Experian 2009 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 Experian Annual Report 2009

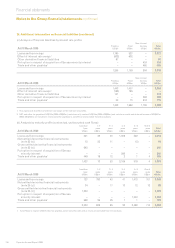

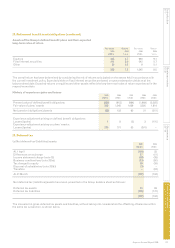

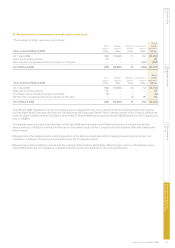

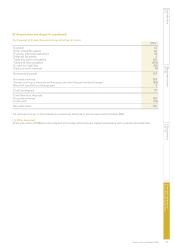

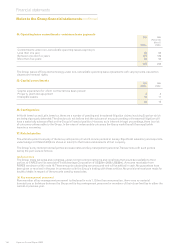

29. Deferred tax (continued)

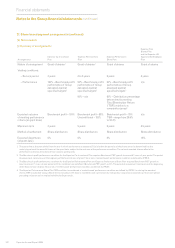

(b) Deferred tax assets

Share option Other

Accelerated and award Asset temporary

depreciation Intangibles plans provisions Tax losses differences To t a l

US$m US$m US$m US$m US$m US$m US$m

At 1 April 2008 9 115 9 36 42 52 263

Differences on exchange (3) – (3) (14) (20) (2) (42)

Income statement credit/(charge) 16 (71) 13 (22) (53) 72 (45)

Business combinations – 7 – – – – 7

Tax charged to equity – – 3 – – 56 59

Disposal of subsidiaries – (3) – – – – (3)

Transfers – 15 – – 48 (34) 29

At 31 March 2009 22 63 22 – 17 144 268

Share option Other

Accelerated and award Asset temporary

depreciation Intangibles plans provisions Tax losses differences To t a l

US$m US$m US$m US$m US$m US$m US$m

At 1 April 2007 3 128 20 26 8 119 304

Differences on exchange – – – 2 (1) 1 2

Income statement credit/(charge) 6 (16) – (9) 35 (29) (13)

Business combinations – 3 – 17 – 9 29

Tax charged to equity – – (11) – – – (11)

Transfers – – – – – (48) (48)

At 31 March 2008 9 115 9 36 42 52 263

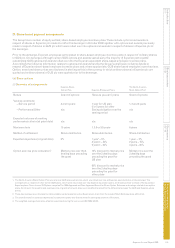

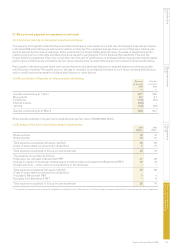

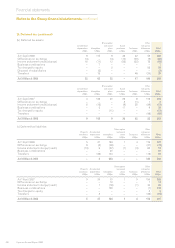

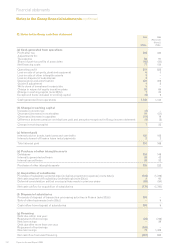

(c) Deferred tax liabilities

Share option Other

Property Accelerated and award temporary

valuations depreciation Intangibles plans Tax losses differences To t a l

US$m US$m US$m US$m US$m US$m US$m

At 1 April 2008 5 37 184 1 4 176 407

Differences on exchange 8 (2) (48) – – (37) (79)

Income statement charge/(credit) (13) 6 (57) (1) (4) 82 13

Business combinations – – 20 – – – 20

Transfers – (36) 144 – – (79) 29

At 31 March 2009 – 5 243 – – 142 390

Share option Other

Property Accelerated and award temporary

valuations depreciation Intangibles plans Tax losses differences To t a l

US$m US$m US$m US$m US$m US$m US$m

At 1 April 2007 5 34 70 1 5 154 269

Differences on exchange – – 12 – – 1 13

Income statement charge/(credit) – 1 (18) – (1) 43 25

Business combinations – – 120 – – (1) 119

Tax charged to equity – – – – – 5 5

Transfers – 2 – – – (26) (24)

At 31 March 2008 5 37 184 1 4 176 407

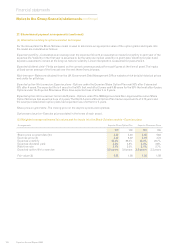

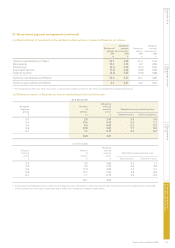

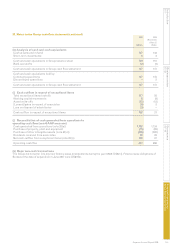

Notes to the Group nancial statements continued

Financial statements