Experian 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 Experian Annual Report 2009

2. Basis of preparation and signicant accounting policies (continued)

Goodwill

Goodwill is allocated to CGUs and monitored for internal management purposes by geographical segment. The allocation is made to

those CGUs or groups of CGUs that are expected to benet from the business combination in which the goodwill arose.

The Group tests goodwill for impairment annually or more frequently if events or changes in circumstances indicate that

the goodwill may be impaired. The recoverable amount of each CGU is generally determined on the basis of value-in-use

calculations which require the use of cash ow projections based on nancial budgets approved by management, looking

forward up to ve years. Management determines budgeted gross margin based on past performance and its expectations

for the market development. Cash ows are extrapolated using estimated growth rates beyond a ve year period. The growth

rates used do not exceed the long-term average growth rate for the markets in which the segment operates. The discount rates

used reect the region’s weighted average cost of capital (‘WACC’). The key assumptions used for value-in-use calculations

are:

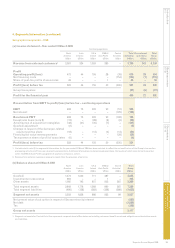

Pre-tax Long term

Region WACC growth rate

North America 11.6% 2.3%

Latin America 17.0% 8.0%

UK & Ireland 11.5% 2.3%

EMEA/Asia Pacic 12.5% 4.5%

The recoverable amount of the Latin America CGU exceeds the carrying value by approximately US$200m and an increase in

the pre-tax WACC of 1.3% or a reduction of 1.5% in the long term growth rate would reduce the value-in-use of its goodwill to an

amount equal to its carrying value.

Share-based payments

The Group has a number of equity settled share-based employee incentive plans. The assumptions used in determining the

amounts charged in the Group income statement include judgments in respect of performance conditions and length of service

together with future share prices, dividend and interest yields and exercise patterns.

Critical judgments

Management has made certain judgments in the process of applying the Group’s accounting policies set out above that have

a signicant effect on the amounts recognised in the Group nancial statements. The accounting policy descriptions indicate

where judgment needs exercising and these judgments include the classication of transactions between the Group income

statement and the Group balance sheet.

The most signicant of these judgments is in respect of intangible assets where certain costs incurred in the developmental

phase of an internal project are capitalised if a number of criteria are met. Management has made certain judgments and

assumptions when assessing whether a project meets these criteria, and on measuring the costs and the economic life

attributed to such projects. On acquisition, specic intangible assets are identied and recognised separately from goodwill

and then amortised over their estimated useful lives. These include such items as brand names and customer lists, to which

value is rst attributed at the time of acquisition. The capitalisation of these assets and the related amortisation charges are

based on judgments about the value and economic life of such items. The economic lives for intangible assets are estimated at

between three and seven years for internal projects, which include databases, internal use software and internally generated

software, and between two and twenty years for acquisition intangibles.

Recent accounting developments

The following accounting standards, amendments and interpretations issued by the IASB and the International Financial

Reporting Interpretations Committee are effective for the Group’s accounting periods beginning on or after 1 April 2008 but

have had no material effect on the results or nancial position of the Group:

IFRIC 12 ‘Service Concession Arrangements’ *

-

IFRIC 14 ‘IAS 19 – The Limit on a Dened Benet Asset, Minimum Funding Requirements and their Interaction’ -

Notes to the Group nancial statements continued

Financial statements