DIRECTV 2004 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

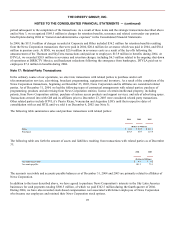

independent third party appraisal of DLA LLC indicated a valuation in excess of approximately $1.6 billion, then we could be

obligated to cooperate with attempts by Darlene to sell all of DLA LLC, conduct an initial public offering of the equity of DLA

LLC or exercise our call rights, which would cost approximately $400 million. These rights are subject to many conditions and

requirements, which are described in more detail in the DLA LLC Agreement. In a lawsuit filed in October 2004 by Darlene

against us and others, Darlene asserts, among other claims, that it was fraudulently induced to enter into the DLA LLC

Agreement and that the Sky Deal is prohibited by the DLA LLC Agreement. For further information, see Note 21.

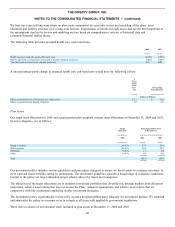

Note 19: Derivative Financial Instruments and Risk Management

Our cash flows and earnings are subject to fluctuations resulting from changes in foreign currency exchange rates, interest rates

and changes in the market value of our equity investments. We manage our exposure to these market risks through internally

established policies and procedures and, when deemed appropriate, through the use of derivative financial instruments. We

enter into derivative instruments only to the extent considered necessary to meet our risk management objectives, and do not

enter into derivative contracts for speculative purposes. As of December 31, 2004, we had no significant foreign currency or

interest related derivative financial instruments outstanding.

We generally conduct our business in U.S. dollars with some business conducted in a variety of foreign currencies and therefore

are exposed to fluctuations in foreign currency exchange rates. Our objective in managing our exposure to foreign currency

changes is to reduce earnings and cash flow volatility associated with foreign exchange rate fluctuations. Accordingly, we may

enter into foreign exchange contracts to mitigate risks associated with foreign currency denominated assets, liabilities,

commitments and anticipated foreign currency transactions. The gains and losses on derivative foreign exchange contracts

offset changes in value of the related exposures.

We are exposed to interest rate changes from our outstanding fixed rate and floating rate borrowings. We manage our fixed to

floating rate debt mix to mitigate the impact of adverse changes in interest rates on earnings and cash flows and on the market

value of our borrowings. In accordance with policy, from time to time we may enter into interest rate hedging contracts which

effectively convert floating rate borrowings to fixed rate borrowings, or fixed rate borrowings to floating rate borrowings.

We are exposed to credit risk in the event of non-performance by the counterparties to our derivative financial instrument

contracts. While we believe this risk is remote, credit risk is managed through the periodic monitoring and approval of

financially sound counterparties.

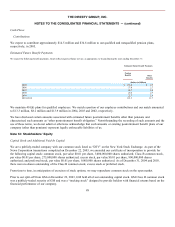

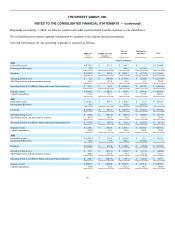

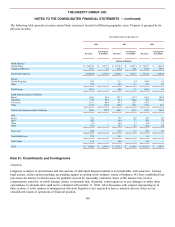

Note 20: Segment Reporting

Our three business segments, which are differentiated by their products and services as well as geographic location, are

DIRECTV U.S. and DIRECTV Latin America, which are engaged in acquiring, promoting, selling and/or distributing digital

entertainment programming via satellite to residential and commercial customers, and the Network Systems segment, which is a

provider of satellite-based private business networks and broadband Internet access. Eliminations and other includes the

corporate office and other entities.

Beginning in the third quarter of 2004, we disaggregated the Direct-To-Home Broadcast segment, which included the

DIRECTV U.S. and DIRECTV Latin America businesses. We now report the DIRECTV U.S. and DIRECTV Latin America

businesses as separate segments as provided by SFAS No. 131, “Disclosures about Segments of an Enterprise and Related

Information.”

97