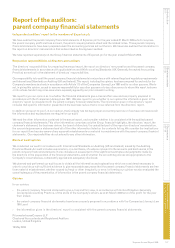

Experian 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

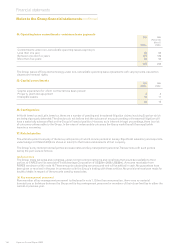

134 Experian Annual Report 2009

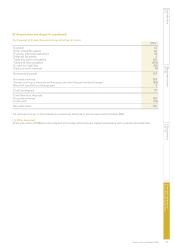

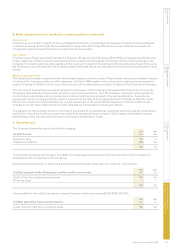

33. Acquisitions and disposals

(a) Acquisitions for the year ended 31 March 2009

On 10 December 2008, the Group acquired the whole of the issued share capital of Search

America

, Inc., a leading provider of

payment prediction data and analytics to the healthcare industry in the USA, for US$90m. On 1 December 2008, a company in

which the Group has a 75% interest acquired the whole of the issued share capital of KreditInform (Pty) Ltd, a leading provider

of commercial credit information and analytics in South Africa. There were no other individually material acquisitions.

In aggregate, the acquired businesses contributed revenues of US$14m to the Group for the periods from their respective

acquisition dates to 31 March 2009. The acquired businesses contributed aggregate prot after tax of US$4m to the Group for

the periods from their respective acquisition dates to 31 March 2009. If these acquisitions had been completed on 1 April 2008,

further revenues of US$22m would have been reported. It has been impracticable to estimate the impact on Group prot after

tax had the acquired entities been owned from 1 April 2008, due to the acquired entities having different accounting policies

prior to acquisition and previously reporting to different period ends.

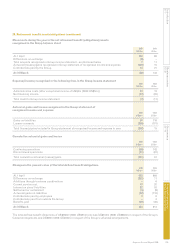

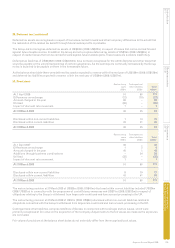

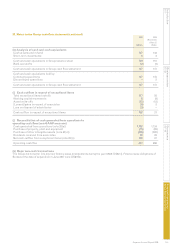

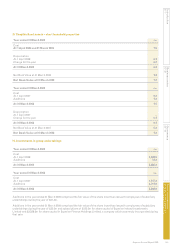

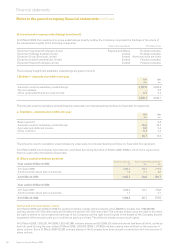

Details of the net assets acquired at provisional fair values are as follows:

Book value Fair value

US$m US$m

Intangible assets – 63

Property, plant and equipment 1 1

Deferred tax assets – 7

Trade and other receivables 8 8

Cash and cash equivalents 4 4

Trade and other payables (12) (12)

Current tax liabilities (1) (1)

Deferred tax liabilities (8) (20)

(8) 50

Goodwill 90

140

Satised by:

Cash 122

Acquisition expenses 2

Deferred consideration 8

Recognition of minority interest 8

140

The book values above are the carrying amounts of each class of asset and liability, determined in accordance with IFRS,

immediately before the acquisition.

The fair values set out above contain certain provisional amounts which will be nalised no later than one year after the date

of acquisition. Provisional amounts have been included at 31 March 2009 as a consequence of the timing and complexity of the

acquisitions. Fair value adjustments in respect of acquisitions made during the year resulted in an increase in book value of

US$58m and arose principally in respect of acquisition intangibles. Goodwill represents the synergies, assembled workforce

and future growth potential of the businesses acquired.

Deferred consideration is primarily payable in cash up to three years after the date of acquisition and in some cases is

contingent on the businesses acquired achieving revenue and prot targets. The deferred consideration settled during the year

on acquisitions made in previous years was US$59m.

There have been no material gains, losses, error corrections or other adjustments recognised in the year ended 31 March 2009

that relate to acquisitions that were effected in the current or previous years.

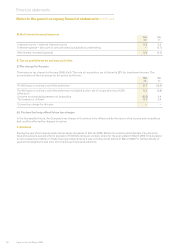

Notes to the Group nancial statements continued

Financial statements