Experian 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 Experian Annual Report 2009

UK and Ireland continued

Credit Services

The major disruption in the nancial

services industry during the year

caused a signicant reduction

in lending as well as major client

consolidations. Total revenue for Credit

Services was at at constant exchange

rates, while organic revenue declined

by 2%. The relatively modest rate of

decline was reective of growth in

non-nancial verticals such as public

sector and utilities, growth in revenue

from countercyclical initiatives and a

resilient performance within business

information. Strategic initiatives during

the year included further investment in

sales infrastructure across the public

sector and utilities verticals, and re-

orientation of existing sales resource

towards countercyclical opportunities.

Decision Analytics

Total revenue at Decision Analytics

increased by 9% at constant exchange

rates, with organic revenue growth

of 6%. The acquisition contribution

related to Tallyman and N4 Solutions,

both of which performed ahead of plan.

Growth was driven by strong demand

for countercyclical products, including

fraud prevention and collections

software, and there was good progress

in non-nancial verticals such as

telecommunications and public sector.

During the year, there were large

contract wins with Anglian Water and

Vanquis Bank, for example.

Marketing Services

Total revenue in Marketing Services

decreased by 2% at constant exchange

rates. Organic revenue declined by

3%. Traditional marketing activities

were further affected by the downturn

in the nancial services market. New

media activities performed well, with

double-digit growth across contact

data management, email services and

online competitive intelligence. There

was good strategic progress during

the year across new media, with further

penetration of the public sector by

the Mosaic segmentation tool and

enhancements to contact data tools.

Interactive

Interactive performed strongly,

delivering organic revenue growth of

47%. Growth was driven by increased

direct memberships, reecting

product enhancements, greater

market segmentation and investment

in branding and customer acquisition.

Experian has also made good progress

in growing indirect memberships with

a number of afnity partnership wins in

the year.

Financial review

Revenue from continuing activities was

US$850m, up 5% at constant exchange

rates. Organic revenue growth was 3%.

The contribution to revenue growth from

acquisitions during the period was 2%.

The acquisition contribution related to

Tallyman, N4 Solutions, pH Group and

Hitwise.

EBIT from continuing activities was

US$213m, up 10% at constant exchange

rates. The EBIT margin was 25.1%

(2008: 23.6%). The improvement in

margin was due to strong execution

on cost efciency initiatives, including

outsourcing to India, organisational

delayering and technology efciencies.

Social, ethical and

environmental (SEE) risks

and opportunities

The UK and Ireland’s performance has

been recognised with two awards from

the charity ‘Business in the Community’.

The region has again achieved

environmental certication to ISO14001,

the most stringent international

measure of environmental management.

Investment in products with strong

social and environmental aspects will

make a demonstrable contribution in the

new nancial year.

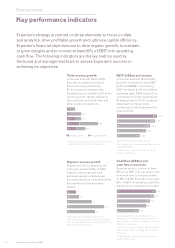

Organic revenue growth

7%

7%

3%

8%

3%09

08

07

06

05

Organic growth is dened as year-on-year revenue growth

at constant exchange rates, excluding acquisitions until the

date of their anniversary

2006, 2007 and 2008 exclude UK account processing

Organic growth Acquired growth

Total revenue growth

17%

Total growth is dened as year-on-year revenue growth at

constant exchange rates

2006, 2007 and 2008 exclude UK account processing

8%

22%

16%

5%

09

08

07

06

05

Business review