Experian 2009 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

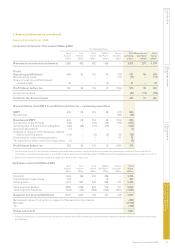

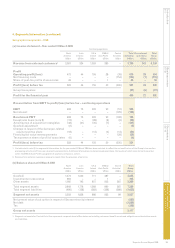

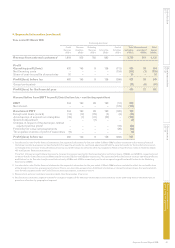

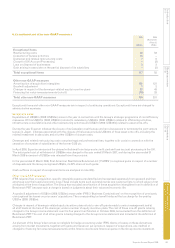

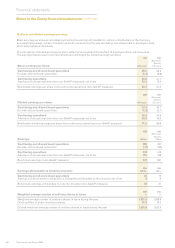

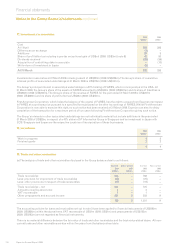

10. Tax expense

2009 2008

(Restated)

(Note 2)

US$m US$m

(a) Analysis of expense recognised in the Group income statement

Current tax:

UK Corporation tax on income for the year – (15)

Adjustments in respect of prior years (28) (43)

(28) (58)

Non-UK tax:

Tax on income for the year 54 110

Adjustments in respect of prior years – 1

54 111

Total current tax charge for the year 26 53

Deferred tax:

Origination and reversal of temporary differences 61 28

Adjustments in respect of prior years (3) 10

Total deferred tax charge for the year 58 38

Total tax expense in the Group income statement 84 91

The total tax expense comprises:

UK tax (43) (67)

Non-UK tax 127 158

Total tax expense in the Group income statement 84 91

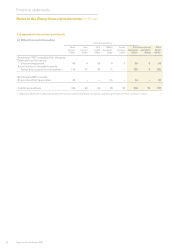

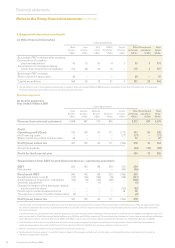

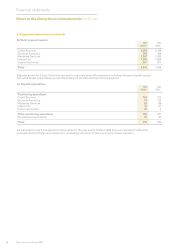

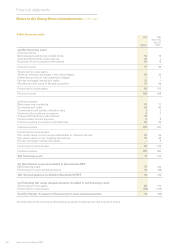

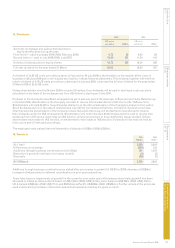

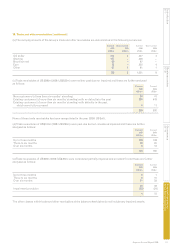

(b) Tax reconciliations

2009 2008

(Restated)

(Note 2)

US$m US$m

(i) Reconciliation of the tax expense reported in the Group income statement

Prot before tax 578 521

Add: tax expense on share of prots of associates 2 6

Adjusted prot before tax 580 527

Adjusted prot before tax multiplied by the standard rate of corporation tax

in the UK of 28% (2008: 30%) 162 158

Effects of:

Other adjustments to tax charge in respect of prior years (31) (32)

Income not taxable (25) (24)

Expenses not deductible 53 48

Adjustment in respect of previously unrecognised tax losses 1 10

Tax expense on share of prots of associates (2) (6)

Effect of different tax rates in non-UK businesses (74) (63)

Total tax expense in the Group income statement 84 91

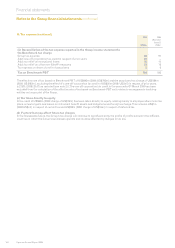

The effective rate of tax, after adjusting for the net income from associates, is 14.5% (2008: 17.5% as restated (see note 2)),

based on the prot before tax for the year ended 31 March 2009 of US$578m (2008: US$521m) and the associated tax charge

of US$84m (2008: US$91m). The effective tax rate for the year is lower than the standard rate of corporation tax in the UK of

28% (2008: 30%) and the differences are explained above. The standard rate of corporation tax for the Group’s UK businesses

changed from 30% to 28% with effect from 1 April 2008.