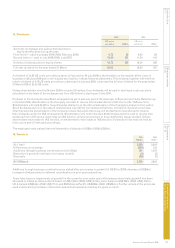

Experian 2009 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

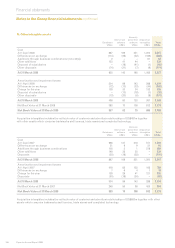

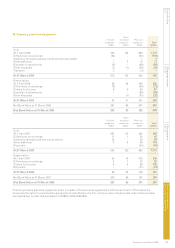

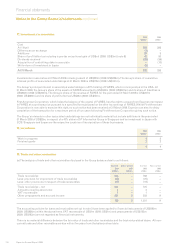

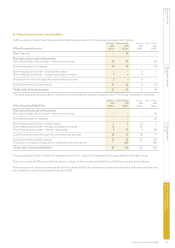

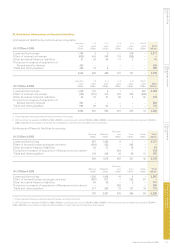

25. Other nancial assets and liabilities

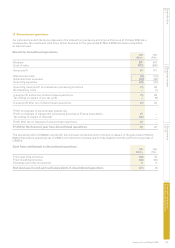

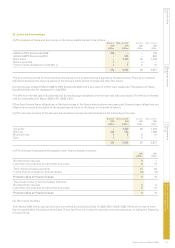

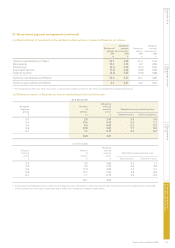

(a) The analysis of other nancial assets and liabilities disclosed in the Group balance sheet is as follows:

Current Non-current Current Non-current

2009 2009 2008 2008

Other nancial assets US$m US$m US$m US$m

Bank deposits – 29 – –

Derivative nancial instruments:

Fair value hedge of borrowings – interest rate swaps 14 32 – 24

Derivatives used for hedging 14 32 – 24

Non-hedging derivatives - interest rate swaps – – 2 –

Non-hedging derivatives - foreign exchange contracts 7 – 4 –

Assets at fair value through the prot and loss account 7 – 6 –

Derivative nancial instruments 21 32 6 24

Total other nancial assets 21 61 6 24

The bank deposits included above comprise an amount held as collateral against one of the Group’s derivative contracts.

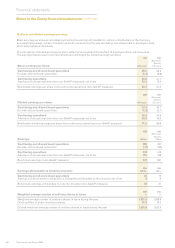

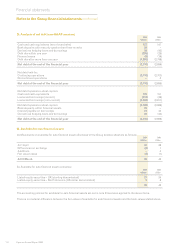

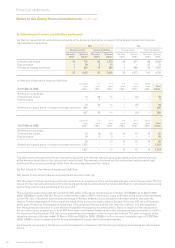

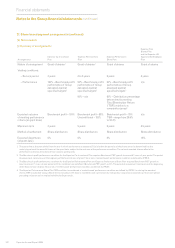

Current Non-current Current Non-current

2009 2009 2008 2008

Other nancial liabilities US$m US$m US$m US$m

Derivative nancial instruments:

Fair value hedge of borrowings – interest rate swaps – – – 20

Derivatives used for hedging – – – 20

Non-hedging derivatives – equity swaps 1 1 16 5

Non-hedging derivatives – foreign exchange contracts 12 – 32 –

Non-hedging derivatives – interest rate swaps 9 74 2 66

Liabilities at fair value through the prot and loss account 22 75 50 71

Derivative nancial instruments 22 75 50 91

Put option in respect of acquisition of Serasa minority interest – 424 – 583

Total other nancial liabilities 22 499 50 674

The accounting policies for nancial instruments set out in note 2 have been applied as appropriate to the above items.

There is no material difference between the fair values of these assets and liabilities and the book values stated above.

There are put and call options associated with the shares held by the remaining principal shareholders of Serasa and these are

exercisable for a period of ve years from June 2012.