DIRECTV 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

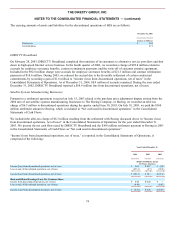

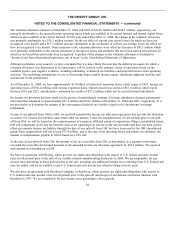

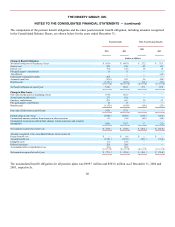

Overview. During the first quarter of 2003, DIRECTV U.S. raised approximately $2,625.0 million of cash through the

issuance of $1,400.0 million of senior notes and $1,225.0 million of borrowings under the Term Loan portion of the senior

secured credit facilities described more fully below. We used a portion of these proceeds to repay the $506.3 million

outstanding principal balance plus accrued interest under a prior credit facility agreement, which then terminated.

Notes Payable. DIRECTV U.S.’ $1,400.0 million in registered senior notes are due in 2013 and bear interest at 8.375%.

Principal on the senior notes is payable upon maturity, while interest is payable semi-annually. The senior notes are unsecured

and have been fully and unconditionally guaranteed, jointly and severally, by each of DIRECTV U.S.’ material domestic

subsidiaries (other than DIRECTV Financing Co., Inc.).

The fair value of DIRECTV U.S.’ senior notes was approximately $1,569.8 million at December 31, 2004 and $1,619.0 million

at December 31, 2003 based on quoted market prices on those dates.

Credit Facilities. DIRECTV U.S.’ senior secured credit facilities consist of a Term Loan and a $250.0 million revolving credit

facility, which was undrawn at December 31, 2004. DIRECTV U.S. is required to pay a commitment fee of 0.50% per year on

the unused commitment under the revolving credit facility. Borrowings under the Term Loan bear interest at a rate equal to the

London Interbank Offered Rate, or LIBOR, plus 2.00%. The interest rate may be increased or decreased under certain

conditions. The Term Loan matures in 2010 and the revolving credit facility matures in 2008.

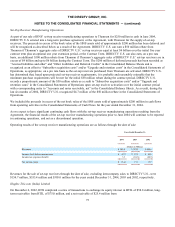

Principal payments under the Term Loan are due primarily in 2008 to 2010. However, at each year end DIRECTV U.S. may be

required to make a computation of excess cash flow for the year, as defined by the senior secured credit facilities agreement,

which could result in DIRECTV U.S. making a prepayment under the Term Loan. DIRECTV U.S. was not required to make a

payment of excess cash flow for the year ended December 31, 2004, however, DIRECTV U.S. made a prepayment of $201.0

million on April 15, 2004 for the year ended December 31, 2003.

The revolving portion of the senior secured credit facilities is available to fund DIRECTV U.S.’ working capital and other

requirements. The senior secured credit facilities are secured by substantially all of DIRECTV U.S.’ assets and are fully and

unconditionally guaranteed, jointly and severally, by each of DIRECTV U.S.’ material domestic subsidiaries.

$17.5 million in other short-term and long-term debt, related to DTVLA and HNS, was outstanding at December 31, 2004.

Principal on these borrowings is due in varying amounts through 2008.

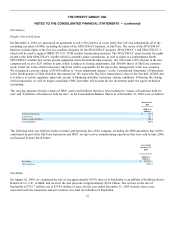

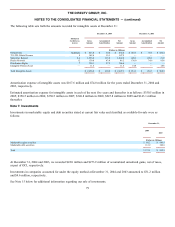

Our short-term borrowings, notes payable, credit facilities and other borrowings mature as follows: $19.8 million in 2005; $15.2

million in 2006; $11.4 million in 2007; $254.6 million in 2008; $485.4 million in 2009; and $1,642.9 million thereafter.

However, these amounts do not reflect potential prepayments that may be required under DIRECTV U.S.’ senior secured credit

facilities.

Covenants and Restrictions. The senior secured credit facilities require DIRECTV U.S. to comply with certain financial

covenants. The senior notes and the senior secured credit facilities also include covenants that restrict DIRECTV U.S.’ ability

to, among other things, (i) incur additional indebtedness, (ii) place liens upon assets, (iii) make distributions, (iv) pay dividends

to the Company or make certain other restricted payments and investments, (v) consummate asset sales, (vi) enter into certain

transactions with affiliates, (vii) conduct businesses other than DIRECTV U.S.’ current or related businesses, (viii) merge or

consolidate with any other person, (ix) sell, assign, transfer, lease, convey or otherwise dispose of all or substantially all of

DIRECTV U.S.’ assets, (x) make voluntary prepayments of certain debt (including any repayment of the senior notes) and (xi)

81