DIRECTV 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

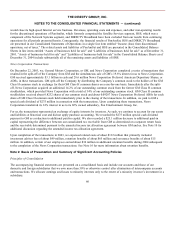

Upgrade and Retention Costs

Upgrade and retention costs in the Consolidated Statements of Operations consist primarily of costs for loyalty programs

offered to existing subscribers. The costs for loyalty programs include the costs of installing or providing hardware under our

movers program (for subscribers relocating to a new residence), multiple set-top receiver offers, DVR (digital video recorder)

and local channel upgrade programs and other similar initiatives, and third party commissions we incur for the sale of additional

set-top receivers to existing subscribers.

Effective January 1, 2004, we changed our method of accounting for upgrade and retention costs to expense the cost of

installation and hardware under our loyalty programs. Previously, we deferred a portion of upgrade and retention costs equal to

the amount of profit to be earned from the subscriber, typically over the 12 month subscriber contract, and amortized these costs

to expense over the contract period. We included the deferred portion of the costs in “Prepaid expenses and other” in the

Consolidated Balance Sheets. See “Accounting Changes” below for further discussion of the change in accounting method.

Cash and Cash Equivalents

Cash equivalents consist of highly liquid investments we purchase with original maturities of three months or less.

Inventories

We state inventories at the lower of cost or market principally using the average cost method.

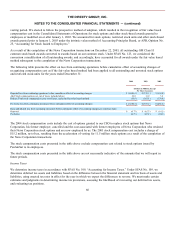

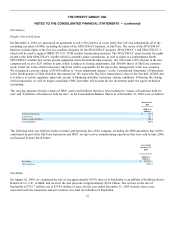

The following table sets forth the amounts we recorded for inventories, net, at December 31:

2004

2003

(Dollars in Millions)

Finished goods

$

124.6

$

158.3

Productive material and supplies

—

64.2

Work in process

—

81.1

Total

124.6

303.6

Less provision for excess or obsolete inventory

0.2

33.3

Inventories, net

$

124.4

$

270.3

Property, Satellites and Depreciation

We carry property and satellites at cost. Satellite costs include construction costs, launch costs, launch insurance, incentive

obligations, direct development costs and capitalized interest. Capitalized satellite costs represent satellites under construction

and the cost of successful satellite launches. Capitalized customer leased set-top receiver costs include the cost of hardware and

installation. We generally compute depreciation using the straight-line method over the estimated useful lives of the assets. We

amortize leasehold improvements over the lesser of the life of the asset or term of the lease.

Goodwill and Intangible Assets

Intangible assets with indefinite lives consist of Federal Communications Commission, or FCC, licenses for DTH broadcasting

frequencies, or Orbital Slots. We do not amortize goodwill and Orbital Slots, but rather they

63