Experian 2009 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118 Experian Annual Report 2009

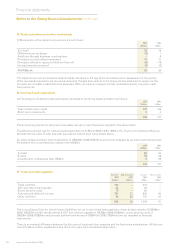

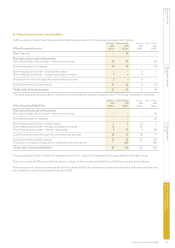

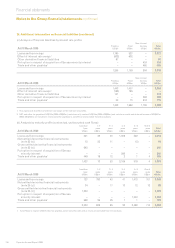

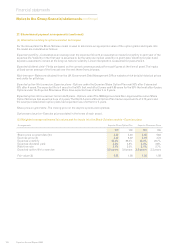

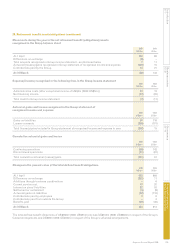

26. Additional information on nancial liabilities (continued)

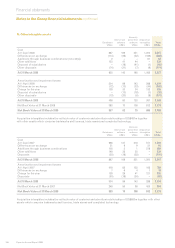

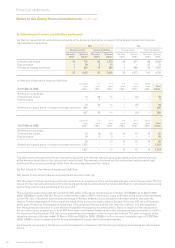

(c) Analysis of nancial liabilities by interest rate prole:

Non-interest

Floating Fixed bearing To t a l

At 31 March 2009 US$m US$m US$m US$m

Loans and borrowings 1,790 527 – 2,317

Effect of interest rate swaps1 (632) 632 – –

Other derivative nancial liabilities 97 – – 97

Put option in respect of acquisition of Serasa minority interest – – 424 424

Trade and other payables2 – – 480 480

1,255 1,159 904 3,318

Non-interest

Floating Fixed bearing To t a l

At 31 March 2008 US$m US$m US$m US$m

Loans and borrowings 1,443 1,407 – 2,850

Effect of interest rate swaps1 (185) 185 – –

Other derivative nancial liabilities 141 – – 141

Put option in respect of acquisition of Serasa minority interest – – 583 583

Trade and other payables2 33 70 612 715

1,432 1,662 1,195 4,289

1. This represents the effect of interest rate swaps on the interest rate prole.

2. VAT and other tax payable of US$32m (2008: US$52m), social security costs of US$78m (2008: US$95m) and certain accruals and deferred income of US$447m

(2008: US$474m) are included in trade and other payables in note 21 but are excluded from this analysis.

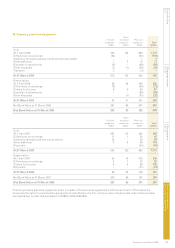

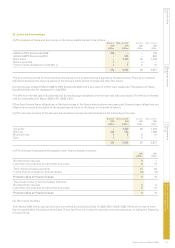

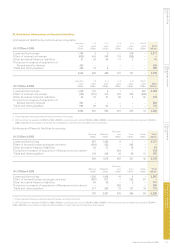

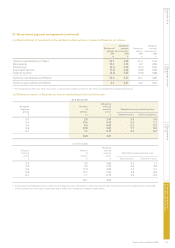

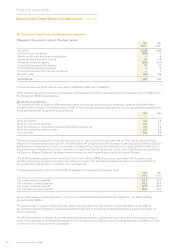

(d) Analysis by maturity prole (contractual, undiscounted cash ows):

Less than 1 – 2 2 – 3 3 – 4 4 – 5 Over 5

1 year years years years years years To t a l

At 31 March 2009 US$m US$m US$m US$m US$m US$m US$m

Loans and borrowings 321 32 30 1,509 522 – 2,414

Net settled derivative nancial instruments

(note 25 (c)) 15 23 11 – (5) – 44

Gross settled derivative nancial instruments

(note 25 (c)) 642 – – – – – 642

Put option in respect of acquisition of Serasa

minority interest – – – 595 – – 595

Trade and other payables1 449 18 12 2 1 4 486

1,427 73 53 2,106 518 4 4,181

Less than 1 – 2 2 – 3 3 – 4 4 – 5 Over 5

1 year years years years years years To t a l

At 31 March 2008 US$m US$m US$m US$m US$m US$m US$m

Loans and borrowings 127 783 43 41 1,473 701 3,168

Net settled derivative nancial instruments

(note 25 (c)) 34 – 17 13 12 12 88

Gross settled derivative nancial instruments

(note 25 (c)) 1,223 – – – – – 1,223

Put option in respect of acquisition of Serasa

minority interest – – – – 1,003 – 1,003

Trade and other payables1 669 26 25 1 1 – 722

2,053 809 85 55 2,489 713 6,204

1. Cash ows in respect of VAT, other tax payable, social security costs and accruals are excluded from this analysis.

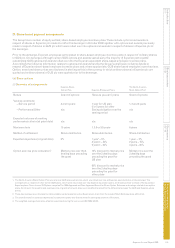

Notes to the Group nancial statements continued

Financial statements