DIRECTV 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

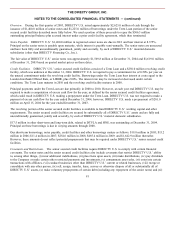

Set-Top Receiver Manufacturing Operations

As part of our sale of HNS’ set-top receiver manufacturing operations to Thomson for $250 million in cash in June 2004,

DIRECTV U.S. entered into a long-term purchase agreement, or the Agreement, with Thomson for the supply of set-top

receivers. The proceeds in excess of the book value of the HNS assets sold of approximately $200 million has been deferred and

will be recognized as described below as a result of the Agreement. DIRECTV U.S. can earn a $50 million rebate from

Thomson if Thomson’s aggregate sales of DIRECTV U.S.’ set-top receivers equal at least $4 billion over the initial five year

contract term plus an optional one year extension period, or the Contract Term. DIRECTV U.S. can also earn, on a pro rata

basis, an additional $100 million rebate from Thomson if Thomson’s aggregate sales of DIRECTV U.S.’ set-top receivers are in

excess of $4 billion and up to $6 billion during the Contract Term. The $200 million of deferred proceeds has been recorded as

“Accrued liabilities and other” and “Other Liabilities and Deferred Credits” in the Consolidated Balance Sheets and is

recognized as an offset to “Subscriber acquisition costs” and/or “Upgrade and retention costs” in the Consolidated Statements of

Operations, as appropriate, on a pro rata basis as the set-top receivers purchased from Thomson are activated. DIRECTV U.S.

has determined that, based upon projected set-top receiver requirements, it is probable and reasonably estimable that the

minimum purchase requirements will be met for the initial $50 million rebate during the contract period. DIRECTV U.S.

records a proportionate amount of the $50 million rebate as a credit to “Subscriber acquisition costs” and/or “Upgrade and

retention costs” in the Consolidated Statements of Operations upon set-top receiver activation over the initial contract period

with a corresponding entry to “Accounts and notes receivable, net” in the Consolidated Balance Sheets. As a result, during the

last six months of 2004, DIRECTV U.S. recognized $4.7 million of the $50 million rebate in the Consolidated Statements of

Operations.

We included the proceeds in excess of the net book value of the HNS assets sold of approximately $200 million in cash flows

from operating activities in the Consolidated Statements of Cash Flows for the year ended December 31, 2004.

As we expect to have significant continuing cash flows with the set-top receiver manufacturing operations resulting from the

Agreement, the financial results of the set-top receiver manufacturing operations prior to June 2004 will continue to be reported

in continuing operations, and not as a discontinued operation.

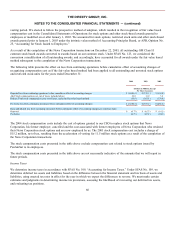

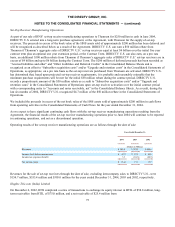

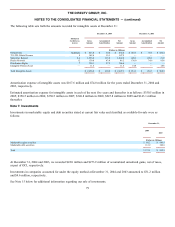

Operating results of the set-top receiver manufacturing operations are as follows through the date of sale:

Years Ended December 31,

2004

2003

2002

(Dollars in Millions)

Revenues

$

306.6

$

519.2

$

408.6

Income (loss) before income taxes

$

(8.7

)

$

27.6

$

26.0

Income tax (expense) benefit

3.3

(10.6

)

(10.5

)

Net income (loss)

$

(5.4

)

17.0

15.5

Revenues for the sale of set-top receivers through the date of sale, excluding intercompany sales to DIRECTV U.S., were

$154.7 million, $353.4 million and $305.0 million for the years ended December 31, 2004, 2003 and 2002, respectively.

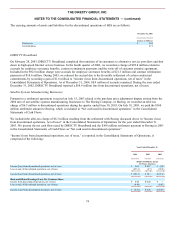

Hughes Tele.com (India) Limited

On December 6, 2002, HNS completed a series of transactions to exchange its equity interest in HTIL of $58.8 million, long-

term receivables from HTIL of $75.0 million, and a net receivable of $25.4 million from

75