Experian 2009 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18 Experian Annual Report 2009

Latin America

Business review

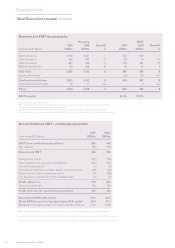

Total Organic

2009 2008 growth1 growth1

Year ended 31 March US$m US$m % %

Revenue

– Credit Services 437 305 51 17

– Decision Analytics 10 8 31 31

– Marketing Services 15 10 56 56

Total Latin America 462 324 51 18

EBIT

Total Latin America 118 75 67

EBIT margin 25.5% 23.1%

1 Growth at constant exchange rates

Credit Services

There was strong growth in Credit

Services in Brazil. Total revenue

increased by 51% at constant exchange

rates. Organic revenue growth was

17%, following the annualisation of

the acquisition of Serasa (acquired in

June 2007). While lending conditions

tightened progressively during the year,

revenue continued to grow strongly

reecting the relative under-penetration

of credit reference products in Brazil.

There was excellent organic performance across all activities within

Latin America. The strong uplift in margins reected positive

operating leverage. On EBIT, both Serasa and Informarketing

exceeded their respective acquisition buy-plans.

In consumer information, there

was excellent progress across both

nancial and non-nancial verticals,

as well as a growing contribution

from countercyclical products such

as collection notications. Growth at

business information was driven by

strong demand for richer reports, which

help to better assess risk. In addition,

Experian beneted from deeper inroads

into the small and mid-sized channel,

where penetration of credit risk

management products is low.

• Organicrevenuegrowth

of 18%

• StronggrowthinCredit

Services despite tightened

lending conditions

• Growingdemandfor

customer management

tools

• Signicantnewbusiness

wins for Marketing Services