Experian 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

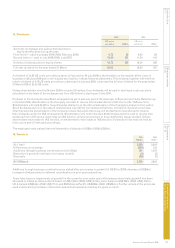

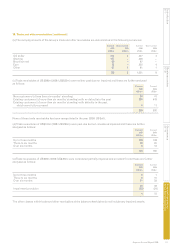

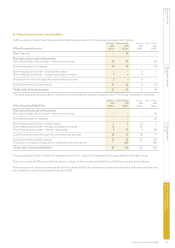

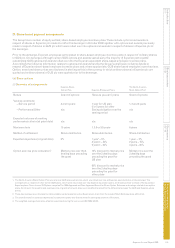

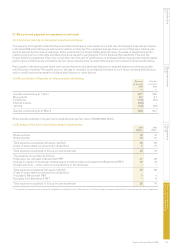

26. Additional information on nancial liabilities

(a) Analysis of liabilities by contractual repricing dates:

Less than 1 – 2 2 – 3 3 – 4 4 – 5 Over 5

1 year years years years years years To t a l

At 31 March 2009 US$m US$m US$m US$m US$m US$m US$m

Loans and borrowings 1,794 3 2 – 518 – 2,317

Effect of interest rate swaps1 (632) 444 343 174 (329) – –

Other derivative nancial liabilities 21 23 34 17 2 – 97

Put option in respect of acquisition of

Serasa minority interest 424 – – – – – 424

Trade and other payables2 459 12 9 – – – 480

2,066 482 388 191 191 – 3,318

Less than 1 – 2 2 – 3 3 – 4 4 – 5 Over 5

1 year years years years years years To t a l

At 31 March 2008 US$m US$m US$m US$m US$m US$m US$m

Loans and borrowings 1,448 737 4 1 – 660 2,850

Effect of interest rate swaps1 (185) (210) 475 379 209 (668) –

Other derivative nancial liabilities 50 15 21 26 9 20 141

Put option in respect of acquisition of

Serasa minority interest 583 – – – – – 583

Trade and other payables2 666 25 23 1 – – 715

2,562 567 523 407 218 12 4,289

1. These represent the gross notional values of interest rate swaps.

2. VAT and other tax payable of US$32m (2008: US$52m), social security costs of US$78m (2008: US$95m) and certain accruals and deferred income of US$447m

(2008: US$474m) are included in trade and other payables in note 21 but are excluded from this analysis.

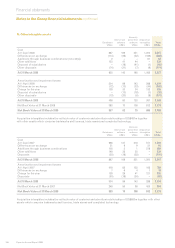

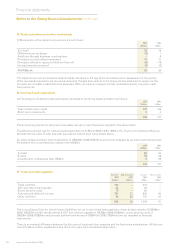

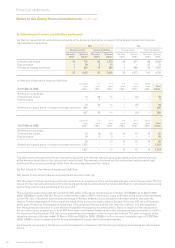

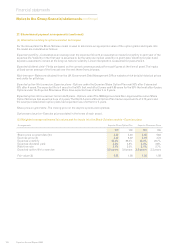

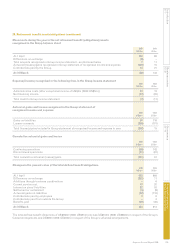

(b) Analysis of nancial liabilities by currency:

Brazilian

Sterling US dollar real Euro Other To t a l

At 31 March 2009 US$m US$m US$m US$m US$m US$m

Loans and borrowings 827 1,480 9 1 – 2,317

Effect of forward foreign exchange contracts1 (494) 232 – 262 – –

Other derivative nancial liabilities 23 57 – 16 1 97

Put option in respect of acquisition of Serasa minority interest – – 424 – – 424

Trade and other payables2 138 209 34 58 41 480

494 1,978 467 337 42 3,318

Brazilian

Sterling US dollar real Euro Other To t a l

At 31 March 2008 US$m US$m US$m US$m US$m US$m

Loans and borrowings 1,392 1,438 16 4 – 2,850

Effect of forward foreign exchange contracts1 (900) 611 – 222 67 –

Other derivative nancial liabilities 84 55 – 2 – 141

Put option in respect of acquisition of Serasa minority interest – – 583 – – 583

Trade and other payables2 211 283 76 127 18 715

787 2,387 675 355 85 4,289

1. These represent the gross notional values of foreign exchange contracts.

2. VAT and other tax payable of US$32m (2008: US$52m), social security costs of US$78m (2008: US$95m) and certain accruals and deferred income of US$447m

(2008: US$474m) are included in trade and other payables in note 21 but are excluded from this analysis.