Experian 2009 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

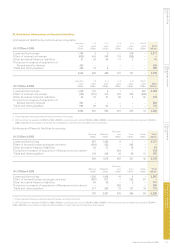

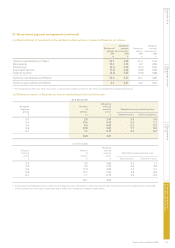

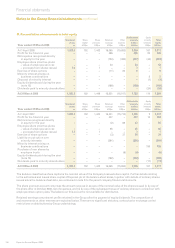

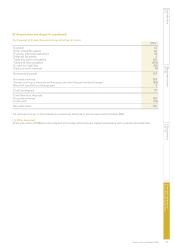

28. Retirement benet assets/obligations (continued)

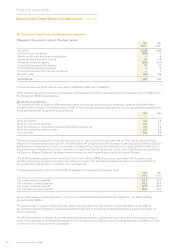

Assets of the Group’s dened benet plans and their expected

long-term rates of return

Fair value Return Fair value Return

2009 2009 2008 2008

US$m % p.a. US$m % p.a.

Equities 345 8.7 693 9.1

Fixed interest securities 214 6.0 343 5.7

Other 36 6.5 9 5.1

595 7.5 1,045 8.0

The overall return has been determined by considering the mix of returns anticipated on the assets held in accordance with

the current investment policy. Expected yields on xed interest securities are based on gross redemption yields as at the

balance sheet date. Expected returns on equities and other assets reect the long-term real rates of return experienced in the

respective markets.

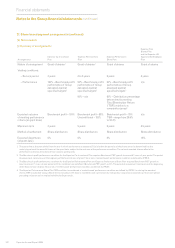

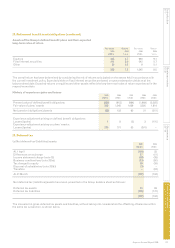

History of experience gains and losses

2009 2008 2007 2006 2005

US$m US$m US$m US$m US$m

Present value of dened benet obligations (653) (913) (984) (1,989) (2,025)

Fair value of plans’ assets 595 1,045 1,069 2,020 1,814

Net pension (obligations)/assets (58) 132 85 31 (211)

Experience adjustment arising on dened benet obligations:

Losses/(gains) 1 8 (5) 2 (110)

Experience adjustment arising on plans’ assets:

Losses/(gains) 236 101 53 (241) –

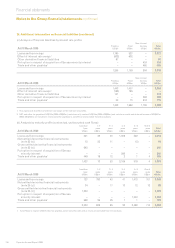

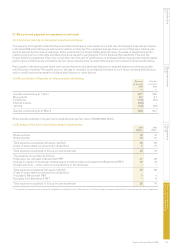

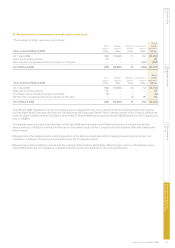

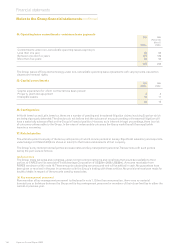

29. Deferred tax

(a) Net deferred tax (liabilities)/assets

2009 2008

US$m US$m

At 1 April (144) 35

Differences on exchange 37 (11)

Income statement charge (note 10) (58) (38)

Business combinations (note 33(a)) (13) (90)

Tax charged to equity 59 (16)

Disposal of subsidiaries (note 33(b)) (3) –

Tr a n s f e r s – (24)

At 31 March (122) (144)

Net deferred tax (liabilities)/assets have been presented in the Group balance sheet as follows:

Deferred tax assets 13 26

Deferred tax liabilities (135) (170)

(122) (144)

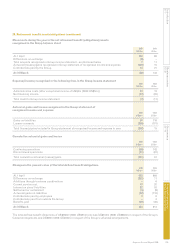

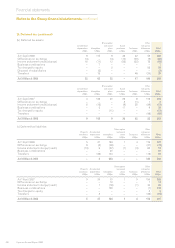

The movement in gross deferred tax assets and liabilities, without taking into consideration the offsetting of balances within

the same tax jurisdiction, is shown below.