DIRECTV 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

The decrease in net subscribers in 2003 was primarily due to the poor economic conditions and political instability in several of

the major countries in the region, as well as the effects from the bankruptcy proceedings. The decrease in ARPU was primarily

related to the 2002 FIFA World Cup non-recurring revenues and the depreciation of certain Latin American currencies in 2003,

partially offset by the increase in revenues resulting from the consolidation of the Venezuelan and Puerto Rican LOCs.

The decrease in operating loss before depreciation and amortization was primarily due to the $80.0 million non-recurring loss

from the 2002 FIFA World Cup, lower foreign currency translation losses in 2003 and lower 2003 expenses resulting from cost

savings initiatives including programming cost reductions from the rejection and/or renegotiation of certain contracts in

connection with the bankruptcy proceedings. The lower operating loss resulted from the improvement in operating loss before

depreciation and amortization as well as a decrease in depreciation expense of $13.9 million.

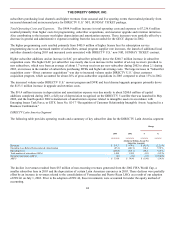

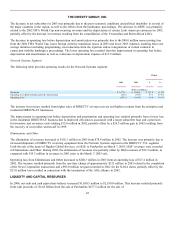

Network Systems Segment

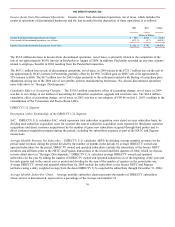

The following table provides operating results for the Network Systems segment:

Change

2003

2002

$

%

(Dollars in Millions)

Revenues

$

1,271.0

$

1,140.0

$

131.0

11.5

%

Operating Loss Before Depreciation & Amortization

(32.6

)

(99.7

)

67.1

67.3

%

Operating Loss

(103.4

)

(169.8

)

66.4

39.1

%

The increase in revenues resulted from higher sales of DIRECTV set-top receivers and higher revenues from the enterprise and

residential DIRECWAY businesses.

The improvement in operating loss before depreciation and amortization and operating loss resulted primarily from a lower loss

in the residential DIRECWAY business due to improved efficiencies associated with a larger subscriber base and a provision

for inventory and severance costs totaling $15.0 million in 2002, partially offset by a $24.5 million gain in 2002 resulting from

the recovery of receivables written-off in 1999.

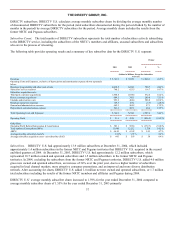

Eliminations and Other

The elimination of revenues increased to $192.1 million in 2003 from $78.8 million in 2002. The increase was primarily due to

increased shipments of DIRECTV receiving equipment from the Network Systems segment to the DIRECTV U.S. segment.

Until the sale of the assets of Hughes Global Services, or HGS, to PanAmSat on March 7, 2003, HGS’ revenues were recorded

in Eliminations and Other. During 2002, the elimination of revenues was partially offset by HGS revenues of $52.3 million, as

compared with $15.3 million in revenues in 2003 prior to the March 7, 2003 sale.

Operating loss from Eliminations and Other increased to $208.3 million in 2003 from an operating loss of $17.4 million in

2002. The increase resulted primarily from the one-time charge of approximately $132 million in 2003 related to the completion

of the News Corporation transactions and a $95.0 million net gain recorded in 2002 for the NASA claim, partially offset by the

$23.0 million loss recorded in connection with the termination of the AOL alliance in 2002.

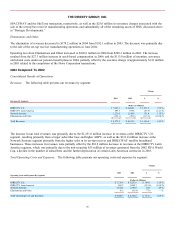

LIQUIDITY AND CAPITAL RESOURCES

In 2004, our cash and cash equivalents balance increased $1,050.5 million to $2,830.0 million. This increase resulted primarily

from cash proceeds of: $2.64 billion from the sale of PanAmSat; $477.5 million for the sale of

45