Experian 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 Experian Annual Report 2009

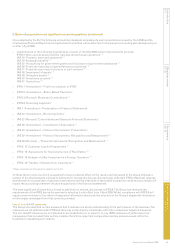

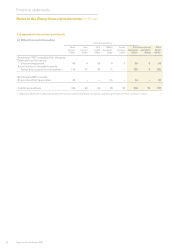

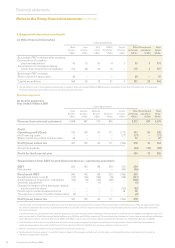

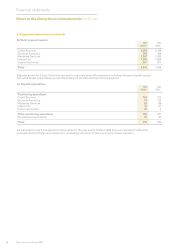

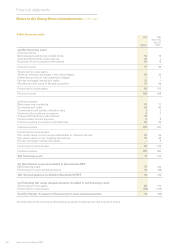

4. Segmental information (continued)

(c) Other nancial information

Continuing operations

North Latin UK & EMEA/ Central Total Discontinued To t a l

America America Ireland Asia Pacific Activities continuing operations1 Group

US$m US$m US$m US$m US$m US$m US$m US$m

Benchmark PBT is stated after charging:

Depreciation of property,

plant and equipment 42 12 30 6 3 93 8 101

Amortisation of intangible assets

(other than acquisition intangibles) 104 26 33 16 – 179 8 187

Benchmark PBT includes:

Share of prot of associates 49 – – 1 – 50 – 50

Capital expenditure 164 50 72 31 4 321 23 344

1. As indicated in note 2, the segmental information in respect of the year ended 31 March 2008 has been restated to reect the reclassication of the Group’s

transaction processing activities in France as a discontinued operation.

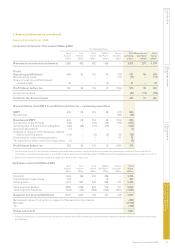

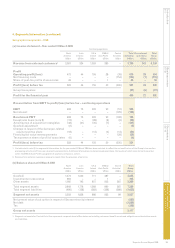

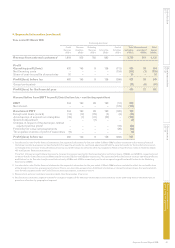

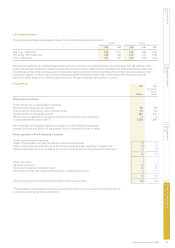

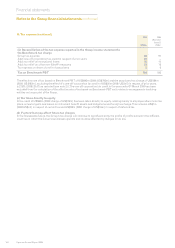

Business segments

(a) Income statement

Year ended 31 March 2009

Continuing operations1

Credit Decision Marketing Central Total Discontinued Total

Services Analytics Services Interactive Activities continuing operations2 Group

US$m US$m US$m US$m US$m US$m US$m US$m

Revenue from external customers3 1,666 487 770 950 – 3,873 201 4,074

Prot

Operating prot/(loss) 415 120 24 171 (117) 613 26 639

Net nancing costs – – – – (77) (77) – (77)

Share of post-tax prots of associates 42 – – – – 42 – 42

Prot/(loss) before tax 457 120 24 171 (194) 578 26 604

Group tax expense (84) (14) (98)

Prot for the nancial year 494 12 506

Reconciliation from EBIT to prot/(loss) before tax – continuing operations

EBIT 554 142 88 212 (57) 939

Net interest – – – – (96) (96)

Benchmark PBT 554 142 88 212 (153) 843

Exceptional items (note 8) (41) (16) (23) (9) (28) (117)

Amortisation of acquisition intangibles (54) (6) (40) (32) – (132)

Goodwill adjustment – – (1) – – (1)

Charges in respect of the demerger-related

equity incentive plans4 – – – – (32) (32)

Financing fair value remeasurements – – – – 19 19

Tax expense on share of prot of associates (2) – – – – (2)

Prot/(loss) before tax 457 120 24 171 (194) 578

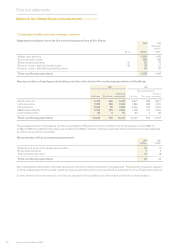

1. As indicated in note 2 to the nancial statements, there have been some reclassications in respect of three of the Group’s smaller businesses within the reporting of results

for continuing operations by business segment and the above results reect the new reporting structure. These reclassications relate to the Vente, Baker Hill and Experian

Payments businesses.

The effect of these reclassications on the reported results has been to increase the revenue reported for Decision Analytics and Interactive by US$39m and US$14m respectively

and to reduce that for Credit Services and Marketing Services by US$15m and US$38m respectively. The associated effect has been to increase operating prot and prot before

tax for Decision Analytics and Credit Services by US$7m and US$1m respectively and to reduce operating prot and prot before tax for Marketing Services by US$8m.

2. As indicated in note 2 to the nancial statements, discontinued operations comprise the Group’s transaction processing activities in France. Additional information on

discontinued operations, the results of which were formerly reported within the Credit Services business segment, is shown in note 11.

3. Revenue from external customers arose principally from the provision of services.

4. No allocation by business segment is made for charges in respect of the demerger-related equity incentive plans as the underlying data is maintained only to provide an

allocation by geographical segment.

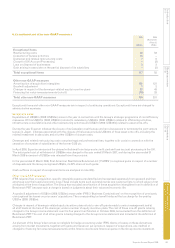

Notes to the Group nancial statements continued

Financial statements