DIRECTV 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

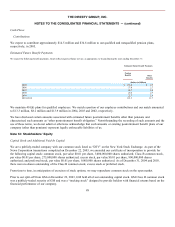

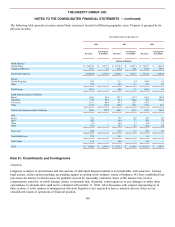

Note 15: Other, Net

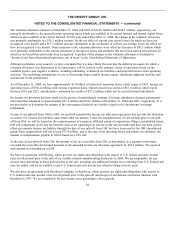

The following table summarizes the components of “Other, net” for the years ended December 31:

2004

2003

2002

(Dollars in Millions)

Equity losses from unconsolidated affiliates

$

(0.2

)

$

(81.5

)

$

(70.1

)

EchoStar Merger termination payment

—

—

600.0

Net unrealized gain (loss) on investments

—

79.4

(180.6

)

Net gain from sale of investments

396.5

7.5

84.1

Net gain on exit of DIRECTV Japan business (Note 3)

—

—

41.1

Other

1.3

(5.4

)

(49.0

)

Total Other, net

$

397.6

$

—

$

425.5

On January 28, 2004, we sold 10,000,000 shares of XM Satellite Radio common stock for $254.4 million. On March 25, 2004,

we sold our remaining 9,014,843 shares of XM Satellite Radio common stock for $223.1 million. As a result of these

transactions, we recorded a pre-tax gain of $387.1 million in the first quarter of 2004 in “Other, net” in the Consolidated

Statements of Operations.

For the years ended December 31, 2003 and 2002, equity losses from unconsolidated affiliates are primarily comprised of losses

at the DTVLA LOCs. Also included in 2003 are equity losses from the XM Satellite Radio investment.

Net unrealized gain on investments for 2003 includes a $79.6 million gain resulting from an increase in the fair market value of

an investment in an XM Satellite Radio convertible note. Net unrealized loss on investments for 2002 is primarily comprised of

$148.9 million of other-than-temporary declines in fair value of our investment in XM Satellite Radio and Crown Media

Holdings.

In December 2002, we recognized a $600.0 million gain related to a termination agreement entered into by us, GM and

EchoStar Communications Corporation, or EchoStar. As a part of this agreement, the parties agreed to terminate the merger

agreement and certain related agreements due to the proposed merger’s failure to obtain regulatory approval. Under the terms of

the termination agreement, EchoStar paid us $600 million in cash.

On August 21, 2002, we sold about 8.8 million shares of Thomson multimedia S.A., or Thomson, common stock for

approximately $211.0 million in cash, resulting in a pre-tax gain of about $158.6 million.

In October 2002, we sold all of our interest in Sky Perfect for approximately $105 million in cash, resulting in a pre-tax loss of

about $24.5 million.

During 2002, we reversed $41.1 million of accrued liabilities related to the exit costs for DIRECTV Japan upon the resolution

of the remaining claims, resulting in a credit adjustment to “Other, net” in the Consolidated Statements of Operations.

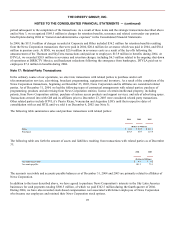

Note 16: Severance, Retention and Pension Benefit Costs

During the first quarter of 2004, we announced the reduction of corporate office headcount by over half as a result of our plan to

consolidate corporate and DIRECTV U.S. support functions. There were also additional headcount reductions at DIRECTV

U.S. and at DTVLA. As a result of the completion of the News Corporation transactions on December 22, 2003, certain of our

employees earned retention benefits during the twelve month

94