Experian 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 Experian Annual Report 2009

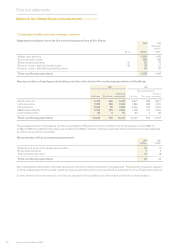

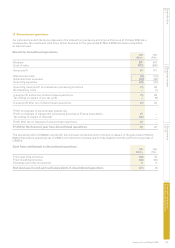

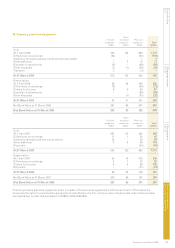

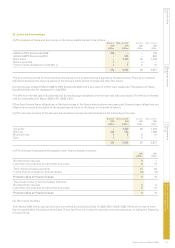

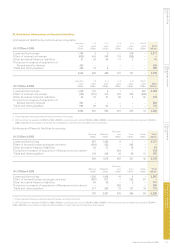

17. Investments in associates

2009 2008

US$m US$m

Cost

At 1 April 295 286

Differences on exchange (1) –

Additions 29 5

Share of prot after tax including a pre-tax exceptional gain of US$nil (2008: US$3m) (note 8) 42 50

Dividends received (28) (36)

Acquisition of controlling stake in associate – (10)

Write-down of investment in Japan (5) –

At 31 March 332 295

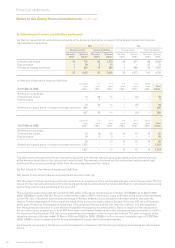

Investments in associates at 31 March 2009 include goodwill of US$224m (2008: US$228m). The Group’s share of cumulative

retained prots of associated undertakings at 31 March 2009 is US$155m (2008: US$141m).

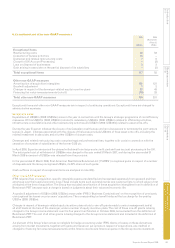

The Group’s principal interest in associated undertakings is a 20% holding of FARES, which in incorporated in the USA. At

31 March 2009, the Group’s share of the assets of FARES amounted to US$500m (2008: US$497m) and its share of liabilities is

US$202m (2008: US$202m). The Group’s share of the revenue of FARES for the year ended 31 March 2009 is US$237m

(2008: US$249m) and its share of prot after tax US$46m (2008: US$50m).

First American Corporation, which holds the balance of the capital of FARES, has the right to acquire from Experian its interest

in FARES at a purchase price pursuant to a specied formula based on the after tax earnings of FARES. Whilst First American

Corporation is now able to exercise this right, no such notice had been received at 31 March 2009. Experian can elect to delay

completion of the transaction for a maximum period of two years following First American Corporation giving such notice.

The Group’s interests in other associated undertakings are not individually material but include additions in the year ended

31 March 2009 of US$29m, in respect of a 40% stake in DP Information Group in Singapore and an investment in Japan with

CCB. Singapore and Japan are the respective countries of incorporation of these businesses.

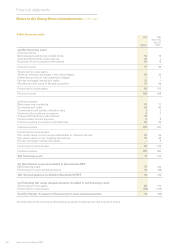

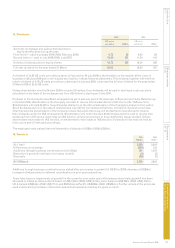

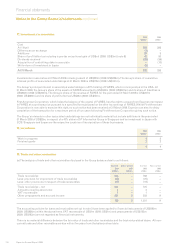

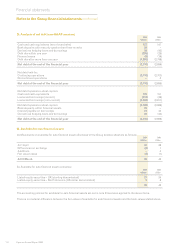

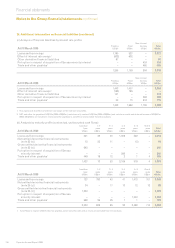

18. Inventories

2009 2008

US$m US$m

Work in progress 2 2

Finished goods 2 2

4 4

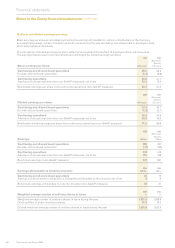

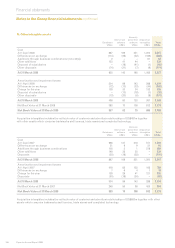

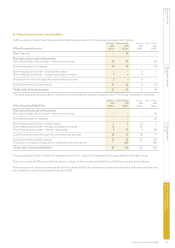

19. Trade and other receivables

(a) The analysis of trade and other receivables disclosed in the Group balance sheet is as follows:

Current Non-current Current Non-current

2009 2009 2008 2008

US$m US$m US$m US$m

Trade receivables 546 – 768 –

Less: provision for impairment of trade receivables (25) – (24) –

Less: other provisions in respect of trade receivables (17) – (19) –

Trade receivables – net 504 – 725 –

Amounts owed by associates 2 – 3 –

VAT recoverable 1 – 1 –

Other prepayments and accrued income 231 5 302 9

738 5 1,031 9

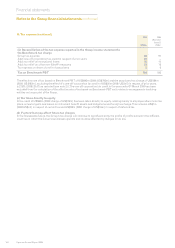

The accounting policies for loans and receivables set out in note 2 have been applied to nancial instruments of US$590m

(2008: US$856m) within the above items. VAT recoverable of US$1m (2008: US$1m) and prepayments of US$152m

(2008: US$183m) are not regarded as nancial instruments.

There is no material difference between the fair value of trade and other receivables and the book value stated above. All non-

current trade and other receivables are due within ve years from the balance sheet date.

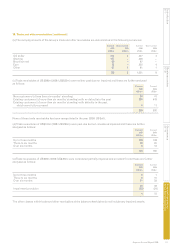

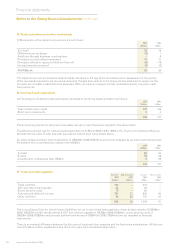

Notes to the Group nancial statements continued

Financial statements