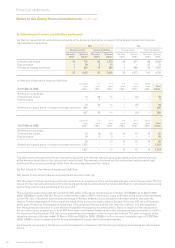

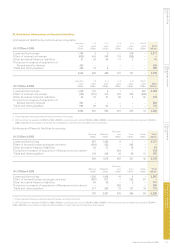

Experian 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111Experian Annual Report 2009

Introduction

2 – 7

Business review

8 – 43

Governance

44 – 72

Financial statements

Group nancial statements

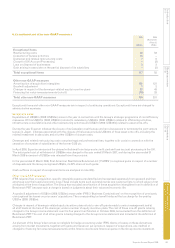

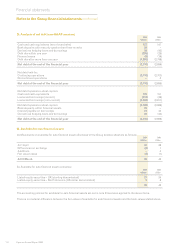

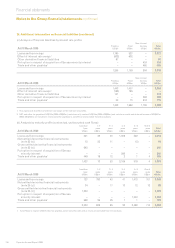

19. Trade and other receivables (continued)

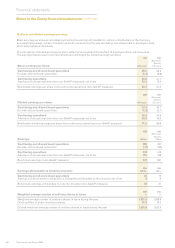

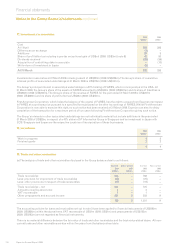

(b) The carrying amounts of the Group’s trade and other receivables are denominated in the following currencies:

Current Non-current Current Non-current

2009 2009 2008 2008

US$m US$m US$m US$m

US dollar 312 4 327 4

Sterling 177 – 306 –

Brazilian real 89 – 87 –

Euro 93 – 250 4

Other 67 1 61 1

738 5 1,031 9

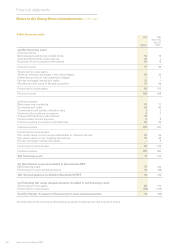

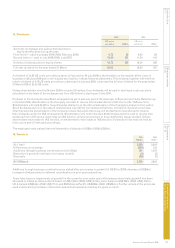

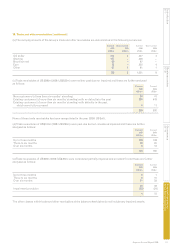

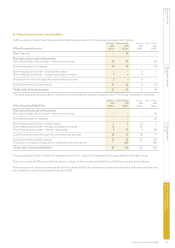

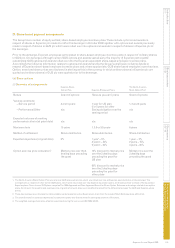

(c) Trade receivables of US$366m (2008: US$530m) were neither past due nor impaired and these are further analysed

as follows:

Current Current

2009 2008

US$m US$m

New customers (of less than six months’ standing) 24 41

Existing customers (of more than six months’ standing) with no defaults in the past 336 478

Existing customers (of more than six months’ standing) with defaults in the past

which were fully recovered 6 11

366 530

None of these trade receivables has been renegotiated in the year (2008: US$nil).

(d) Trade receivables of US$134m (2008: US$180m) were past due but not considered impaired and these are further

analysed as follows:

Current Current

2009 2008

US$m US$m

Up to three months 108 148

Three to six months 20 20

Over six months 6 12

134 180

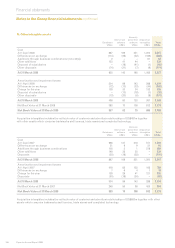

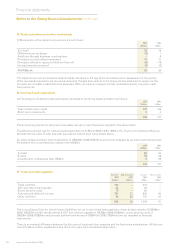

(e) Trade receivables of US$29m (2008: US$39m) were considered partially impaired and provided for and these are further

analysed as follows:

Current Current

2009 2008

US$m US$m

Up to three months 9 7

Three to six months 9 10

Over six months 11 22

29 39

Impairment provision (25) (24)

4 15

The other classes within trade and other receivables at the balance sheet dates do not include any impaired assets.