Experian 2009 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

129Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

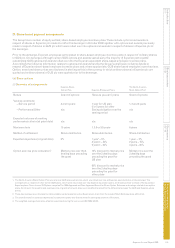

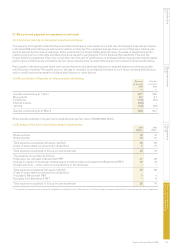

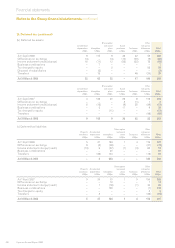

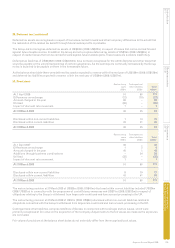

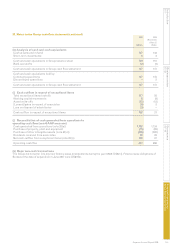

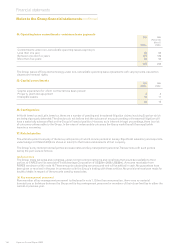

29. Deferred tax (continued)

Deferred tax assets are recognised in respect of tax losses carried forward and other temporary differences to the extent that

the realisation of the related tax benet through future taxable prots is probable.

The Group did not recognise deferred tax assets of US$430m (2008: US$32m) in respect of losses that can be carried forward

against future taxable income. In addition the Group did not recognise deferred tax assets of US$16m (2008: US$25m) in

respect of capital losses that can be carried forward against future taxable gains. These losses are available indenitely.

Deferred tax liabilities of US$2,062m (2008: US$2,004m) have not been recognised for the withholding tax and other taxes that

would be payable on the unremitted earnings of certain subsidiaries. As the earnings are continually reinvested by the Group,

no tax is expected to be payable on them in the foreseeable future.

At the balance sheet date there were deferred tax assets expected to reverse within the next year of US$129m (2008: US$128m)

and deferred tax liabilities expected to reverse within the next year of US$94m (2008: US$57m).

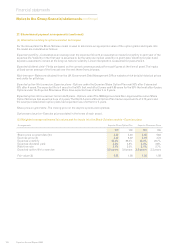

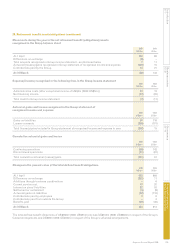

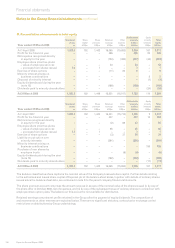

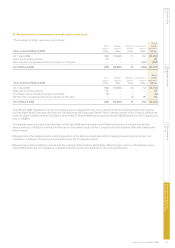

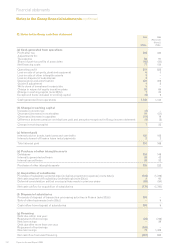

30. Provisions

Restructuring Contingent and

costs other liabilities To t a l

US$m US$m US$m

At 1 April 2008 51 60 111

Differences on exchange (12) (15) (27)

Amount charged in the year 92 – 92

Utilised (96) – (96)

Impact of discount rate movement 1 – 1

At 31 March 2009 36 45 81

Disclosed within non-current liabilities 1 14 15

Disclosed within current liabilities 35 31 66

At 31 March 2009 36 45 81

Restructuring Contingent and

costs other liabilities To t a l

US$m US$m US$m

At 1 April 2007 39 – 39

Differences on exchange 1 5 6

Amount charged in the year 45 1 46

Additions through business combinations – 54 54

Utilised (35) – (35)

Impact of discount rate movement 1 – 1

At 31 March 2008 51 60 111

Disclosed within non-current liabilities 8 19 27

Disclosed within current liabilities 43 41 84

At 31 March 2008 51 60 111

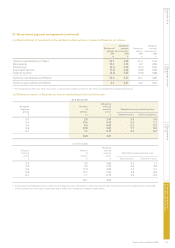

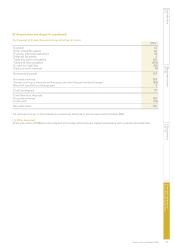

The restructuring provision at 31 March 2009 of US$35m (2008: US$43m) disclosed within current liabilities included US$24m

(2008: US$31m) in connection with the programme of cost efciency measures and US$11m (2008: US$12m) in respect of

obligations relating to the Group’s withdrawal from large scale credit card and loan account processing in the UK.

The restructuring provision at 31 March 2009 of US$1m (2008: US$8m) disclosed within non-current liabilities related to

obligations connected with the Group’s withdrawal from large scale credit card and loan account processing in the UK.

Contingent and other liabilities comprise liabilities of Serasa, in connection with local legal and tax issues, which were

primarily recognised at fair value on the acquisition of that company. Adjustments to the fair values are made as the exposures

are concluded.

Fair values of provisions at the balance sheet dates do not materially differ from the recognised book values.