Experian 2009 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16 Experian Annual Report 2009

North America continued

During the year, Experian continued

to focus on strengthening its market

position and on expanding into new

growth verticals. In addition, through

the acquisition of Search

America

in

December 2008, Experian is extending

its core data and analytics to the fast-

growth healthcare payments sector.

As previously announced, Experian

has discontinued efforts to launch

a credit bureau in Canada. This

reects the reduced attractiveness of

the opportunity following the global

nancial crisis, which has caused lender

needs in Canada to change.

Decision Analytics

Revenue growth at Decision Analytics

was 1%. There was good progress

during the year across custom analytics,

as well as account management,

commercial lending and fraud

prevention software. This helped

to offset weaker demand for loan

origination products. Experian further

penetrated the market during the year,

with a number of new business wins.

In addition, Experian is developing

its presence in new verticals, such

as capital markets, by building

relationships with lenders, ratings

agencies and regulators.

Marketing Services

Total revenue at Marketing Services

declined by 1%, while organic revenue

declined by 2%. Recessionary conditions

and cutbacks in discretionary retail

spend impacted the traditional

activities of list processing, data and

database, which declined during the

year. New media businesses delivered

good growth reecting deeper market

penetration through new business wins

and good retention rates.

Interactive

Revenue growth at Interactive was 7%.

Consumer Direct delivered a very strong

performance, with growth in excess of

20%, further extending Experian’s market

lead. Growth was driven by higher

memberships, growth in the afnity

channel, plus contribution from one-off

data breach contracts. During the year,

Experian has invested in enhancing the

value of the customer experience as well

as in new product introductions, such as

identity management tools.

In lead generation, Experian Interactive

Media continued to experience very weak

market conditions as lenders exited the

market for subprime mortgage leads.

Comparison shopping revenues were

impacted by the weak retail environment

and by adverse business mix as

shoppers switched to lower value items.

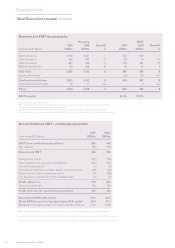

Financial review

Revenue from continuing activities was

US$2,083m, up 1%, with organic revenue

growth of 1%.

EBIT from direct businesses was

US$568m (2008: US$554m), an increase

of 3% in the year, giving an EBIT margin

of 27.3% (2008: 26.9%). The margin

improvement reected progress on

cost efciency initiatives, including

offshoring of administrative and

development roles to Chile and Costa

Rica and technology efciencies.

EBIT from FARES, the 20%-owned

real estate information associate, was

US$48m (2008: US$54m). The reduction

reected the very weak environment for

mortgage origination.

Social, ethical and

environmental (SEE) risks

and opportunities

Experian in North America has taken

steps to incorporate consideration

of SEE issues into its everyday

processes, communicating its stance

with employees, clients and industry

advocates. Environmental initiatives are

beginning to contribute energy and cost

savings, which are reported in the full CR

report at www.experiancrreport.com.

Organic revenue growth

1%

3%

8%

15%

10%

Organic growth is dened as year-on-year revenue growth

at constant exchange rates, excluding acquisitions except

afliates, until the date of their anniversary

2006, 2007 and 2008 exclude MetaReward

09

08

07

06

05

Business review

Total revenue growth

Total growth is dened as year-on-year revenue growth at

constant exchange rates

2006, 2007 and 2008 exclude MetaReward

40%

15%

Organic growth Acquired growth

4%

18%

1%

09

07

06

05

08