Experian 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6Experian Annual Report 2009

Growth drivers

Experian has many growth

opportunities and investing for future

growth is a cornerstone of its strategy.

Despite marketplace challenges

caused by the global recession, the

Group has continued to deliver strong

nancial performances due to the

exibility and diversity of its business

model.

Credit-related activities

In the short term, Experian is a

beneciary of increased demand for

its countercyclical products, which

help lenders calculate and preserve

capital and manage loan portfolio risk.

In the medium term, growth prospects

for Experian’s credit-related activities

are underpinned by a number of

factors: global demand for consumer

and business credit; increasing

demand for analytics that help

institutions and consumers to predict

and manage lending risk and prevent

fraud; standardisation in technology

platforms amongst global nancial

services clients; and growth in

demand for Experian’s products from

outside the nancial services industry,

including telecommunications,

utilities, public sector and the US

healthcare payments sector.

Marketing-related activities

New communication channels

are driving growth in Experian’s

marketing-related activities. There is

a growing requirement from around

the world for marketing campaigns

that can be targeted more precisely,

executed more quickly, coordinated

across multiple channels and

delivered with a measurable return

on investment. This is stimulating

increased demand for the type of

expertise, data and sophisticated

software and analytical tools in which

Experian has invested.

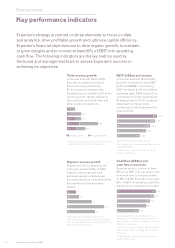

Strategy

In order to capitalise on the market

opportunities available to Experian

and to drive long-term shareholder

value, the Group has centred its

strategy on three elements:

1. Focus on data and analytics

Experian’s core expertise lies in

the ownership and operation of

comprehensive databases about

consumers and businesses. From

these it is able to extract signicant

extra value by applying its own

proprietary analytics and software.

This combination of data and

analytics is a key differentiator.

Experian’s principal business lines

are characterised by their market-

leading positions, high barriers to

entry, global reach and potential for

long-term growth, as well as their

attractive nancial characteristics.

The Group is therefore focusing

its investment on developing these

core capabilities in order to build

market-leading positions in credit

risk management and targeted

marketing. It is also taking advantage

of synergies across its credit and

marketing activities, where it can

leverage a signicant number of data

management processes to serve

clients in both areas.

2. Drive protable growth

Experian has excellent positions in

its two end-markets of credit and

marketing and its aim is to drive

organic revenue growth by leveraging

its scale and focusing on ‘best-in-

class’ performance.

The Group’s strategic framework

for driving protable growth has the

following components:

- Increase global reach: by expanding

its global network and extending

its existing capabilities into new

geographic and vertical markets.

- Innovate to stay ahead: by

promoting its culture of innovation

and investing in new data sources

and enhanced analytics to deliver

signicant value to clients.

- Drive operational excellence: by

leveraging its global scale and

common platforms to allow it to

deploy global products quickly into

new markets.

3. Optimise capital efciency

Experian is committed to maintaining

a prudent, exible and efcient

balance sheet. The Group aims to

use its strong cash ow to reinvest

in the business to retain competitive

advantage and to make targeted

acquisitions that t its strategy and

meet its nancial hurdles. As credit

ratios improve, Experian will evaluate

additional opportunities for returning

surplus cash to shareholders via

dividends or share repurchases.

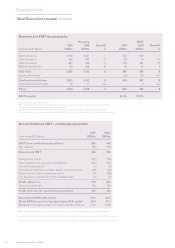

Revenue by activity 1

Decision Analytics

Credit Services

Marketing Services

Interactive

1 Excludes discontinuing

activities

Revenue by geography 1

Latin America

North America

UK and Ireland

EMEA/Asia Pacic

1 Excludes discontinuing

activities

Business and market overview continued

Introduction