Experian 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Experian Annual Report 2009

Meeting obligations under

share-based incentives

Obligations under Experian’s employee

share plans may be met using either

shares purchased in the market or,

except for rolled-over awards under

certain GUS schemes, newly issued

shares. The approach during the

year has been to use a combination

of newly issued shares and shares

previously purchased by the employee

trusts. Following a recent review it

has been decided that for the time

being all awards will be satised by

the purchase of shares or from shares

previously purchased by the employee

trusts. The policy will remain under

regular review.

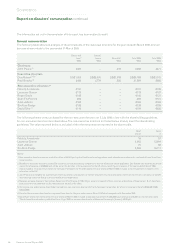

The above graphs show that, at 31

March 2009, a hypothetical £100

invested in GUS and subsequently,

Experian would have generated a

total return of £180 compared with a

return of £83 if invested in the FTSE

on 31 March 2001 and a total return of

£120 compared with a return of £105 if

invested on 31 March 2004.

With respect to Responsible

Investment Disclosure, the committee

is satised that environmental, social

and governance risks are not raised

by the incentive structure for senior

management and do not inadvertently

motivate irresponsible behaviour.

Experian share option plan

The Experian share option plan was

approved by GUS plc shareholders at

the EGM held on 29 August 2006. This

plan seeks to align shareholder and

participant interests through share

price growth and the employment of

a stretching performance condition.

For awards to be granted to executive

directors in the next nancial

year, options will vest subject to

the achievement of a stretching

performance condition, being growth in

earnings per share (‘EPS’). 25% of an

award will vest for EPS growth of 4%

per annum rising to 100% vesting for

EPS growth of 8% per annum.

In addition, vesting of these awards

will be subject to satisfactory

ROCE performance.

For each of the long-term incentive

plans, external consultants will be used

to calculate whether, and the extent

to which, the performance conditions

have been met.

Experian Sharesave

All executive directors and employees

of Experian and any participating

subsidiaries in which sharesave or a

local equivalent is operated are eligible

to participate if they are employed

by Experian at a qualifying date.

Sharesave provides an opportunity for

employees to save a regular monthly

amount, over either three or ve years

which, at the end of the savings period,

may be used to purchase Experian

shares under option for up to 20%

below market value at the date of grant.

Performance graph

The committee has chosen to illustrate

the ‘TSR’ for GUS plc until demerger

and Experian plc against the FTSE 100

Index for the period since listing on

11 October 2006 to 31 March 2009. The

FTSE 100 Index is the most appropriate

index against which TSR should

be measured, as it is a widely used

and understood index of leading UK

companies.

Performance as GUS (to 6 October 2006)

Performance as Experian (from 6 October 2006)

Value of £100 invested in GUS/Experian and the FTSE 100

on 31 March 2001

FTSE 100 Index

March

04

March

05

March

06

March

07

March

08

March

09

£150

£100

£50

£0

£200

Value of £100 invested in GUS/Experian and the FTSE 100

on 31 March 2004

FTSE 100 Index

Performance as GUS (to 6 October 2006)

Performance as Experian (from 6 October 2006)

March

01

March

02

March

03

March

04

March

05

March

06

March

07

March

08

March

09

£200

£150

£100

£50

£0

£250

Governance

Report on directors’ remuneration continued