Experian 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60 Experian Annual Report 2009

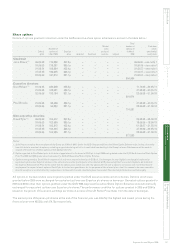

2009/10 incentive arrangements

for the CEO

In recognition of his personal

performance and the continued

valuable contribution Don Robert

makes to Experian and to continue

to incentivise him to create future

shareholder value, the remuneration

committee proposes to make awards

worth 300% of salary in face value

under each of the PSP and Executive

Share Option Plan (‘ESOP’) in the

coming year. These changes will

position our CEO’s remuneration

highly competitively against UK and

US nancial services and other

US-listed companies of similar size

to Experian. The committee believes

the approach taken is appropriate for

a CEO of Don Robert’s calibre and

that it is appropriate for his overall

remuneration to be highly variable,

with a strong link to the Group’s

performance. As such, his base salary

during 2009/10 will continue to be

frozen at the level set in 2007.

The future level of any awards for

the CEO will be determined by the

remuneration committee on an annual

basis, taking account of the prevailing

circumstances at the time.

These proposals are within the

parameters of the current rules but in

line with our commitment to engage

with shareholders, the committee

consulted with key shareholders on the

proposed changes.

Service contracts

Each executive director has a

rolling service contract which can

be terminated by the Group giving

twelve months’ notice. In the event

of termination of the director’s

contract, any compensation payment

is calculated in accordance with

normal legal principles, including the

application of mitigation to the extent

appropriate in the circumstances of the

case.

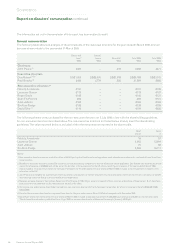

Remuneration of

executive directors

Each element of reward is important

and has a specic role in achieving

the aims of the remuneration

philosophy. The combined potential

remuneration from annual bonus and

share-based incentives outweighs

the other elements and is subject

to performance conditions, thereby

placing much of it at risk. In fair value

terms, the proportion of the total

remuneration (excluding pension and

benets) of the CEO which is variable

is approximately 80% as illustrated.

The remuneration committee selects

performance measures that are

designed to be aligned with the

Group’s strategic goals and that

are transparent to directors and

shareholders. Each element

of remuneration is designed to

support the achievement of different

corporate objectives as outlined in the

following table.

Fair value of CEO remuneration

Variable (80%)

Fixed (20%)

Governance

Report on directors’ remuneration continued