Experian 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122 Experian Annual Report 2009

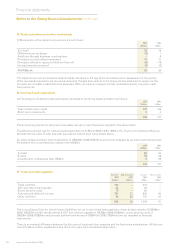

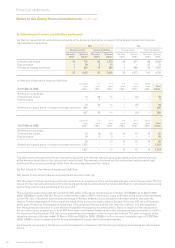

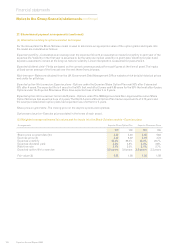

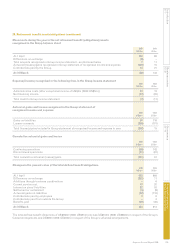

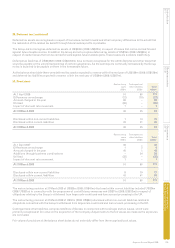

27. Share-based payment arrangements (continued)

(b) Share awards

(i) Summary of arrangements

Experian Free

Shares Plan

and the Experian UK

Experian Co-Investment Experian Reinvestment Experian Performance Approved All-Employee

Arrangements Plan Plan Share Plan Plan

Nature of arrangement Grant of shares1 Grant of shares1 Grant of shares Grant of shares

Vesting conditions:

– Service period 4 years 3 to 5 years 5 years 3 years

– Performance 100% – Benchmark prot 50% – Benchmark prot 50% – Benchmark prot n/a

performance of Group performance of Group performance of Group

assessed against assessed against assessed against

specied targets2 specied targets3 specied targets3

50% – n/a 50% – Distribution percentage

determined by ranking

Total Shareholder Return

(‘TSR’) relative to a

comparator group4

Expected outcome Benchmark prot – 100% Benchmark prot – 80% Benchmark prot – 79% n/a

of meeting performance Unconditional – 100% TSR – range from 29.6%

criteria (at grant date) to 57.4%

Maximum term 4 years 5 years 5 years 3.5 years

Method of settlement Share distribution Share distribution Share distribution Share distribution

Expected departures 5% 5% 5% 15%

(at grant date)

1. The grant date is the start of the nancial year in which performance is assessed. This is before the quantity of the shares award is determined but the

underlying value of the award is known at the grant date, subject to the outcome of the performance condition. The value of awarded shares reects the

performance outcome at the date of their issue to participants.

2. The Benchmark prot performance condition for the Experian Co-Investment Plan requires Benchmark PBT growth to exceed 6% over a 3 year period. The period

of assessment commences at the beginning of the nancial year of grant. This is not a ‘market-based’ performance condition as dened by IFRS 2.

3. The Benchmark prot performance condition for the Experian Reinvestment Plan and Experian Performance Share Plan requires Benchmark PBT growth at

least to exceed 7% over a 3 year period with the condition fully satised if Benchmark PBT growth is 14%. The period of assessment commences at the beginning

of the nancial year of grant. This is not a ‘market-based’ performance condition as dened by IFRS 2.

4. The Experian Performance Share Plan TSR condition is considered a ‘market-based’ performance condition as dened by IFRS 2. In valuing the awarded

shares, TSR is evaluated using a Monte Carlo simulation with historic volatilities and correlations for comparator companies measured over the 3 year period

preceding valuation and an implied volatility for Experian plc.

.

Notes to the Group nancial statements continued

Financial statements