Experian 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63Experian Annual Report 2009

Introduction

2 – 7

Governance

Report on directors’ remuneration Financial statements

73 – 148

Business review

8 – 43

Business review

8 – 43

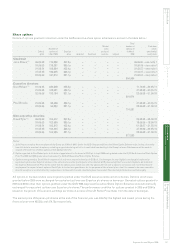

In addition, it is intended to increase

the maximum match under the CIP

from 1:1 to up to 2:1. The CIP is used as

part of a suite of long-term incentive

arrangements and the increase in

potential match has been factored

into market-based remuneration

benchmarking that has been carried

out on behalf of the committee. The fair

value of total remuneration, including

the increased match, remains within

competitive levels.

The match of 1:1 will be awarded for

the achievement of a target level of

growth in PBT, increasing on a straight

line basis to up to a 2:1 match for the

achievement of stretching levels of

performance. The nal targets will be

determined shortly before the awards

are made in June 2010 and will be fully

disclosed at the appropriate time.

However, the committee undertakes

to ensure that any targets, whilst they

must be seen as achievable to retain

and motivate executives during the

deferral period, must be sufciently

stretching to deliver signicant

shareholder value.

Experian performance share plan

(‘Experian PSP’)

The Experian PSP was approved

by GUS plc shareholders at the

Extraordinary General Meeting (‘EGM’)

held on 29 August 2006. An initial award

was made to participants, including

the executive directors, on 11 October

2006. Performance shares are ‘free’

Experian shares for which no exercise

price is payable. Shares are allocated

subject to a performance condition

which is measured over a three-year

performance period with a ve-year

vesting period. Dividend equivalents

accrue on these awards.

For the above demerger awards

granted in October 2006, the

performance condition is in two

separate parts; 50% of the award is

subject to achievement against a

sliding scale of growth in PBT, which

the committee considers to be an

appropriate measure as this represents

one of the key drivers of the business.

The threshold for vesting is growth in

PBT of 7% per annum at which 25% of

this part of the award will vest, rising

on a straight-line basis to 100% of this

part of the award vesting if PBT grows

at a rate of 14% per annum.

The remaining 50% of the award will

vest according to the performance of

Experian’s total shareholder return

(‘TSR’) (dened as share price

movement plus reinvested dividends)

relative to the following group of peer

companies as set at the award date:

Acxiom

Alliance Data Systems

Bisys Group

Capita Group

Choicepoint

Dun & Bradstreet

Equifax

Fair Isaac

Fidelity National Financial

Fimalac

First American

First Data

Fiserv

Global Payments

Harte-Hanks

IAC/Interactive Corp

Moodys

Reuters Group

Thomson

Total System Services

This bespoke comparator group

consists of Experian’s main

competitors in the business areas

and countries in which the Group

operates. This part of the award will

not vest if Experian’s TSR is below

the median return for the comparator

group. Once Experian achieves median

performance, 25% of this portion

of the award may vest, rising on a

straight-line basis to 100% of this part

of the award vesting for upper quartile

performance or better.

Performance conditions for

future awards under the Experian

performance share plan will be decided

in advance of grant. For awards to be

made in 2009/10, it is intended that

75% of any award will be subject to a

growth in PBT performance condition

and 25% will be subject to a relative

TSR performance condition. This is to

ensure that greater line of sight exists

between participating executives and

the performance measures employed.

For the element of an award which

is subject to the PBT performance

condition, 25% will vest for growth in

PBT of 4% per annum on average rising

to 100% vesting for growth in PBT

of 8% per annum on average, which

is expected to be broadly equivalent

to median and upper quartile

performance respectively. For the TSR

element of the awards, vesting will be

according to the percentage extent to

which Experian’s TSR outperforms the

TSR of the FTSE 100 Index. 25% of the

award would vest at threshold, rising

to 100% where Experian outperforms

the FTSE 100 Index by at least 25% over

the three-year performance period.

This equates to approximately 7.7%

per annum. In addition, vesting of these

awards will be subject to satisfactory

return on capital employed (’ROCE’)

performance.