DIRECTV 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

SIGNIFICANT EVENTS AFFECTING THE COMPARABILITY OF THE RESULTS OF OPERATIONS

Strategic Developments

In February 2004, we announced our intent to focus on the DTH satellite businesses. During 2004, we have announced or

completed the following actions in support of this strategy:

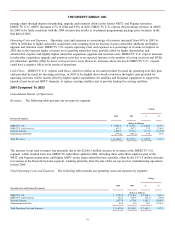

Acquisitions

•

Effective June 1, 2004, DIRECTV U.S. and the NRTC agreed to end the NRTC’s exclusive DIRECTV service

distribution agreement to certain rural territories in the United States and all related agreements. As consideration,

DIRECTV U.S. agreed to pay the NRTC approximately $4.4 million per month through June 2011, or $322.1 million

on a present value basis. As a result of this agreement, DIRECTV U.S. now has the rights to sell its services in all

territories across the United States.

•

During the third quarter of 2004, DIRECTV U.S. completed the acquisition of 357,000 NRTC subscribers from NRTC

members other than Pegasus for cash payments, including transaction fees, of $385.5 million, plus interest. Of these

cash payments, $187.2 million was paid in the third quarter of 2004 and the remainder will be made in monthly

payments through 2011.

•

On August 27, 2004, DIRECTV U.S. acquired certain assets of Pegasus, including approximately 1.1 million

DIRECTV subscribers activated through Pegasus. DIRECTV U.S. paid $773.0 million in cash, which is the $987.9

million total purchase price net of amounts owed by Pegasus for programming and other services, and the $63 million

attributable to a May 2004 judgment in favor of DIRECTV U.S.

•

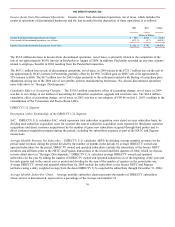

On October 8, 2004, we entered into the Sky Transactions. The Sky Transactions are designed to strengthen the

operating and financial performance of DTVLA by consolidating the DTH platforms of DTVLA and Sky Latin

America into a single platform in each of the major territories served in the region. In Brazil, DIRECTV Brasil and

Sky Brasil have agreed to merge, with DIRECTV Brasil’s customers migrating to the Sky Brasil platform. In addition,

we intend to acquire the interests of News Corporation and Liberty in Sky Brasil upon completion, acquiring in excess

of 70% of the merged platform. The transactions in Brazil are subject to local regulatory approval, which has been

requested but not yet granted. In Mexico, DTVLA’s local affiliate, DIRECTV Mexico, is in the process of closing its

operations and has sold its subscriber list to Sky Mexico. In addition, we will acquire the interest of News Corporation

and, jointly with Televisa, the interest of Liberty in Sky Mexico, which will not be a controlling interest. Upon

consummation of these transactions in Mexico, we anticipate having an equity interest of approximately 43% in Sky

Mexico, which will not be a controlling interest. In the rest of the region, or PanAmericana, we have acquired the

interest of News Corporation and Liberty and have agreed to acquire the interest of Globo and Televisa in Sky Multi-

Country Partners and certain related businesses, which own DTH platforms in Colombia and Chile. DTVLA began

consolidating the results of these entities in the fourth quarter of 2004. Total cash consideration for the equity interests

in the Sky Latin America platforms is approximately $580 million, of which we paid $398 million in October 2004.

The remainder is subject to adjustment and will be paid at the completion of the transactions. As of December 31,

2004, the Sky Latin America businesses had approximately 1.9 million total subscribers.

Divestitures

•

During the first quarter of 2004, we sold our investment in XM Satellite Radio common stock for $477.5

million in cash.

•

On June 22, 2004, we completed the sale of HNS’ set-top receiver manufacturing operations to Thomson for $250

million in cash. In connection with the sale, DIRECTV U.S. entered into a long-term

28