DIRECTV 2004 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

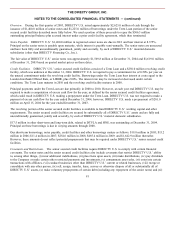

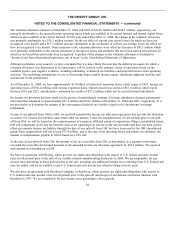

Our September 2004 decision to use SPACEWAY 1 and SPACEWAY 2 and certain related ground segment equipment to

support DIRECTV U.S.’ DTH broadcast business rather than for their original intended use in HNS’ broadband data business

triggered a requirement to test the assets for impairment under SFAS No. 144, “Accounting for the Impairment or Disposal of

Long-Lived Assets.” Since the book value of the SPACEWAY system had been supported by the expected cash flows from the

SPACEWAY broadband business plan, and we no longer intended to pursue that business plan as originally contemplated, we

considered the assets impaired. Further, a majority of the capitalized value of the SPACEWAY assets related to functionality

that will not be utilized for the DTH business. We determined the impairment charge by comparing the fair value of the

SPACEWAY assets to their book value as of September 30, 2004. We determined the fair value of SPACEWAY 1 and

SPACEWAY 2 and certain related ground segment assets based on the fair value of those assets as configured to DIRECTV

U.S.’ DTH business. The estimation of fair value of SPACEWAY 1 and SPACEWAY 2 and related ground segment equipment

included an analysis performed by management and an independent valuation firm. We determined the fair value of

SPACEWAY 3 based on the fair value of several possible utilizations of this satellite still under construction.

Based on the results of this analysis, we reduced the capitalized value of the SPACEWAY assets in “Satellites, net” by $1.099

billion to $305 million, and the capitalized value in “Property, net” by about $367 million to $30 million. We recorded these

reductions as a $1.466 billion pre-tax ($903 million after-tax) charge included in “Asset impairment charges” in the

Consolidated Statements of Operations in the third quarter of 2004.

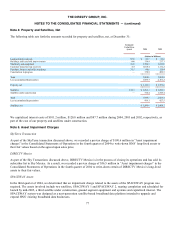

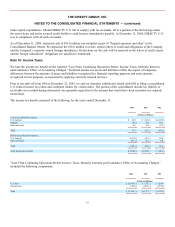

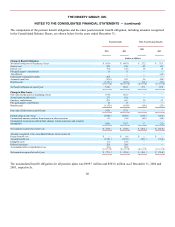

Note 6: Goodwill and Intangible Assets

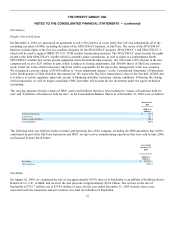

The changes in the carrying amounts of goodwill by reporting unit for the years ended December 31, 2004 and 2003 were as

follows:

DIRECTV

U.S.

DIRECTV Lati

n

America

Network

Systems

Total

(Dollars in Millions)

Balance as of January 1, 2003

$

3,029.1

$

—

$

2.4

$

3,031.5

Additions and other

2.6

—

—

2.6

Balance as of December 31, 2003

3,031.7

—

2.4

3,034.1

Additions and other

—

12.4

(2.4

)

10.0

Balance as of December 31, 2004

$

3,031.7

$

12.4

$

—

$

3,044.1

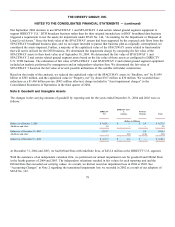

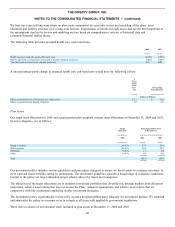

At December 31, 2004 and 2003, we had Orbital Slots with indefinite lives, of $432.4 million at the DIRECTV U.S. segment.

With the assistance of an independent valuation firm, we performed our annual impairment tests for goodwill and Orbital Slots

in the fourth quarters of 2004 and 2003. The independent valuations resulted in fair values for each reporting unit and the

Orbital Slots that exceeded our carrying values. As a result, we did not record an impairment loss in 2004 or 2003. See

“Accounting Changes” in Note 2 regarding the transitional impairment loss we recorded in 2002 as a result of our adoption of

SFAS No. 142.

78