Experian 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

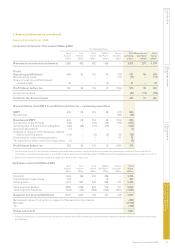

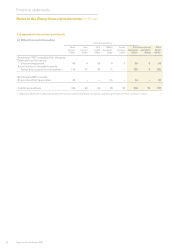

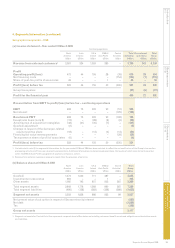

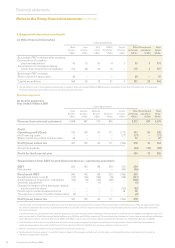

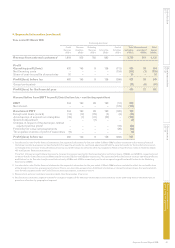

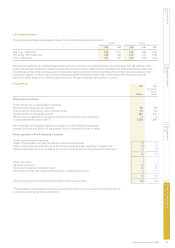

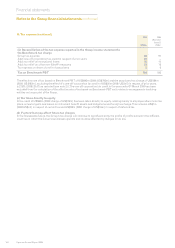

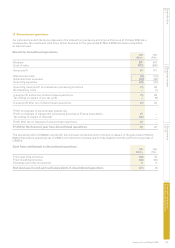

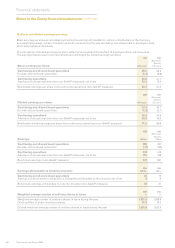

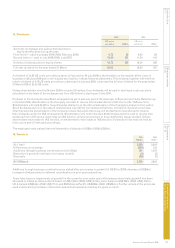

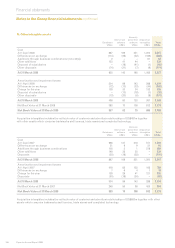

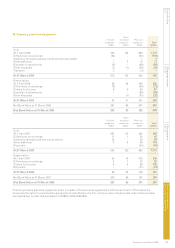

8. Exceptional and other non-GAAP measures

2009 2008

(Restated)

(Note 2)

US$m US$m

Exceptional items

Restructuring costs 92 52

Cessation of bureau activities 15 –

Demerger and related restructuring costs 7 6

Closure of UK Account Processing – (2)

Loss on disposal of businesses 3 2

Gain arising in associate on the partial disposal of its subsidiary – (3)

Total exceptional items 117 55

Other non-GAAP measures

Amortisation of acquisition intangibles 132 121

Goodwill adjustment 1 2

Charges in respect of the demerger-related equity incentive plans 32 49

Financing fair value remeasurements (note 9) (19) 29

Total other non-GAAP measures 146 201

Exceptional items and other non-GAAP measures are in respect of continuing operations. Exceptional items are charged to

administrative expenses.

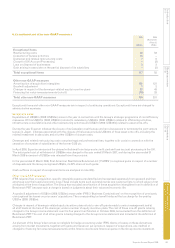

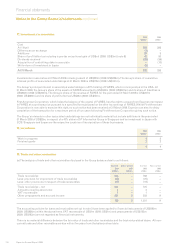

Exceptional items

Expenditure of US$92m (2008: US$52m) arose in the year in connection with the Group’s strategic programme of cost efciency

measures. Of this US$51m (2008: US$34m) related to redundancy, US$34m (2008: US$6m) related to offshoring activities,

infrastructure consolidations and other restructuring activities and US$7m (2008: US$12m) related to asset write-offs.

During the year Experian initiated the closure of its Canadian credit bureau and is in discussions to terminate the joint venture

bureau in Japan. Charges associated with the closure of the bureaux include US$13m of xed asset write offs, including the

related investment in associate, and a further US$2m of closure costs.

Demerger and related restructuring costs comprise legal and professional fees, together with costs in connection with the

cessation of a number of subsidiaries of the former GUS plc.

In April 2006, Experian announced the phased withdrawal from large scale credit card and loan account processing in the UK.

The anticipated cost of withdrawal of US$26m was charged in the year ended 31 March 2007, and during the year ended 31

March 2008 an amount of US$2m was released from the provision.

In the year ended 31 March 2008, First American Real Estate Solutions LLC (‘FARES’) recognised gains in respect of a number

of disposals and the Group recognised US$3m, its 20% share of such gains.

Cash outows in respect of exceptional items are analysed in note 32(i).

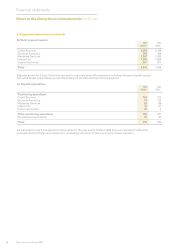

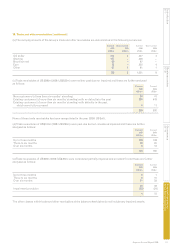

Other non-GAAP measures

IFRS requires that, on acquisition, specic intangible assets are identied and recognised separately from goodwill and then

amortised over their useful economic lives. These include items such as brand names and customer lists, to which value is rst

attributed at the time of acquisition. The Group has excluded amortisation of these acquisition intangibles from its denition of

Benchmark PBT because such a charge is based on judgments about their value and economic life.

A goodwill adjustment of US$1m (2008: US$2m) arose under IFRS 3 ‘Business Combinations’ on the recognition of previously

unrecognised tax losses on prior years’ acquisitions. The corresponding tax benet reduced the tax charge for the year by

US$1m (2008: US$2m).

Charges in respect of demerger-related equity incentive plans relate to one-off grants made to senior management and at

all staff levels at the time of the demerger, under a number of equity incentive plans. The cost of these one-off grants is being

charged to the Group income statement over the ve years from otation in October 2006, but excluded from the denition of

Benchmark PBT. The cost of all other grants is being charged to the Group income statement and included in the denition of

Benchmark PBT.

An element of the Group’s derivatives is ineligible for hedge accounting under IFRS. Gains or losses on these derivatives

arising from market movements, together with gains and losses on put options in respect of acquisitions, are credited or

charged to nancing fair value remeasurements within nance income and nance expense in the Group income statement.