Rest of Asia-Pacific ...North America ...South America ...Profit /(loss) on ordinary activities before tax3 ...Share of HSBC' s pre-tax profits3 ...Cost:income... -

Page 60

... the presentation of customer group data includes internal allocations of certain items of income and expense. These allocations include the costs of certain support services and head office functions, to the extent that these can be meaningfully attributed to operational business lines. While such... -

Page 61

... Bank USA from HSBC Finance Corporation in December 2003. The main items reported under 'Other' are the income and expenses of wholesale insurance operations, certain property activities, unallocated investment activities including hsbc.com, centrally held investment companies and HSBC' s holding... -

Page 62

... HSBC Finance Corporation' s consumer finance business since the date of acquisition. 3 Intra-group charges previously netted between countries are reported gross in 2004. Figures for 2003 and 2002 have been restated on a comparable basis. 4 France principally comprises CCF' s domestic operations... -

Page 63

... of investments and tangible fixed assets ...Profit on ordinary activities before tax ...Share of HSBC' s pre-tax profits (excluding goodwill amortisation) ...Share of HSBC' s pre-tax profits ...Cost:income ratio (excluding goodwill amortisation) ...Period-end staff numbers (full-time equivalent... -

Page 64

... of increased profitability. Strong growth in UK consumer lending and mortgages was achieved, from brand-led awareness, marketing campaigns and competitive pricing. The same factors also contributed to increased earnings on savings and deposit accounts, and HSBC increased its current account base... -

Page 65

... loans in particular rising by close to 15 per cent. Other operating income rose by 15 per cent, of which M&S Money added 1 per cent. The strong growth in UK personal lending, mortgages and credit cards was reflected in an increase in fee income, and boosted sales of credit protection products... -

Page 66

.... HSBC attracted over 100,000 new customers in 2004 and now holds just under 20 per cent of startup business accounts in the UK. In addition to the rise in customer numbers, average current account balances increased by 17 per cent. The UK saw renewed demand for lending products in 2004. Commercial... -

Page 67

... sector heads for certain industry teams based in the UK and additional senior hires in investment banking advisory, while staff were also recruited to support the expansion of the cash equities, options, structured products and derivatives businesses. The planned development of global research... -

Page 68

... number of specific accounts, was offset by net releases in the UK and Switzerland, following a review of historic loss trends and current economic conditions, which led to release of general provisions. Profits on disposal in 2004 included a gain on sale of a former head office building following... -

Page 69

... in personal loan protection premiums. HSBC maintained its position as the leading provider of income protection products in the UK, with a market share of 17 per cent at the end of September 2003. Lack of customer confidence in equity markets led to a decline in sales of investments and pension... -

Page 70

.... This reflected income growth in foreign exchange, derivatives and debt securities, partly offset by higher bad debt provisions in Corporate Banking. HSBC also absorbed the costs of restructuring and repositioning the equities and investment banking businesses. In Global Markets UK, earnings from... -

Page 71

... product lines. Restructuring and research costs of US$24 million were also incurred to build and reshape HSBC' s investment banking and equities businesses. Premises and equipment expenses were lower as a result of savings in rental payments from the London office move to Canary Wharf. Credit... -

Page 72

... B C H O L D I N G S PL C Financial Review (continued) Profit/(loss) excluding goodw ill amortisation by customer group Year ended 31 December 2004 Total Corporate, Personal Investment Financial Commercial Banking & Private Services Banking Markets Banking US$m US$m US$m US$m 4,569 2 2,347 44 411... -

Page 73

... associates ...Gains/(losses) on disposal of investments and tangible fixed assets ...Profit on ordinary activities before tax3 ...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data5 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The... -

Page 74

... ...Profit on ordinary activities before tax ...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were significant to Corporate, Investment Banking... -

Page 75

Hong Kong Profit/(loss) before tax excluding goodw ill amortisation 2004 US$m Personal Financial Services ...Commercial Banking ...Corporate, Investment Banking and Markets ...Private Banking ...Other ...Total1 ...1 Goodwill amortisation excluded: - arising on subsidiaries ...- arising on ... -

Page 76

...in the net bad debt charge, more than offset an 8 per cent reduction in net interest income. During 2004, the Hong Kong banking sector was characterised by high levels of surplus liquidity as foreign funds entered Hong Kong to invest in the buoyant stock market, and there were inflows from investors... -

Page 77

... deployment of customer relationship management systems, an increase in the number of HSBC Premier relationship managers, and a rise in stock market activity. New products, including a range of structured treasury products, capital-guaranteed funds, open-ended funds and certificates of deposit, were... -

Page 78

... to lock in funding requirements at historically low rates. Fee income increased from structured solutions and yield enhancement products, and sales of securities and unit trusts. Structured finance also generated an increased contribution compared with 2003. Equity capital markets benefited from an... -

Page 79

... activity. Fees and commissions benefited from a higher volume of equity transactions, unit trust sales, and portfolio management fees on increased funds under discretionary management. Higher client volumes also boosted dealing income from foreign exchange, options, and structured products. Revenue... -

Page 80

... of unit trusts and capital guaranteed funds, which increased by US$1.6 billion, or 32 per cent, over 2002. Net fee income from credit cards was broadly in line with 2002. Despite fierce competition in the market, HSBC maintained its position as the largest credit card issuer in Hong Kong with some... -

Page 81

...solutions. Increased sales of structured transactions, offering yield enhancement products to retail clients, generated further revenue. Debt securities trading achieved a strong turnaround in income during the year, as losses caused by widening credit spreads in 2002 did not recur. Foreign exchange... -

Page 82

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets5 ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 83

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets5 ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 84

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets5 ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 85

... Asia-Pacific (including the Middle East) Profit before tax excluding goodw ill amortisation 2004 US$m Personal Financial Services ...Commercial Banking ...Corporate, Investment Banking and Markets ...Private Banking ...Other ...Total1 ...1 Goodwill amortisation excluded: - arising on subsidiaries... -

Page 86

... amortisation) ...Share of HSBC' s pre-tax profits ...Cost:income ratio (excluding goodwill amortisation) ...Period-end staff numbers (full-time equivalent) ... Year ended 31 December 2004 compared w ith year ended 31 December 2003 Driven primarily by external demand, growth in Asia-Pacific was... -

Page 87

...its insurance business across the region and income grew by 86 per cent as the number of policies in force increased by 25 per cent. Fee income also benefited from the strong growth in the credit card base, increased account service fees and growth in sales of structured products. Operating expenses... -

Page 88

... dealing profits from foreign currency transactions and trade services fees were both higher. Operating expenses, before amortisation of goodwill, were 6 per cent higher than last year. Additional relationship managers, business development and sales staff, credit analysts and support staff were... -

Page 89

... 10 per cent increase in dealing income was driven by sales of tailored structured products in Singapore, in part reflecting cross-sales to HSBC' s personal, commercial and corporate customers. In India, higher foreign exchange gains resulted from successful positioning and growing corporate volumes... -

Page 90

...the year accounted for US$6 million of the increase. Provisions for bad and doubtful debts were 38 per cent higher than in 2002. Provisions against personal lending increased in Singapore, India, Korea and Australia in line with growth in advances. Commercial Banking reported pre-tax profits, before... -

Page 91

... bad and doubtful debts compared with a net charge of US$26 million in 2002, at constant exchange rates. A specific provision raised against a New Zealand corporate customer in 2002 was recovered during the year. HSBC' s Private Banking activities in the rest of Asia-Pacific reported pre-tax profit... -

Page 92

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 93

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets5 ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 94

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets5 ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 95

North America Profit/(loss) before tax excluding goodw ill amortisation 2004 US$m Personal Financial Services ...USA ...Canada ...Mexico ...Other ...Consumer Finance2 ...USA ...Canada ...Total Personal Financial Services ...USA ...Canada ...Mexico ...Other ...Commercial Banking ...USA ...Canada ...... -

Page 96

... activities before tax ...Share of HSBC' s pre-tax profits (excluding goodwill amortisation) ...Share of HSBC' s pre-tax profits ...Cost:income ratio (excluding goodwill amortisation) ...Period-end staff numbers (full-time equivalent) ... Year ended 31 December 2004 compared w ith year ended 31... -

Page 97

... increase in Mexico, where growth in low cost deposits and consumer loans, and higher interest income from the insurance business, contributed to the rise. Acquisitions in Mexico accounted for 17 per cent of the overall improvement. HSBC attracted 359,000 net new deposit customers in Mexico during... -

Page 98

... to generally higher salaries and performance-related bonuses. Staff numbers increased in the Mexican branch network to support growth in business volumes, improve customer service, and support the rollout of HSBC Premier. The introduction of the WHIRL credit card system in Mexico and the US... -

Page 99

... various service level agreements, HSBC Finance Corporation will continue to maintain the related customer account relationships for the assets transferred. By the end of 2004, HSBC had provided a total of US$35.6 billion in direct and client funding to HSBC Finance Corporation, and cash savings... -

Page 100

... tax payments via electronic banking channels from January 2004. HSBC seized the opportunities presented by this change to increase both the number of clients using electronic banking, and the number of transactions and income per client. Earnings from new trade services products and increased loan... -

Page 101

.... In Mexico, earnings from debt trading fell as interest rates rose during the year, while in Canada, higher fees from securities sales and corporate finance reflected improved market sentiment in local equity markets. Foreign exchange income in Canada grew by 10 per cent in response to the... -

Page 102

... US$146 million last year, predominantly reflecting the acquisition of HSBC Finance Corporation and, to a lesser extent, HSBC Mexico. The commentaries that follow are based on constant exchange rates. Personal Financial Services, excluding Consumer Finance, generated pre-tax profit, before goodwill... -

Page 103

... technology support for HSBC Mexico's branch network. On an underlying basis, operating expenses, excluding goodwill amortisation, increased by 7 per cent. Pension costs rose due to falls in the long-term rates of return on assets, and higher profitability drove increased staff incentive payments... -

Page 104

... business and increases in fees related to commercial real estate lending, deposit taking and trade. The inclusion of HSBC Finance Corporation's commercial portfolio reduced other operating income by US$17 million. These losses were more than offset by tax credits, resulting in an overall benefit... -

Page 105

HSBC Mexico contributed US$325 million to total operating income in the Commercial Banking segment in North America, reflecting a strong position in customer deposits. In addition, a growing level of fee income was generated from payments and cash management, loan and credit card fees. Of the total ... -

Page 106

..., mainly reflected the benefit from increased investment activity by clients and a greater emphasis on fee-based non-discretionary advisory and structured products. In addition, WTAS (HSBC' s tax advisory service for high net-worth clients), in its first full year of operation, contributed to this... -

Page 107

Profit/(loss) excluding goodw ill amortisation by customer group Year ended 31 December 2004 Total Corporate, Personal Investment Financial Commercial Banking & Private Services Banking Markets Banking US$m US$m US$m US$m 13,039 13 2,657 54 857 3,581 16,620 1,146 - 302 15 159 476 1,622 664 19 492 ... -

Page 108

...Profit/(loss) on ordinary activities before tax3 ...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data5 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were also significant to the customer groups... -

Page 109

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 110

... C Financial Review (continued) South America Profit/(loss) before tax excluding goodw ill amortisation 2004 US$m Personal Financial Services ...Brazil ...Argentina ...Other ...Commercial Banking ...Brazil ...Argentina ...Other ...Corporate, Investment Banking and Markets ...Brazil ...Argentina... -

Page 111

... amortisation) ...Share of HSBC' s pre-tax profits ...Cost:income ratio (excluding goodwill amortisation) ...Period-end staff numbers (full-time equivalent) ... US$m Selected balance sheet data1 Loans and advances to customers (net) ...Loans and advances to banks (net) ...Debt securities, treasury... -

Page 112

... operational synergies. Plans to embed Losango branches within the HSBC Brazil network are well advanced. In the second half of the year, Losango benefited from the acquisition of the two consumer finance portfolios noted above. Excluding the impact of the acquired businesses, net interest income... -

Page 113

...Transactional taxes increased by 26 per cent in line with operating income growth. Prices also increased on the renewal of a number of service contracts. Costs in Argentina were 21 per cent higher, largely from increased staff costs, notably pensions and labour claims, together with higher marketing... -

Page 114

... interest income was broadly in line with last year. The benefit from higher personal lending balances in Brazil was offset by lower interest income from the insurance businesses in Argentina, largely due to lower CER, an inflation adjustment applied to all pesified loans. Other operating income of... -

Page 115

.... Credit related fee income in Brazil increased, reflecting the expansion in the current account customer base by 8 per cent. Fees earned on foreign exchange rose from a higher volume of transactions. In response to aggressive pricing by competitors, the introduction of a new fee pricing structure... -

Page 116

... of improved market conditions and collections within the lending portfolios. Provisions for contingent liabilities and commitments reflected court decisions (amparos) relating to formally frozen US dollar denominated customer deposits required to be settled at the prevailing market rate. 114 -

Page 117

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 118

...Share of HSBC' s pre-tax profits3 ...Cost:income ratio1 ...Selected balance sheet data4 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 119

...Share of HSBC' s pre-tax profits1 ...Cost:income ratio1 ...Selected balance sheet data2 Loans and advances to customers (net) ...Total assets ...Customer accounts ...The following assets and liabilities were also significant to Corporate, Investment Banking and Markets: Loans and advances to banks... -

Page 120

... accounts in HSBC Finance Corporation's consumer portfolios and to the following portfolios in the rest of HSBC low value, homogeneous small business accounts in certain jurisdictions; residential mortgages less than 90 days overdue; and credit cards and other unsecured consumer lending products... -

Page 121

... Corporation, which utilises portfolio analysis, to residential mortgages 90 days or more overdue. HSBC has no individual loans where changes in the underlying factors upon which specific bad and doubtful debt provisions have been established could cause a material change to the Group' s reported... -

Page 122

... interest rate swaps) are accounted for on an accruals basis. Changes in the value of securities and derivatives held for trading purposes are reflected in 'Dealing profits' and hence directly impact HSBC' s profit on ordinary activities. Any impairment in the value of debt and equity securities not... -

Page 123

... requirements in relation to measurement of realistic liabilities and disclosure of capital position. HSBC continues to assess the likely impact of this accounting standard. UK GAAP compared w ith US GAAP 2004 US$m Net income US GAAP ...UK GAAP ...Shareholders' equity US GAAP ...UK GAAP ...12... -

Page 124

... investment in loans or debt securities acquired in a transfer if those differences are attributable to credit quality. SOP 03-3 is effective for loans acquired in fiscal years beginning after 15 December 2004. Adoption is not expected to have a material impact on the US GAAP information in HSBC... -

Page 125

...3.41 North America HSBC Bank USA ...HSBC Bank Canada ...HSBC Markets Inc ...HSBC Mexico1 ...South America Brazilian operations...HSBC Bank Argentina ...Other operations ... Loans and advances to customers Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...CCF ...HSBC Finance Corporation1... -

Page 126

... 3.89 North America HSBC Bank USA ...HSBC Bank Canada ...HSBC Markets Inc ...HSBC Mexico1 ...South America Brazilian operations ...HSBC Bank Argentina ...Other operations ... Investment securities Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...CCF ...HSBC Finance Corporation1 ...Hang... -

Page 127

...North America HSBC Bank USA ...HSBC Finance Corporation1 ...HSBC Bank Canada ...HSBC Markets Inc ...HSBC Mexico1 ...South America Brazilian operations ...HSBC Bank Argentina ...Other operations ...Total interest-earning assets Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...CCF ...HSBC... -

Page 128

... total assets Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...CCF ...HSBC Finance Corporation ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East .. 2004 % Year ended 31... -

Page 129

...56 2.99 North America HSBC Bank USA ...HSBC Bank Canada ...HSBC Markets Inc ...HSBC Mexico2 ...South America Brazilian operations ...HSBC Bank Argentina ...Other operations ... Customer accounts1 Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...CCF ...HSBC Finance Corporation2 ...Hang... -

Page 130

... 3.92 North America HSBC Bank USA ...HSBC Finance Corporation2 ...HSBC Bank Canada ...HSBC Mexico2 ...South America Brazilian operations ...HSBC Bank Argentina ...Other operations ... Loan capital Europe HSBC Bank ...CCF ...HSBC Finance Corporation2 ...The Hongkong and Shanghai Banking Corporation... -

Page 131

....29 North America HSBC Bank USA ...HSBC Finance Corporation1 ...HSBC Bank Canada ...HSBC Markets Inc ...HSBC Mexico1 ...South America Brazilian operations ...HSBC Bank Argentina ...Other operations...Summary Total interest-bearing liabilities ...Non interest-bearing current accounts ...Shareholders... -

Page 132

... 'Loans and advances to customers' . Interest income on such loans is included in the consolidated profit and loss account to the extent to which it has been received. (iii) Balances and transactions with fellow subsidiaries are reported gross in the principal commercial banking and consumer finance... -

Page 133

...2004 compared with 2003 Increase/(decrease) Interest income Short-term funds and loans to banks Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...CCF ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia... -

Page 134

...Financial Review (continued) 2004 compared with 2003 Increase/(decrease) Interest income (continued) Trading securities Europe Hong Kong HSBC Bank ...CCF ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...846... -

Page 135

...Rate US$m 9 (29) (160) - - (12) (19) - (6) (4) (8) (8) 5 33 (60) (57) (334) 2002 US$m 376 60 596 - 1 35 103 3 15 46 26 44 11 79 69 122 1,586 Hong Kong Rest of AsiaPacific North America HSBC USA Inc...HSBC Bank Canada ...HSBC Markets Inc ...HSBC Mexico ...South America Brazilian operations ...HSBC... -

Page 136

... market instruments Europe Hong Kong HSBC Bank ...CCF ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...424 214 30 357 183 8 26 188 89 134 15 - 106 1,774 Loan capital Europe HSBC Bank ...CCF ...HSBC Finance... -

Page 137

...to meet its obligations under a contract. It arises principally from lending, trade finance, treasury and leasing activities. HSBC has dedicated standards, policies and procedures to control and monitor all such risks. Within Group Head Office, a separate function, Group Credit and Risk, is mandated... -

Page 138

... and portfolio provisioning; new products; training courses; and credit-related reporting. • • • Acting on behalf of HSBC Holdings as the primary interface for credit-related issues with external parties including the Bank of England, the UK FSA, rating agencies, corporate analysts, trade... -

Page 139

... reviewed on a portfolio basis, for example credit cards, other unsecured consumer lending, motor vehicle financing and residential mortgage loans, two alternative methods are used to calculate specific provisions: • When appropriate empirical information is available, the Group utilises roll rate... -

Page 140

... such until some time in the future. HSBC requires each operating company to maintain a general provision which is determined after taking into account: • historical loss experience in portfolios of similar risk characteristics, for example, by industry sector, loan grade or product; the estimated... -

Page 141

...' ). Within portfolios of low value, high volume, homogeneous loans, interest will normally be suspended on facilities 90 days or more overdue. In certain operating subsidiaries, interest income on credit cards may continue to be included in earnings after the account is 90 days overdue, provided... -

Page 142

... total advances to customers at 31 December 2004. 2003 US$m Personal Residential mortgages ...Hong Kong Government Home Ownership Scheme ...Other personal ...Total personal ...Corporate and commercial Commercial, industrial and international trade ...Commercial real estate ...Other property-related... -

Page 143

...the cards base and balances, and an expansion of auto finance lending. Loans and advances to the large corporate sector remained subdued but commercial lending in Hong Kong and in the rest of Asia-Pacific expanded as regional trade volumes grew. International trade balances in Hong Kong increased by... -

Page 144

... gross loans and advances to customers are the following numbers in respect of HSBC Finance, 92 per cent of which relate to North America: 2004 US$m Residential mortgages ...Motor vehicle finance ...MasterCard/Visa credit cards ...Private label cards ...Other unsecured personal lending ...Corporate... -

Page 145

... gross loans % 30.3 1.2 24.7 56.2 Europe US$m Personal Residential mortgages ...Hong Kong Government Home Ownership Scheme ...Other personal ...Total personal ...Corporate and commercial Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government... -

Page 146

... gross loans % 26.9 2.0 13.4 42.3 Europe US$m Personal Residential mortgages ...Hong Kong Government Home Ownership Scheme ...Other personal ...Total personal ...Corporate and commercial Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government... -

Page 147

... gross loans % 24.7 2.6 12.3 39.6 Europe US$m Personal Residential mortgages ...Hong Kong Government Home Ownership Scheme ...Other personal ...Total personal ...Corporate and commercial Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government... -

Page 148

... gross loans % 24.0 2.5 12.5 39.0 Europe US$m Personal Residential mortgages ...Hong Kong Government Home Ownership Scheme ...Other personal ...Total personal ...Corporate and commercial Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government... -

Page 149

... of Asia-Pacific and South America At 31 December 2004 Commercial, international trade and other US$m Residential mortgages US$m Loans and advances to customers (gross) Australia and New Zealand ...India ...Indonesia ...Japan ...Mainland China ...Malaysia ...Middle East ...Singapore ...South Korea... -

Page 150

... US$m US$m At 1 January 2004 ...Amounts written off ...Recoveries of advances written off in previous years ...Charge/(credit) to profit and loss account ...Acquisition of subsidiaries ...Exchange and other movements ...At 31 December 2004 ...- HSBC Finance ...- Rest of HSBC ...10,902 (8,896) 912... -

Page 151

...Total recoveries ...Net charge to profit and loss account : Banks ...Commercial, industrial and international trade Real estate ...Non-bank financial institutions ...Governments ...Other commercial ...Residential mortgages ...Other personal ...General provisions ...Total charge ...Foreign exchange... -

Page 152

...Total recoveries ...Net charge to profit and loss account1: Banks ...Commercial, industrial and international trade Real estate ...Non-bank financial institutions ...Governments ...Other commercial ...Residential mortgages ...Other personal ...General Provisions ...Total charge ...Foreign exchange... -

Page 153

...Total recoveries ...Net charge to profit and loss account : Banks ...Commercial, industrial and international trade Real estate ...Non-bank financial institutions ...Governments ...Other commercial ...Residential mortgages ...Other personal ...General Provisions ...Total charge ...Foreign exchange... -

Page 154

...Total recoveries ...Net charge to profit and loss account1: Banks ...Commercial, industrial and international trade Real estate ...Non-bank financial institutions ...Governments ...Other commercial ...Residential mortgages ...Other personal ...General provisions ...Total charge ...Foreign exchange... -

Page 155

...Total recoveries ...Net charge to profit and loss account : Banks ...Commercial, industrial and international trade Real estate ...Non-bank financial institutions ...Governments ...Other commercial ...Residential mortgages ...Other personal ...General provisions ...Total charge ...Foreign exchange... -

Page 156

... Review (continued) Net charge to t he profit and loss account for bad and doubtful debts The charge for bad and doubtful debts and non-performing customer loans and related customer provisions can be analysed as follows: Year ended 31 December 2004 Rest of AsiaNorth Hong America Pacific Kong... -

Page 157

...bad and doubtful debt charge as a percentage of closing gross loans and advances ...31 December 2003 Non-performing loans ...HSBC Finance ...Rest of HSBC ...Provisions ...HSBC Finance ...Rest of HSBC ...1 Since the date of acquisition. 874 (6) 880 Year ended 31 December 2003 Rest of North Hong Kong... -

Page 158

... C Financial Review (continued) Net charge to t he profit and loss account for bad and doubtful debts (continued) Year ended 31 December 2001 Rest of North Hong Kong Asia-Pacific America US$m US$m US$m 449 (212) (31) 206 - Europe US$m Specific provisions: New provisions ...Release of provisions... -

Page 159

...UK personal and consumer finance customer bases, credit costs represented 0.60 per cent and 3.09 per cent of lending respectively, compared with 0.42 per cent and 2.56 per cent in 2003. In the corporate and commercial portfolios, new specific provisions were raised against a small number of accounts... -

Page 160

...$193 million related to HSBC Finance Corporation's UK consumer finance business, which is provisioned on a portfolio basis. Elsewhere in the UK, the increase in new provisions in personal lending reflected the growth in loan portfolios. In the corporate and commercial portfolio, new provisions were... -

Page 161

electronics sector against a small number of customers in niche markets which suffered from a combination of technological developments and excess market capacity. New specific provisions for personal lending (including credit cards) reduced in 2003, reflecting a reduction in bankruptcy filings and ... -

Page 162

... taking account of the Group' s commercial lending activities. Within this total, losses on residential mortgages remained modest. Lending to personal customers has increased substantially in recent years as a result of both organic growth and acquisitions, most notably HSBC Finance Corporation in... -

Page 163

... UK accounting practice, a number of operating companies suspend interest rather than ceasing to accrue. This additional category is also reported below, as are assets acquired in exchange for advances. Non-performing loans and advances1 At 31 December 2004 2003 US$m US$m Banks ...Customers - HSBC... -

Page 164

... loan products, in line with the broader target markets now being served. In Hong Kong, non-performing loans decreased by US$0.9 billion, or 54 per cent, during 2004 due to the improved economic climate and rising real estate prices. These factors enabled certain corporate customers to increase... -

Page 165

...Hong Kong ...Rest of Asia-Pacific ...North America ...South America ...Total ...Assets acquired in exchange for advances Europe ...Hong Kong ...Rest of Asia-Pacific ...North America ...HSBC Finance ...Other ...Total ...Total non-performing loans ...Troubled debt restructurings Europe ...HSBC Finance... -

Page 166

... the Bank of England Country Exposure Report (Form CE) guidelines, outstandings comprise loans and advances (excluding settlement accounts), amounts receivable under finance leases, acceptances, commercial bills, certificates of deposit and debt and equity securities (net of short positions), and... -

Page 167

At 31 December 2004, HSBC had in-country foreign currency and cross-border outstandings to counterparties in Australia and Canada of between 0.75 per cent and 1 per cent of total assets. The aggregate in-country foreign currency and crossborder outstandings were: Australia: US$12.7 billion; Canada: ... -

Page 168

... funding of certain short-term treasury requirements and start-up operations or branches which do not have access to local deposit markets, all of which are funded under strict internal and regulatory guidelines and limits from HSBC's largest banking operations. These internal and regulatory limits... -

Page 169

... products and services. Market risk is the risk that movements in market rates, including foreign exchange rates, interest rates, credit spreads and equity and commodity prices will reduce HSBC' s income or the value of its portfolios. HSBC separates exposures to market risk into either trading... -

Page 170

... the Group Management Board. Limits are set for each portfolio, product and risk type, with market liquidity being a principal factor in determining the level of limits set. Traded Markets Development and Risk, an independent unit within Corporate, Investment Banking and Markets, develops the Group... -

Page 171

...44 48 1 52 Revenues (US$m) • < Profit and loss frequency Daily distribution of market risk revenues in 2003 Number of days 80 HSBC recognises these limitations by augmenting its VAR limits with other position and sensitivity limit structures. Additionally, HSBC applies a wide range of stress... -

Page 172

... risk which primarily arise where guaranteed investment return policies have been issued. The insurance businesses have a dedicated head office market risk function which oversees management of this risk. Market risk also arises within the Group' s defined benefit pension schemes to the extent that... -

Page 173

... of Hong Kong dollar deposits. • HSBC Finance Corporation' s net interest income sensitivity is such that it benefits in a falling rate environment and its interest margins decline in a rising rate environment. This arises from having substantially fixed rate real estate secured lending funded to... -

Page 174

...over the year increases the room to lower deposit pricing in the event of falling interest rates and Global Markets have been able to position themselves to increase revenue if rates fall. In addition, cash balances at the holding company reduced as the Group acquired businesses, principally Bank of... -

Page 175

...rating agency and other publicly available information together with investment concentrations. Investment credit exposures are aggregated and reported to HSBC' s Group Credit and Risk function on a quarterly basis. Operational risk management assigned at senior management level within the business... -

Page 176

...of reputational risk, including treating customers fairly, conflicts of interest, money laundering deterrence, environmental impact, anti-corruption measures and employee relations. Management in all operating entities is required to establish a strong internal control structure to minimise the risk... -

Page 177

... and liabilities of defined benefit pension schemes. Instead, banks will deduct from capital their best estimate of the funds that will need to be paid into the schemes in addition to normal contributions over the next five years. In June 2004, the Basel Committee on Banking Supervision ('the Basel... -

Page 178

... investor concentration, cost, market conditions, timing and the effect on the composition and maturity profile of HSBC' s capital. The subordinated debt requirements of other HSBC companies are met internally. HSBC recognises the impact on shareholder returns of the level of equity capital employed... -

Page 179

.... This increase was driven by significant growth in loans and advances to customers in North America, the UK and Hong Kong. In constant currency, risk-weighted asset growth was 17 per cent. Risk-weighted assets by principal subsidiary In order to give an indication of how HSBC' s capital is deployed... -

Page 180

...CCF ...HSBC Bank and other subsidiaries ...HSBC Bank ...HSBC Finance Corporation ...HSBC Bank Canada ...HSBC Bank USA and other subsidiaries ...HSBC North America Holdings Inc...HSBC Mexico ...HSBC Bank Middle East ...HSBC Bank Malaysia ...HSBC' s South American operations ...Bank of Bermuda ...HSBC... -

Page 181

...year or less Loans and advances to banks ...Commercial loans to customers Commercial, industrial and international trade Real estate and other property related ...Non-bank financial institutions ...Governments ...Other commercial ...Hong Kong Government Home Ownership Scheme ...Residential mortgages... -

Page 182

... average amount of bank and customer deposits and certificates of deposit ('CDs' ) and other money market instruments (which are included within 'debt securities in issue' in the balance sheet), together with the average interest rates paid thereon for each of the past three years. The geographical... -

Page 183

...Other ...Total ...Total Demand and other - non-interest bearing .. Demand - interest bearing ...Savings ...Time ...Other ...Total ...CDs and other money market instruments Europe ...Hong Kong ...Rest of Asia-Pacific ...North America ...South America ...Total ...22,359 10,830 6,733 20,790 102 60,814... -

Page 184

...deposit ...Time deposits: - banks ...- customers ...Total ...Hong Kong Certificates of deposit ...Time deposits: - banks ...- customers ...Total ...Rest of Asia-Pacific Certificates of deposit ...Time deposits: - banks ...- customers ...Total ...North America Certificates of deposit ...Time deposits... -

Page 185

...customer accounts, deposits by banks and debt securities in issue and does not show short-term borrowings separately on the balance sheet. Short-term borrowings are defined by the SEC as Federal funds purchased and securities sold under agreements to repurchase, commercial paper and other short-term... -

Page 186

... by value of undrawn credit lines arises from 'open to buy' lines on personal credit cards, whereby cheques are issued to potential customers offering them a pre-approved loan, advised overdraft limits, and mortgage offers awaiting customer acceptance. HSBC generally has the right to change or... -

Page 187

... 88,294 40 1,450 495 - 90,279 More than 5 years US$m 42,909 630 1,099 - - 44,638 Total US$m Long-term debt obligations ...Capital (finance) lease obligations ...Operating lease obligations ...Purchase obligations ...Short positions in debt securities ...Total ...231,393 695 3,187 1,212 39,882 276... -

Page 188

... Group of Finance Directors and a former member of the Accounting Standards Board. Age 56. An executive Director since 1998. Executive Director, Corporate, Investment Banking and Markets from 1998 to 2003. Joined HSBC in 1982. Group Treasurer from 1992 to 1998. Chairman of HSBC Bank plc, HSBC Bank... -

Page 189

... of Nuffield Hospitals, President of the Liverpool School of Tropical Medicine and Chairman of the Global Business Coalition on HIV/AIDS. †S W New ton Age 63. Chairman of The Real Return Holdings Company Limited. A non-executive Director since 2002. A Member of the Advisory Board of the East... -

Page 190

...as Global Head of Corporate and Institutional Banking. S T Gulliver Age 45. A Group Managing Director since 1 March 2004. Co-Head Corporate, Investment Banking and Markets since 2003. Joined HSBC in 1980. Appointed a Group General Manager in 2000. Head of Treasury and Capital Markets in Asia-Pacific... -

Page 191

... Age 56. Group General Manager and Head of Corporate, Investment Banking and Markets, Emerging Europe & Africa. Joined HSBC in 1984. Appointed a Group General Manager in 2000. R C Picot Age 53. Group General Manager, President and Chief Executive Officer, HSBC Bank USA, N.A. Joined HSBC in 1982... -

Page 192

...Age 48. President and Chief Executive Officer, The Hongkong and Shanghai Banking Corporation Limited. Joined HSBC in 1978. Appointed a Group General Manager in 2000. I A Stew art Age 46. Group General Manager and Head of Transaction Banking, Corporate, Investment Banking and Markets. Joined HSBC in... -

Page 193

... million. Further information about the results is given in the consolidated profit and loss account on page 237. Spencer Retail Financial Services Holdings Limited was acquired for US$1,044 million. A review of the development of the business of HSBC undertakings during the year and an indication... -

Page 194

... shares. During 2004, HSBC QUEST Trustee (UK) Limited, the corporate trustee of the QUEST, transferred 1,592,371 ordinary shares from the QUEST to employees who exercised options under the HSBC Holdings Savings-Related Share Option Plan and subscribed for 1,079,099 ordinary shares at market values... -

Page 195

...value of the ordinary shares on the five business days immediately preceding the invitation date, then applying a discount of 20 per cent. The all-employee share plans will terminate on 26 May 2010 unless the Directors resolve to terminate the plans at an earlier date. HSBC Holdings Savings-Related... -

Page 196

...being phased in. The maximum value of options which may be granted to an employee in any one year (together with any Performance Share awards under the HSBC Holdings Restricted Share Plan 2000) is 150 per cent of the employee' s annual salary at the date of grant plus any bonus paid for the previous... -

Page 197

... awarded, was £8.18. 5 The closing price per share on 26 August 2004, the day before the options were awarded, was £8.61. CCF and subsidiary company plans When it was acquired in 2000, CCF and certain of its subsidiary companies operated employee share option plans under which options could be... -

Page 198

... CCF share). At 31 December 2004, The HSBC Holdings Employee Benefit Trust 2001 (No. 1) held 26,787,515 HSBC Holdings ordinary shares which may be exchanged for CCF shares arising from the exercise of these options. Banque Chaix shares of â,¬16 Date of award 21 Jun 1999 7 Jun 2000 Exercise price... -

Page 199

.... At 31 December 2004, The CCF Employee Benefit Trust 2001 held 2,294,066 HSBC Holdings ordinary shares which may be exchanged for HSBC Private Bank France shares arising from the exercise of these options. Netvalor shares of â,¬415 Date of award 22 Dec 1999 19 Dec 2000 Exercise price (â,¬) 415 415... -

Page 200

... year - - - - - Options at 31 December 2004 - 148,142 - - 283,131 1 The weighted average closing price of the shares immediately before the dates on which options were exercised was £8.63. HSBC Finance Corporation 1996 Long-Term Executive Incentive Compensation Plan HSBC Holdings ordinary shares... -

Page 201

... HSBC Holdings ordinary shares under this plan is set out below. Full details are available on www.hsbc.com by selecting 'Investor Relations' , then 'Share plans' or can be obtained upon request from the Group Company Secretary, 8 Canada Square, London E14 5HQ. 1 The weighted average closing price... -

Page 202

... average closing price of the shares immediately before the dates on which shares were delivered was £8.45. 2 In May 2004, the rights of participants to receive new HSBC Holdings ordinary shares under the Deferred Phantom Stock Plan for Directors were transferred to the HSBC-North America Directors... -

Page 203

...for each Bank of Bermuda share and the average closing price of HSBC Holdings ordinary shares, derived from the London Stock Exchange Daily Official List, for the five business days preceding the closing date of the Bank of Bermuda Executive Share Option Plan 1997 HSBC Holdings ordinary shares of US... -

Page 204

... details are included in Note 24 of the 'Notes on the Financial Statements' on page 275. Board of Directors The objectives of the management structures within HSBC, headed by the Board of Directors of HSBC Holdings and led by the Group Chairman, are to deliver sustainable value to shareholders... -

Page 205

... the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited each nonexecutive Director determined by the Board to be independent has provided confirmation of his or her independence to HSBC Holdings. The Directors who served during the year were W F Aldinger, Sir John... -

Page 206

...' s Managing for Growth strategy. The Group Chairman, Group Chief Executive and the Group Finance Director hold regular meetings with institutional investors and report to the Board on those meetings. All Directors attended the 2004 Annual General Meeting. At the Annual General Meeting shareholders... -

Page 207

...reviewed annually, are available on www.hsbc.com by selecting 'Investor Relations' , then 'Corporate Governance' , then 'Board Committees' . The Group Audit Committee is accountable to the Board and assists the Board in meeting its responsibilities in ensuring an effective system of internal control... -

Page 208

... in connection with potential acquisitions, audits or reviews of employee benefit plans, ad hoc attestation or agreed-upon procedures reports (including reports requested by regulators), and accounting and regulatory advice on actual or contemplated transactions. Tax services This category includes... -

Page 209

... Board and Senior Management positions as well as procedures to ensure an appropriate balance of skills and experience within HSBC and on the Board. Corporate Social Responsibility Committee The role of the Remuneration Committee and its membership are set out in the Directors' Remuneration Report... -

Page 210

... Stock Exchange of Hong Kong Limited was substantially revised during 2004. The new provisions of Appendix 14 will apply for subsequent reporting periods. Differences in HSBC Holdings/New York Stock Exchange corporate governance practices Services Authority require each listed company incorporated... -

Page 211

...of the Annual Report and Accounts 2004. In the case of companies acquired during the year, including Bank of Bermuda and Marks and Spencer Retail Financial Services Holdings Limited, the internal controls in place are being reviewed against HSBC' s benchmarks and integrated into HSBC's systems. 209 -

Page 212

... systems and operations; property management; and for certain global product lines. Policies and procedures to guide subsidiary companies and management at all levels in the conduct of business to safeguard the Group' s reputation are established by the Board of HSBC Holdings, the Group Management... -

Page 213

... measures and employee relations. The policy manuals address risk issues in detail and co-operation between head office departments and businesses is required to ensure a strong adherence to HSBC's risk management system and its corporate social responsibility practices. Internal controls are an... -

Page 214

... stated, in the shares and loan capital of HSBC and its associated corporations: Communication w ith shareholders Communication with shareholders is given high priority. Extensive information about HSBC' s activities is provided in the Annual Report and Accounts, Annual Review and the Interim... -

Page 215

... 533,659. No directors held any short positions as defined in the Securities and Futures Ordinance of Hong Kong. Save as stated above and in the Directors' Remuneration Report, none of the Directors had an interest in any shares or debentures of any HSBC or associated corporation at the beginning or... -

Page 216

...of Trade and Industry, 1 Victoria Street, London SW1H 0ET; and the internet at www.dti.gov.uk/publications. It is HSBC Holdings' practice to organise payment to its suppliers through a central accounts function operated by its subsidiary undertaking, HSBC Bank. Included in the balance with HSBC Bank... -

Page 217

Hong Kong Limited at least 25 per cent of the total issued share capital of HSBC Holdings has been held by the public at all times during 2004 and up to the date of this Report. definitions in The Political Parties, Elections and Referendums Act 2000. These authorities have not been used. Annual ... -

Page 218

... G S PL C Directors' Remuneration Report Remuneration Committee The Remuneration Committee meets regularly to consider human resource issues, particularly terms and conditions of employment, remuneration, retirement benefits, development of high potential employees and key succession planning. The... -

Page 219

... of shares or share options, variable bonus arrangements have been reviewed and enhanced, as appropriate, taking account of local markets. Such changes may include an element of deferral. To encourage greater participation in the HSBC Holdings Savings-Related Share Option Plan: (International), two... -

Page 220

...have in total more than 793 years of service with HSBC. Directors' fees • • long-term incentives; and pension. Directors' fees are regularly reviewed and compared with other large international companies. The current fee, which was approved by shareholders in 2004, is £55,000 per annum. With... -

Page 221

.... Salary The Committee reviews salary levels for executive Directors each year in the same context as other employees. With reference to market practice and taking account of the international nature of the Group, the Committee benchmarks the salary of each Director and member of Senior Management... -

Page 222

... very high level. The Trustee to the Plan will be provided with funds to acquire HSBC Holdings ordinary shares at an appropriate time after the announcement of the annual results. Under the terms of the 2002 employment agreement entered into at the time of the acquisition of HSBC Finance Corporation... -

Page 223

... return on cash invested, dividend performance and total shareholder return. Following the three-year performance period, awards of Performance Shares under The HSBC Share Plan will be tested and vesting will take place shortly afterwards. Where events occur which cause the Remuneration Committee... -

Page 224

.... TSR for the benchmark constituents was based on their published share prices on the 20th trading day after the annual results were announced. If HSBC Holdings' TSR over the performance period exceeds the benchmark TSR, awards with a value, at the date of grant, of up to 100 per cent of the... -

Page 225

... Mar 2002 Mar 2003 Mar 2004 HSBC' s policy is to employ executive Directors on one-year rolling contracts although, on recruitment, longer initial terms may be approved by the Remuneration Committee. The Remuneration Committee will, consistent with the best interests of the Group, seek to minimise... -

Page 226

...' service contracts save for W F Aldinger, details of which are set out below. As referred to above, Mr Aldinger entered into a new employment agreement with HSBC Finance Corporation on 14 November 2002 for a term of three years, such term to commence on the effective date of the acquisition of HSBC... -

Page 227

... business (including mortgage and credit card lending). Sir John Bond, who is to stand for re-election at the forthcoming Annual General Meeting, is employed on a rolling contract dated 14 July 1994 which requires 12 months' notice to be given by either party. W R P Dalton, who retired as a Director... -

Page 228

... 31 December 2004, executive Directors and Senior Management held, in aggregate, options to subscribe for 11,398,184 HSBC Holdings ordinary shares under the HSBC Holdings Executive Share Option Scheme, HSBC Holdings Group Share Option Plan and HSBC Holdings savings-related share option plans. These... -

Page 229

...a Director on 1 March 2004. 10 In return for the prior waiver of bonus, the employer contribution into the pension scheme has been increased by the amount of £1,200,000 (2003: nil) which would otherwise have been paid. 11 Includes fees as non-executive Chairman of HSBC Private Equity (Asia) Limited... -

Page 230

...the HSBC International Staff Retirement Benefits Scheme. The pensions accrue at a rate of one twenty-seventh of pensionable salary per year of pensionable service. In addition, Mr Geoghegan has joined the HSBC Asia Holdings Pension Plan, on a defined contribution basis, with an employer contribution... -

Page 231

... London Stock Exchange Daily Official List on the relevant date. The payments in respect of R Delbridge and Sir Brian Pearse were made by HSBC Bank plc as former Directors of the bank. Share options At 31 December 2004, the undernamed Directors held options to acquire the number of HSBC Holdings... -

Page 232

..., 2 August 2004, the market value per share was £8.335. At 27 February 2004, the date he retired as a Director, C F W de Croisset held the following options to acquire CCF shares of â,¬5 each. On exercise of these options each CCF share will be exchanged for 13 HSBC Holdings ordinary shares. The... -

Page 233

... be advanced, under the terms of the HSBC Finance Corporation stock option plan, to an earlier date in certain circumstances e.g. retirement. 1,070,000 options remaining unvested will therefore vest on Mr Aldinger' s retirement on 29 April 2005. Based on the market price of HSBC Holdings shares on... -

Page 234

H S B C H O L D I N G S PL C Directors' Remuneration Report Audited Information Restricted Share Plan (continued) HSBC Holdings ordinary shares of US$0.50 Monetary value of awards made during Awards made the year during the £000 year - 372,5874 - - - - - 244,4457 87,3027 - - - - - 121,0587 - - ... -

Page 235

... the Annual Report and Accounts 1998 and set out in the section headed 'Arrangements from 1999-2004' on pages 222 to 223 have been met and the shares have vested. At the date of vesting, 4 March 2004, the market value per share was £8.515. The market value per share (adjusted for the share capital... -

Page 236

... give a true and fair view of the state of affairs of HSBC Holdings plc together with its subsidiary undertakings as at the end of the financial year and of the profit or loss for the financial year. They are also required to present additional information for US shareholders. Accordingly, these... -

Page 237

...to 356. We have also audited the information in the directors' remuneration report that is described as having been audited. This report is made solely to the members of HSBC Holdings plc ('HSBC Holdings' ), as a body, in accordance with section 235 of the Companies Act 1985. Our audit work has been... -

Page 238

... of HSBC Holdings and HSBC as at 31 December 2004 and of the profit of HSBC for the year then ended; and the financial statements and the part of the Directors' remuneration report to be audited have been properly prepared in accordance with the Companies Act 1985. 28 February 2005 KPMG Audit Plc... -

Page 239

... Consolidated profit and loss account for the year ended 31 December 2004 Notes Interest receivable - interest receivable and similar income arising from debt securities ...- other interest receivable and similar income ...Interest payable ...Net interest income ...Dividend income ...Fees and... -

Page 240

... in the course of collection from other banks ...Treasury bills and other eligible bills ...Hong Kong Government certificates of indebtedness ...Loans and advances to banks ...Loans and advances to customers ...Debt securities ...Equity shares ...Interests in joint ventures: gross assets ...gross... -

Page 241

... - undated loan capital ...- dated loan capital ...Minority interests - equity ...- non-equity ...Called up share capital ...Share premium account ...Other reserves ...Revaluation reserves ...Profit and loss account ...Shareholders' funds ...Total liabilities ...12 27 28 29 30 31 2004 US$m 2003... -

Page 242

... 2004 Notes FIXED ASSETS Tangible assets ...Investments - shares in HSBC undertakings ...- loans to HSBC undertakings ...- debt securities of HSBC undertakings ...- other investments other than loans ...24 25 2 94,885 4,712 1,885 581 102,065 CURRENT ASSETS Debtors - money market deposits with HSBC... -

Page 243

... 2004 2004 US$m Profit for the period attributable to shareholders ...Dividends ...Other recognised gains and losses relating to the year ...New share capital subscribed, net of costs ...Purchases of own shares to meet share awards and share option awards ...Own shares released on vesting of share... -

Page 244

... for the year ended 31 December 2004 Notes Net cash inflow from operating activities ...Dividends received from associated undertakings ...Returns on investments and servicing of finance Interest paid on finance leases and similar hire purchase contracts Interest paid on subordinated loan capital... -

Page 245