DIRECTV 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

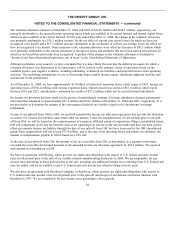

On June 24, 1999, as part of a strategic alliance with us, America Online, Inc., or AOL, invested $1.5 billion in shares of GM

Series H preference stock. The preferred stock accrued quarterly dividends at a rate of 6.25% per year. GM immediately

invested the $1.5 billion received from AOL in shares of our Series A Preferred Stock designed to correspond to the financial

terms of the GM Series H preference stock. Dividends on the Series A Preferred Stock were payable to GM quarterly at an

annual rate of 6.25%. We amortized the underwriting discount on the Series A Preferred Stock over three years.

On June 24, 2002, the GM Series H preference stock, pursuant to its terms, was mandatorily converted to about 80.1 million

shares of GM Class H common stock. Also on June 24, 2002, in connection with the automatic conversion of the GM Series H

preference stock held by AOL, GM contributed the $1.5 billion of our Series A Preferred Stock back to us, which we cancelled

and recorded as a contribution to “Common stock and additional paid-in capital” in the Consolidated Balance Sheets. In

exchange for the Series A Preferred Stock, we issued $914.1 million of Series B Convertible Preferred Stock to GM, which was

recorded as a reduction to “Common stock and additional paid-in capital.” The Series B Convertible Preferred Stock did not

accrue dividends and was convertible into our Class B common stock.

On March 12, 2003, GM contributed 149.2 million shares of GM Class H common stock to certain of its U.S. employee benefit

plans, increasing the number of shares of GM Class H common stock outstanding. The contribution increased the amount of

GM Class H common stock held by GM’s employee benefit plans to approximately 331 million shares, and reduced GM’s

interest in us to approximately 19.9% from 30.7%.

During April 2003, our Board of Directors approved the reclassification of the outstanding Series B convertible preferred stock

into Class B common stock of equivalent value, and a subsequent stock split of our common stock and our Class B common

stock through dividends of additional shares. GM, in its capacity as the holder of all our outstanding capital stock, approved the

reclassification. Shortly thereafter, GM converted some of its common stock of us into an equivalent number of shares of our

Class B common stock. As a result of these transactions, we had issued and outstanding 1,207,518,237 shares of common stock

and 274,373,316 shares of Class B common stock, all of which were owned by GM.

Immediately prior to the News Corporation transactions, we adjusted the number of shares of common and Class B common

stock to assure that the stock outstanding and the stock representing GM’s interest accurately reflected the interests to be sold

directly by GM to News Corporation and the interests to be distributed to holders of GM Class H common stock. After the

adjustment, there were 1,109,270,842 shares of our common stock then outstanding. We adjusted the number of shares of Class

B common stock to equal 274,319,607 shares, representing GM’s 19.8% interest in us.

On December 22, 2003, GM split us off by distributing our common stock to the holders of GM Class H common stock in

exchange for the 1,109,270,842 GM Class H common shares then outstanding on a one-for-one basis. Simultaneously, GM sold

its 19.8% interest in us (represented by 274,319,607 shares of Class B common stock) to News Corporation in exchange for

cash and News Corporation Preferred ADSs. We then converted the shares of Class B common stock to shares of our common

stock on a one-for-one basis.

90