Experian 2009 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120 Experian Annual Report 2009

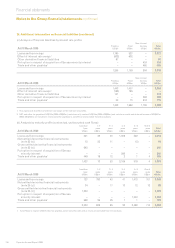

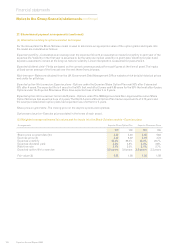

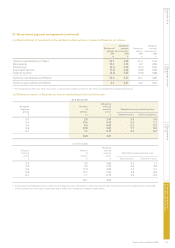

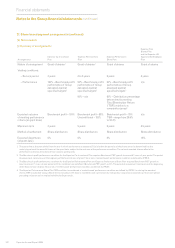

27. Share-based payment arrangements (continued)

(ii) Information relating to option valuation techniques

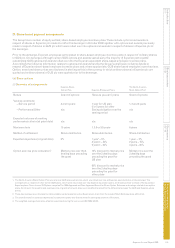

For the above plans the Black-Scholes model is used to determine an appropriate value of the option grants and inputs into

the model are calculated as follows:

Expected volatility

– Calculated as an average over the expected life with an assumption made for volatility in each year of the

expected life. Volatility in the rst year is assumed to be the same as implied volatility on grant date. Volatility for year 4 and

beyond is assumed to remain at the long run historic volatility. Linear interpolation is assumed for years 2 and 3.

Expected dividend yield

– Yields are based on the current consensus analyst forecast gures at the time of grant. The inputs

utilised are an average of the forecast over the next three nancial years.

Risk-free rate

– Rates are obtained from the UK Government Debt Management Ofce website which details historical prices

and yields for gilt strips.

Expected option life to exercise:

Experian plans

- Options under the Experian Share Option Plan vest 50% after 3 years and

50% after 4 years. The expected life is 4 years for the 50% that vest after 3 years and 4.85 years for the 50% that vest after 4 years.

Options under the Experian Sharesave Plans have expected lives of either 3 or 5 years.

Expected option life to exercise: former GUS plans

- Options under The 1998 Approved and Non-Approved Executive Share

Option Schemes had expected lives of 4 years, The North America Stock Option Plan had an expected life of 3.75 years and

the savings related share option plans had expected lives of either 3 or 5 years.

Share price on grant date

- The closing price on the day the options were granted.

Option exercise price

- Exercise price as stated in the terms of each award.

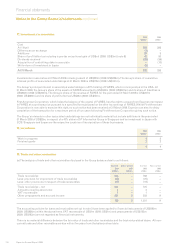

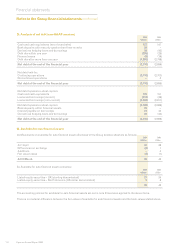

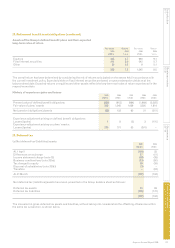

(iii) Weighted average estimated fair values and the inputs into the Black-Scholes models – Experian plans

Arrangements Experian Share Option Plan Experian Sharesave Plans

2009 2008 2009 2008

Share price on grant date (£) 3.29 5.30 3.65 5.83

Exercise price (£) 3.29 5.22 2.91 4.72

Expected volatility 45.2% 29.5% 36.0% 26.7%

Expected dividend yield 3.8% 3.6% 3.0% 3.8%

Risk-free rate 3.1% 5.2% 5.1% 5.7%

Expected option life to exercise 3.5 years 3.6 years 3.8 years 3.3 years

Fair value (£) 0.92 1.08 1.26 1.58

Notes to the Group nancial statements continued

Financial statements