Experian 2009 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 Experian Annual Report 2009

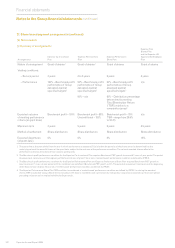

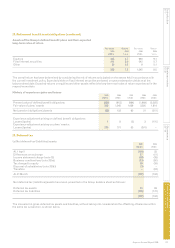

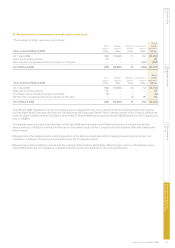

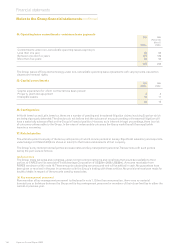

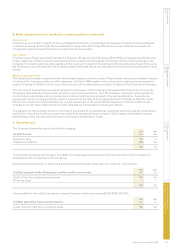

32. Notes to the Group cash ow statement

2009 2008

(Restated)

(Note 2)

US$m US$m

(a) Cash generated from operations

Prot after tax 494 430

Adjustments for:

Tax expense 84 91

Share of post-tax prots of associates (42) (50)

Net nancing costs 77 154

Operating prot 613 625

Loss on sale of property, plant and equipment 6 3

Loss on sale of other intangible assets 3 –

Loss on disposal of subsidiaries 3 –

Depreciation and amortisation 420 406

Goodwill adjustment 1 2

Write down of investment in associate 5 –

Charge in respect of equity incentive plans 52 66

Change in working capital (note 32(b)) 7 23

Exceptional items included in working capital (8) 9

Cash generated from operations 1,102 1,134

(b) Change in working capital

Increase in inventories (2) –

Decrease/(increase) in receivables 24 (51)

(Decrease)/increase in payables (11) 79

Difference between pension contributions paid and amounts recognised in Group income statement (4) (5)

Change in working capital 7 23

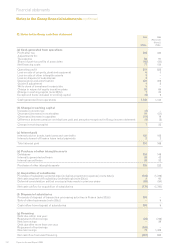

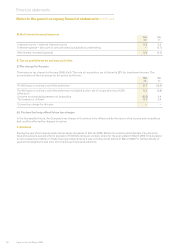

(c) Interest paid

Interest paid on bonds, bank loans and overdrafts 155 166

Interest element of nance lease rental payments 2 2

Total interest paid 157 168

(d) Purchase of other intangible assets

Databases 153 148

Internally generated software 38 42

Internal use software 39 32

Purchase of other intangible assets 230 222

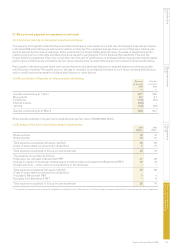

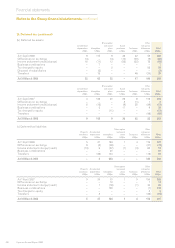

(e) Acquisition of subsidiaries

Purchase of subsidiary undertakings (including acquisition expenses) (note 33(a)) (124) (1,726)

Net cash acquired with subsidiary undertakings (note 33(a)) 4 60

Deferred consideration settled on acquisitions made in previous years (59) (54)

Net cash outow for acquisition of subsidiaries (179) (1,720)

(f) Disposal of subsidiaries

Proceeds of disposal of transaction processing activities in France (note 33(b)) 191 –

Sale of other businesses (note 33(c)) – 6

Cash inow from disposal of subsidiaries 191 6

(g) Financing

Debt due within one year:

Repayment of borrowings (29) (746)

New borrowings – 29

Debt due after more than one year:

Repayment of borrowings (249) –

New borrowings 71 1,409

Net cash ow from debt nancing (207) 692

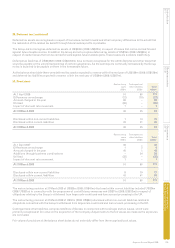

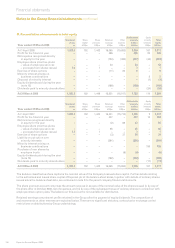

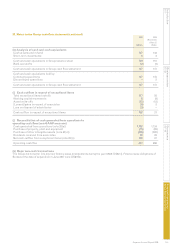

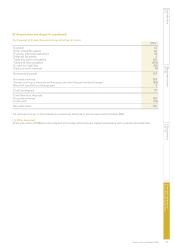

Notes to the Group nancial statements continued

Financial statements